2024-11-22 17:13 |

Newmarket Capital has completed a loan that combines traditional real estate financing with Bitcoin collateral, introducing a novel approach to lending reported on CNBC’s “Squawk Box” on Nov. 22. The loan refinances a 63-unit multifamily property in Philadelphia and incorporates 20 Bitcoin into the collateral package.

The transaction allows the property’s sponsor to repay the existing mortgage, fund capital improvements, and add Bitcoin to the loan’s collateral. Andrew Hohns, founder of Newmarket Capital, explained that this fusion of assets provides better protection for lenders compared to traditional loans backed solely by real estate. “By combining the Bitcoin with credit, we can express a medium-term view on Bitcoin while enhancing the loan’s security,” Hohns said on CNBC.

The loan has a term of ten years, with the Bitcoin held in escrow for a minimum of four years. Borrowers can repay the loan at any time without penalty, a feature uncommon in commercial financing. If repaid before four years, the property is released, but the Bitcoin remains as collateral until the minimum hold period ends.

Hohns highlighted that this structure could benefit pension funds facing asset-liability mismatches. “Pensions have been reaching for risk in high-yield, leveraged, or niche strategies,” he noted.

“By fusing high-quality credit with Bitcoin, we offer an attractive return per unit of risk without relying on traditional high-risk investments.”

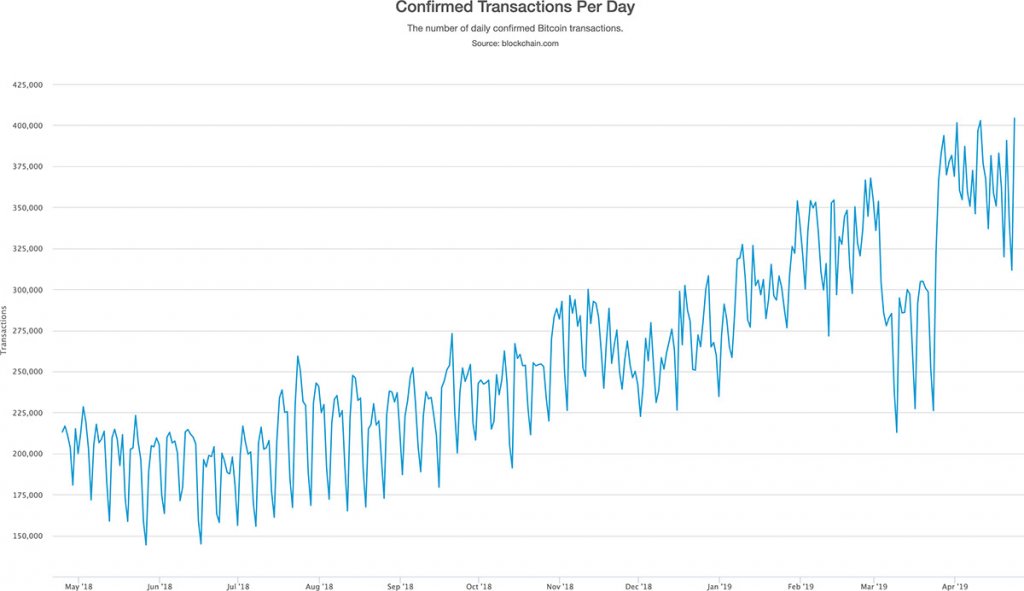

The approach assumes a long-term positive trajectory for Bitcoin, mitigating concerns about its short-term volatility. Historical data suggests that over four-year periods, Bitcoin’s returns have been consistently positive. “For a four-year hold period, the worst-ever return has been just over 23%,” Hohns stated. This potential growth can help close funding gaps in pension portfolios when combined with stable credit assets.

The loan’s structure also addresses fiduciaries’ challenges with inflation and asset diversification. By integrating Bitcoin, the loan offers exposure to an asset class that may outpace inflation over time. This could provide a hedge against the eroding purchasing power that affects traditional fixed-income investments.

Per CNBC, this fusion of assets represents a shift in how traditional finance views and utilizes cryptocurrencies. It signals a growing acceptance of Bitcoin as a viable component in complex financial transactions, potentially influencing future lending practices.

The post Institutions using Bitcoin to support pension funds, adding BTC to loans appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|