2021-11-5 16:55 |

Crypto lender Genesis reported a record $35.7 billion in loan organizations for the quarter third of 2021, up 40% from the previous quarter and a growth of 586% year-over-year.

In its Q3 report, the company noted the continuous institutionalization of Bitcoin has made it less attractive to more opportunistic traders. This resulted in a downward trend in demand for the leading cryptocurrency.

“While this paused in Q2, it resumed over the third quarter due to the continued GBTC premium invasion and flattening of the basis curves.”

Meanwhile, interest in the futures-based bitcoin ETF was strong in the traditional market with global investment banks and $100 bln asset managers relying on Genesis for providing liquidity.

This “shift towards institutionalization” also resulted in a significant decline in the opportunity to cash in on the spread between the price of Bitcoin in the spot and futures market.

The trading and lending volume we’re seeing at @GenesisTrading is nothing short of incredible. This is all thanks to the unbelievable clients we have and the success the entire ecosystem is realizing right now. Onwards and upwards! https://t.co/Q4lwe49bSJ

— Matt Ballensweig (@MattBallen4791) November 4, 2021

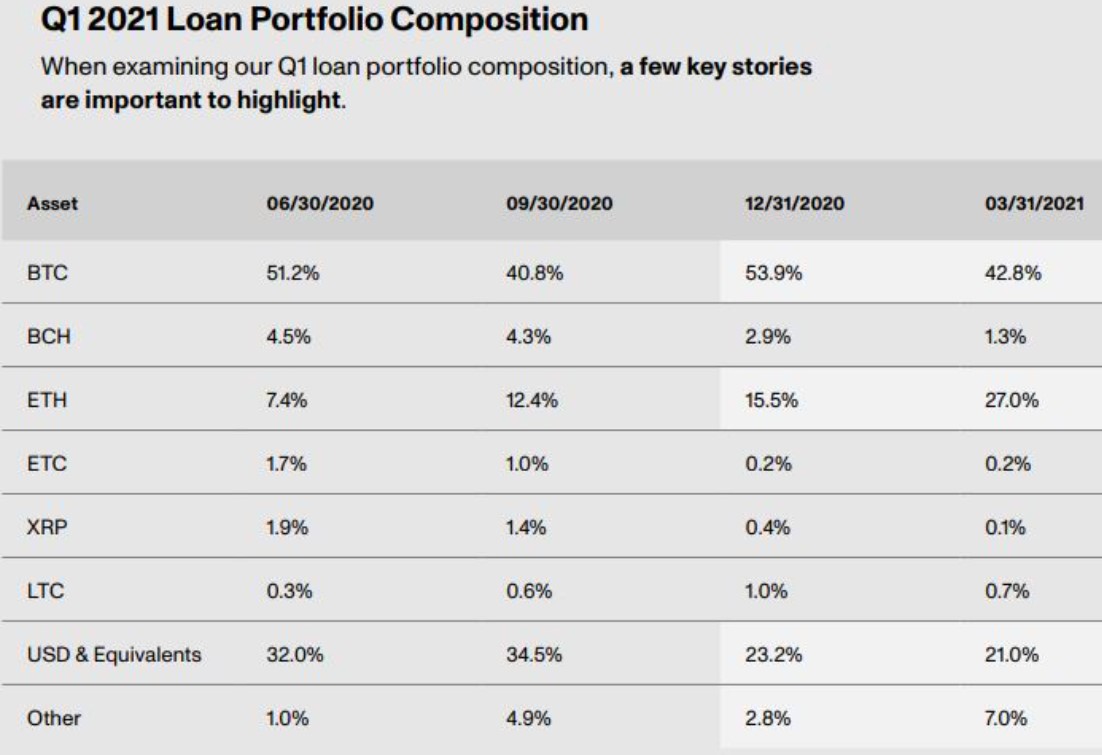

With the GBTC discount still negative, Bitcoin’s percentage of the loan book declined to 32.4%, while ETH loans saw “greater borrowing appetite,” which was propelled by decentralized finance (DeFi) adoption to now account for 32% versus 15.5% from last year.

The firm also reported increased activity in the DeFi market and the growing Layer 1s as institutions explore yield opportunities. This has led to a reduction in Ethereum’s market share in favor of other L1 solutions like Solana (SOL), Avalanche (AVAX), Fantom (FTM), and Terra (LUNA).

As such, Genesis launched bilateral options and forward liquidity in SOL, LUNA, FTM, and DYDX as they rapidly gained adoption with institutional investors.

“While the alt rotation playbook reverted back to deploying capital towards BTC and ETH towards the end of Q3, the adoption of L1s opened up more opportunities to diversify portfolios.”

Overall, Genesis traded more than $37 billion across spot and derivatives and spot in Q3.

“As we begin the start of Q4, demand for front-end options seems to be finally picking up, as market participants large and small position themselves for the late October ETF decisions,” said Genesis, which now anticipates a strong derivatives activity in quarter four.

The post Institutions Exploring Yield Opportunities Across Layer 1s With “Greater Borrowing Appetite” for ETH – Genesis Q3 Report first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Genesis Vision (GVT) íà Currencies.ru

|

|