2021-1-29 20:51 |

Ark Invest, the New York-based Investment Management LLC, has featured Bitcoin as one of the disruptive innovations that macro-focused investors should keep a close eye on. The firm published its annual ‘Big Idea’ report yesterday, highlighting the growing market trends and potential innovations that could take the world’s center stage in this decade.

Per Ark’s report, Bitcoin and other crypto technologies such as the DeFi ecosystem have grown significantly in their fundamental value proposition. The management advisors estimate that the value of BTC can shoot up by $40,000, should all S&P firms allocate 1% of their cash to Bitcoin. An additional allocation to boost the position to 6.5% could see Bitcoin’s price skyrocket to $500,000.

The report further highlights that BTC prices are more fundamentally driven than the 2017 bull-run when its Google searches had hit all-time highs. Notably, 60% of the coins in circulation have not been moved for more than a year, signaling what Ark refers to as a long-term outlook by Bitcoin investors.

Institutions Are Getting Ready for BitcoinWith public companies like Microstrategy and Square investing their cash reserves on BTC, Ark notes that they set the trend for other institutions to hedge against inflation. The analysis estimates that Bitcoin’s market cap could scale from $500 billion to $1-$10 trillion within the next five to ten years. That said, capital allocators ought to factor in the cost opportunity of ignoring BTC as an emerging asset class. The report reads,

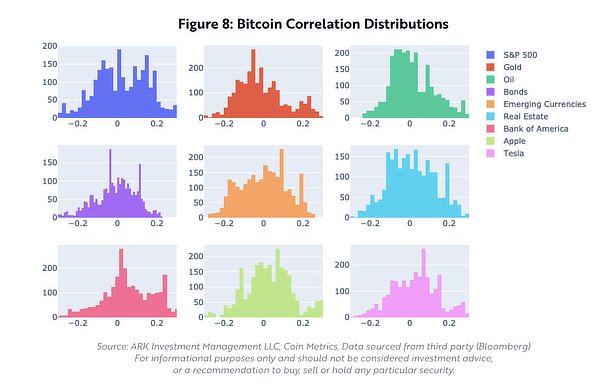

“Untethered from traditional rules and regulations and generally uncorrelated to the behavior of other asset classes, bitcoin seems to have earned a strategic allocation in well-diversified portfolios. During the past decade, bitcoin is the only major asset with consistently low correlations to traditional asset classes.”

Bitcoin’s daily trading volume has also increased to the point of comparison with large-cap stocks. The leading cryptocurrency market cap enjoys an average daily trading volume of $6 billion, a figure that Ark estimates could grow past the U.S equities volume and FX market within 4 and 6 years, respectively.

Meanwhile, the Bitcoin open market interest hit a new all-time high on the CME to total $1 billion as of Q4, 2020. Ark noted that this indicates the crypto market growth given that investors can now access BTC in sophisticated means.

BTC Portfolio AllocationArk ran a Monte-carlo simulation on 1 million portfolios diversified with various asset classes for the portfolio allocation criteria. The efficient frontier captured optimal allocation positions to be between 2.55% to 6.55%,

“Based on daily returns across asset classes during the past 10 years, our analysis suggests that allocations to bitcoin should range from 2.55% when minimizing volatility to 6.55% when maximizing returns.”

The report also touched on Bitcoin’s value proposition as a gateway to other crypto niche products, especially DeFi. While the innovations are still young, Ark mentioned that they are potentially the new wave of financial experimentation.

The post Institutions Allocating 6.5% to Bitcoin Could Drive BTC Price to Hit 0,000: Ark Invest first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Ark (ARK) на Currencies.ru

|

|