2024-5-8 07:27 |

Susquehanna International Group, a leader in quantitative trading, aggressively expanded its portfolio with over $1.1 billion invested in Bitcoin exchange-traded funds (ETFs). The company’s recent 13F SEC filing on May 7 revealed the composition and value of their Bitcoin ETFs portfolio as of March 31, 2024.

The firm’s latest move signals a significant shift towards digital assets in its strategy. This hefty investment also presents growing confidence among major institutional players in cryptocurrency as a viable asset class.

From Grayscale to WisdomTree: Exploring Susquehanna’s Bitcoin ETF ChoicesSusquehanna’s foray into spot Bitcoin ETFs includes diverse holdings across several major funds. The largest holding is in the Grayscale Bitcoin Trust (GBTC), where Susquehanna has invested approximately $1.09 billion for 17,271,326 shares.

Additionally, the firm holds 1,349,414 shares in the Fidelity Wise Origin Bitcoin BTC ETF (FBTC), valued at about $83.74 million. The BlackRock iShares Bitcoin Trust (IBIT) also forms part of its portfolio, with 583,049 shares worth approximately $23.6 million.

Read more: What Is a Bitcoin ETF?

Further investments include $536.1 million in 508,824 shares of the ARK 21Shares Bitcoin ETF (ARKB) and $21.71 million for 560,832 shares in the Bitwise Bitcoin ETF (BITB). Smaller but more significant holdings include the Valkyrie Bitcoin Fund (BRRR), with 192,391 shares valued at $3.87 million. Meanwhile, the Invesco Galaxy Bitcoin ETF (BTCO) has 166,200 shares worth $11.8 million.

Additionally, the VanEck Bitcoin ETF Trust (HODL) holds 256,354 shares valued at $20.6 million. Lastly, Susquehanna has invested in the WisdomTree Bitcoin ETF (BTCW), holding 255,814 shares valued at $19.29 million.

In addition to spot Bitcoin ETFs, Susquehanna significantly boosted its exposure to Bitcoin futures. It did this through the ProShares Bitcoin Strategy ETF (BITO), now holding nearly 8 million shares valued at approximately $255.42 million.

Moreover, the filing reveals that Susquehanna holds stock in MicroStrategy (MSTR), a public company with the largest amount of Bitcoin (BTC) to date. However, Susquehanna reduced its stake in MicroStrategy by almost 15% during a portfolio rebalancing. As a result, its total share count decreased from 287,180 in February to 244,863 in March.

This move by Susquehanna has garnered attention within the crypto community. Building on this enthusiasm, Crypto YouTuber Healthy Pockets took his excitement to X (Twitter).

“Institutional adoption is going to be best and it has only just begun,” Healthy Pockets wrote.

Furthermore, the move by Susquehanna coincides with a noticeable trend among other institutional investors. For instance, New York-based asset manager Hightower has also ramped up investments in Bitcoin ETFs. BeInCrypto reported earlier that Hightower’s investments totaled $68.35 million in various spot Bitcoin ETFs.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

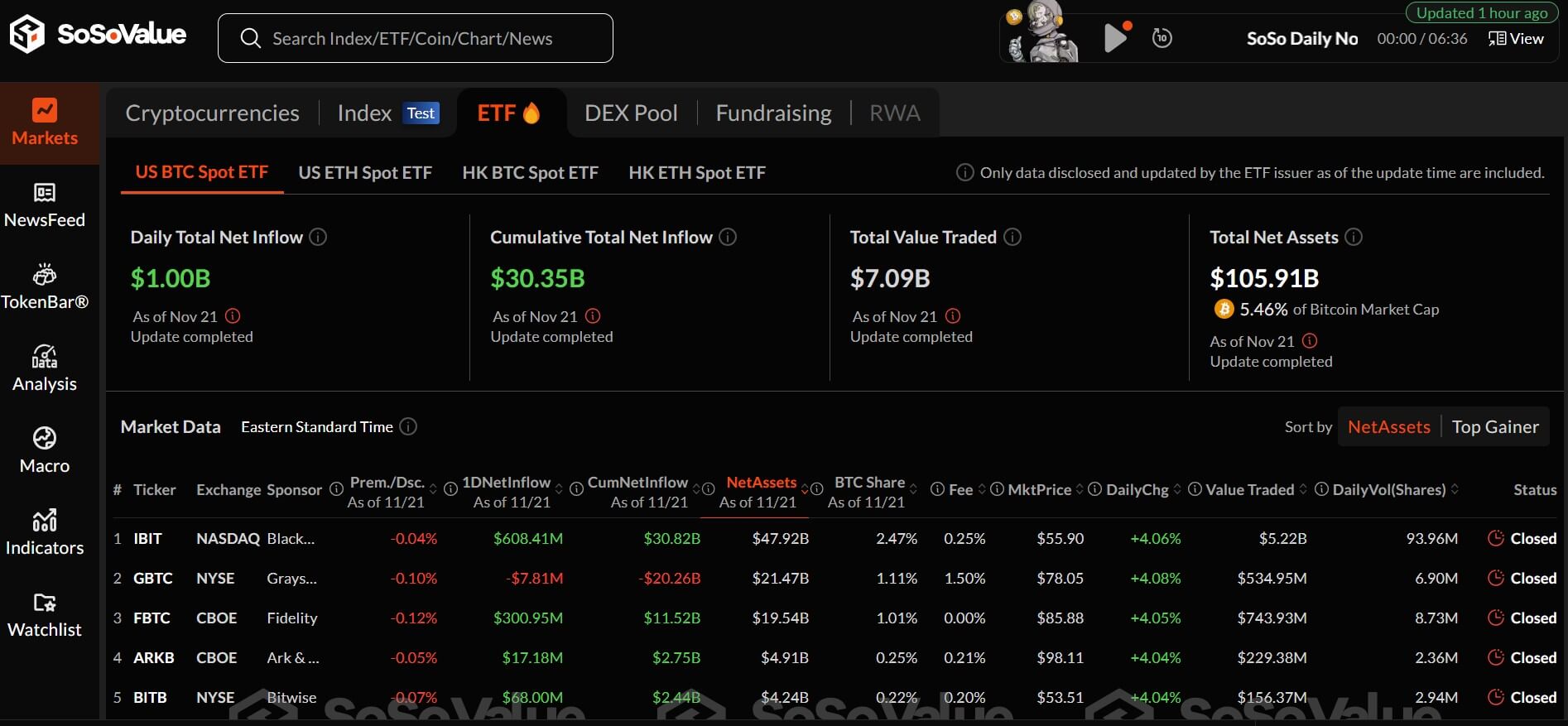

Total US Bitcoin Spot ETF Net Inflow. Source: SoSo ValueThe actions of Susquehanna and Hightower strengthen the renewed interest in US spot Bitcoin ETFs. After experiencing outflows for seven consecutive days, the US spot Bitcoin ETFs finally saw inflows of $378.24 million and $217.06 million on May 3 and 6, respectively. However, according to SoSo Value’s latest data, US spot Bitcoin ETFs recorded a slight outflow of $15.64 million on May 7.

The post Institutional Bold Bet: Susquehanna Pours $1.1 Billion Into Spot Bitcoin ETFs appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|