2019-2-17 20:51 |

Bitcoin Network’s Growth: A New Perspective

It’s been a decade since Bitcoin first came into existence in 2009. A peer-to-peer network that allows to send payments directly from one party to another without any middleman such as financial institutions and banks.

The leading cryptocurrency with the current market cap of $60 billion has been at $20,000 per Bitcoin at its all-time high while having a market cap of more than $320 billion.

Popular crypto analyst, Willy Woo took to Twitter to share a different perspective where Bitcoin as a payments company would be securing close to $300 million in sales for 2018 which is basically the fees paid to miners.

If Bitcoin was a payments company this would be its sales…

Total fees paid to miners by year:

2010: $3.8k

2011: $33k

2012: $66k

2013: $2.2m

2014: $2.5m

2015: $2.3m

2016: $13.6m

2017: $555m

2018: $296m pic.twitter.com/ccGDkpZsNK

— Willy Woo (@woonomic) February 16, 2019

It wasn’t even a one-time sales, rather fees paid to miners has been constantly rising starting at $3.8k in 2010 to $296 million in 2018. And as CEO of the largest cryptocurrency exchange put it, there has been zero marketing budget.

As one crypto enthusiast says, “where there's profit over time, there's longevity.” While another said in part, “Still nice growth over time, shows potential of future growth.”

However, in the literal business sense, the chart would be steeper as one enthusiast pointed out, “That's a log chart which people don't usually look at for business data. It will be a much steeper slope with a traditional chart as log smooths out the exponential growth.”

If we take a look at few of the today’s big companies like Amazon, Tesla Motors, and FedEx, for the first five years, they haven’t been really the profitable companies rather just the opposite only to later become the path-breaking and billion dollar companies that they are today.

Let’s Take a Look at TransactionsBefore the notion of Bitcoin as a store value emerged, it has been envisaged as a payment system so it’s natural that comparison with the traditional global payment systems is made. However, Bitcoin is far away from reaching to the levels of biggest payment systems like Visa and Mastercard in terms of transactions per second.

When it comes to transaction value, in 2018, the Bitcoin network transacted $3.2 trillion in value as reported by Satoshi Research, “Comparing Bitcoin’s network performance in 2018 to prior years: – Total trading volume: $2.2 trillion – Total Layer 1 transaction volume: $3.2 tn – Total change in transaction volume 2017-2018: -8.23% ($0.3 tn) – Median change year-on-year 2017-2018 for every day in the year: +2.91%.”

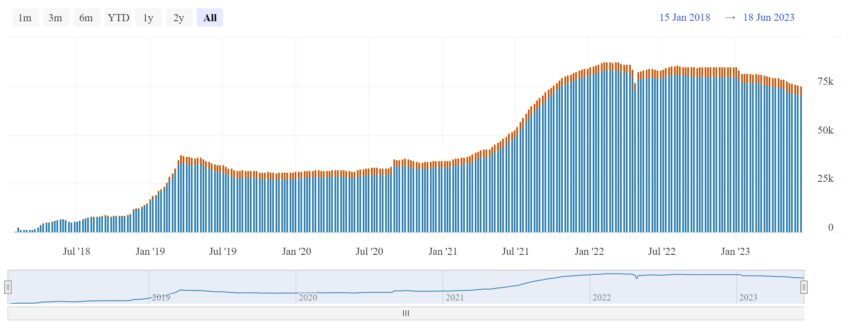

As for the Bitcoin transactions, they have been constantly on the rise as well. Meanwhile, the fee on Bitcoin network is taking a dip, unlike Mastercard and Visa that are planning to hike the fee for merchant banks that is expected to go into effect in April 2019.

This got the community talking as one crypto enthusiast said, “Good opportunity to tell these merchants about Bitcoin and Lightning Network. It's time to really disrupt the financial oligarchy.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|