2020-2-9 21:38 |

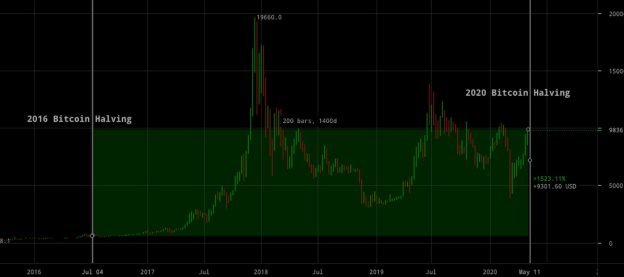

Bitcoin reward halving is less than 100 days away, scheduled to occur in Mid 2020 that would see the new issuance supply of bitcoin declined by 50%. With this supply reduction, there would be changes in the breakeven cost to mine bitcoin before and after the halving.

Digital currency research company TradeBlock tries to find “bitcoin mining profitability following ‘The Halving’ and its indication for price in its latest blog.

Maintaining healthy Profit Margins & Reducing Mining CostIn 2019, commercial mining operators were operating at “healthy profit margins,” as the price of BTC jumped throughout the year.

The network hashrate meanwhile, continued on its record run, making new highs each week as the number of resources committed to secure the network rises. But as the resources rise over time, efficiency and mining costs rise as well.

To maintain healthy profit margins for miners, a rising hashrate is needed to correspond with a rising bitcoin price while to reduce mining costs, newer and more efficient mining devices are continuously being developed.

Miners expecting the price of bitcoin to rise to higher levels?The decentralized peer-to-peer network is secured by miners who receive 12.5 bitcoin for mining each block. Currently, 144 blocks are mined on average per day that results in 1,800 new BTC per day. After the halving, the mining reward will decline to 6.35 bitcoin per block, resulting in 900 new bitcoins mined per day.

Before the halving, the gross cost to mine one BTC at current levels with current device types are estimated by TradeBlock at $6,851. Meanwhile, the BTC price is trading at $9,800.

After the halving, assuming the hashrate will continue to rise over the next three months at the same rate it has been for the past three months and commercial operators transition to newer models for 30% of their rigs, the cost to mine one BTC would be $15,062.

If instead of rising to ~135,882,500 TH/s on halving day, the hashrate remains flat, the cost would fall to $12,525. However, for large scale commercial mining pools like those operated by Bitmain, the largest manufacturer of mining rigs, will have even lower breakeven cost.

The breakeven costs, TradeBlock says indicates miners continue to increase towards which suggests miners are “likely expecting the price of bitcoin to rise to higher levels,” above $12,000-$15,000 around the halving to continue to generate a profit. In contrast, it is also likely they will reduce resources following the halving that will result in a decline in hashrate as profitability falls.

Bitcoin (BTC) Live Price 1 BTC/USD =$10,117.9268 change ~ 2.84%Coin Market Cap

$184.23 Billion24 Hour Volume

$6.95 Billion24 Hour VWAP

$10.01 K24 Hour Change

$286.9099 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|