2022-10-24 11:27 |

Coinspeaker

How US Treasuries Will Be Used by Maker for Buying Ethereum and Boosting DAI

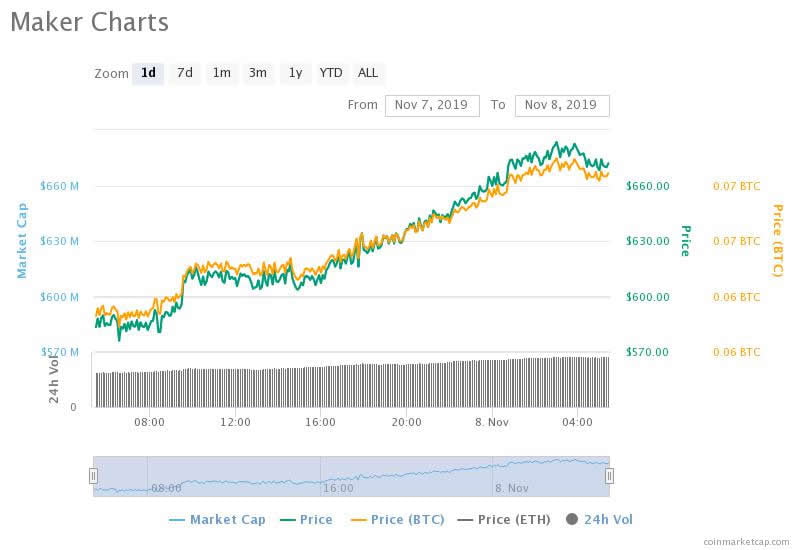

Maker, the project behind the largest decentralized stablecoin DAI, has recently been heavily involved in the centralized finance industry with the likes of Coinbase, Gemini, and Coinshares. It has also reportedly bought US Treasuries and corporate bonds from BlackRock.

According to reports, Gemini has offered to pay Maker 1.25% on every GUSD that existed on Maker’s Peg Stability Module (PSM). Coinbase Prime has also sought to pay 1.5% on USDC being used as collateral behind DAI. It is important to note that PSM is a giant pool of assets that helps Maker to maintain a $1 peg of DAI.

“As we’d like GUSD usage to increase on-chain, we propose that this marketing incentive only be credited if the average monthly balance of GUSD in the PSM is greater than or equal to $100m for the month,” said Gemini CEO Tyler Winklevoss.

In June, the project’s DAO voted to invest $400 million in US Treasuries while they spread the rest across various iShares ETFs.

Considering that USDC Is a centralized stablecoin launched by Circle and Coinbase, DAI has been heavily criticized for being exposed to it.

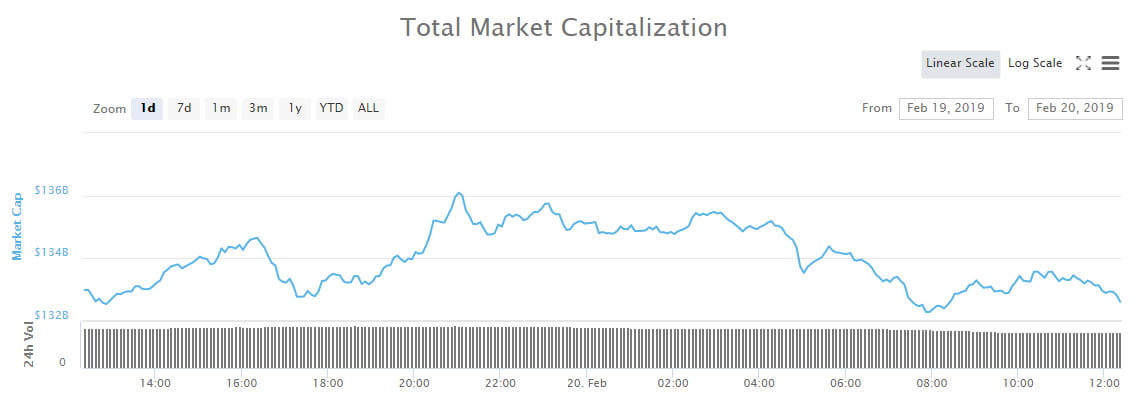

Interestingly, Maker has made several efforts to go fully decentralized with the project founder Rune Christensen removing ties to centralized assets in an operation dubbed the “ENDGAME”.

The idea is to get involved in projects that cannot be banned like Ethereum rather than USDC. Its “ENDGAME” is reportedly divided into three parts with the current part called “Pigeon Stance”. The process is expected to last within three years. It seeks to generate enough returns on every Idle fund to be able to buy up more ETH. Christensen explained the name “Pigeon Stance.”

“is inspired by the evolutionary advantage of pigeons: Low fear of humans makes it a lot easier for them to scavenge leftover food in cities, allowing them to reproduce in massive numbers,” he said.

Within three years, growth would continue as long as there is no immediate risk according to Christensen. Regardless, the project will run into the next phase when any risk emerges. The next phases are Eagle and Phoenix. Eagle focuses on the balance between growth and resilience in addition to a maximum of 25% exposure to a real-world asset. Phoenix is also characterized by maximum resilience in cases of threat of authoritarian attacks. Under this, there is no exposure to sizable real-world assets.

nextHow US Treasuries Will Be Used by Maker for Buying Ethereum and Boosting DAI

origin »Bitcoin price in Telegram @btc_price_every_hour

Maker (MKR) на Currencies.ru

|

|