2023-11-8 17:55 |

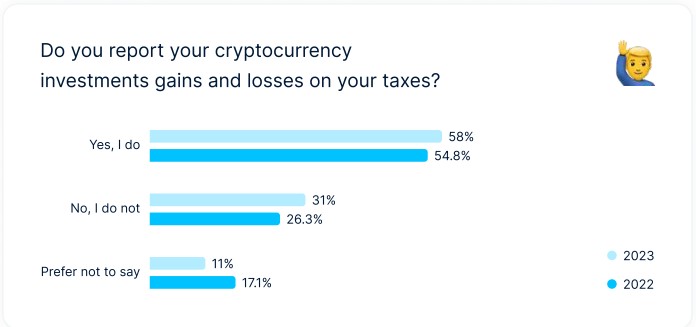

Unlock the complexities of cryptocurrency taxation and learn how crypto losses impact your tax liability in the United States, United Kingdom and Canada. origin »

Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|