2024-4-3 08:11 |

The Difference Between Crypto Trading and Crypto Swapping

Crypto trading and crypto swapping are two distinct processes in global cryptocurrencies.

Crypto trading involves strategic buying and selling of digital assets to make a profit. Traders analyze market trends, utilize advanced order types, and strive to optimize their market positions. It caters to a wide range of traders, from beginners to advanced users, offering detailed market analysis and a diverse selection of tokens.

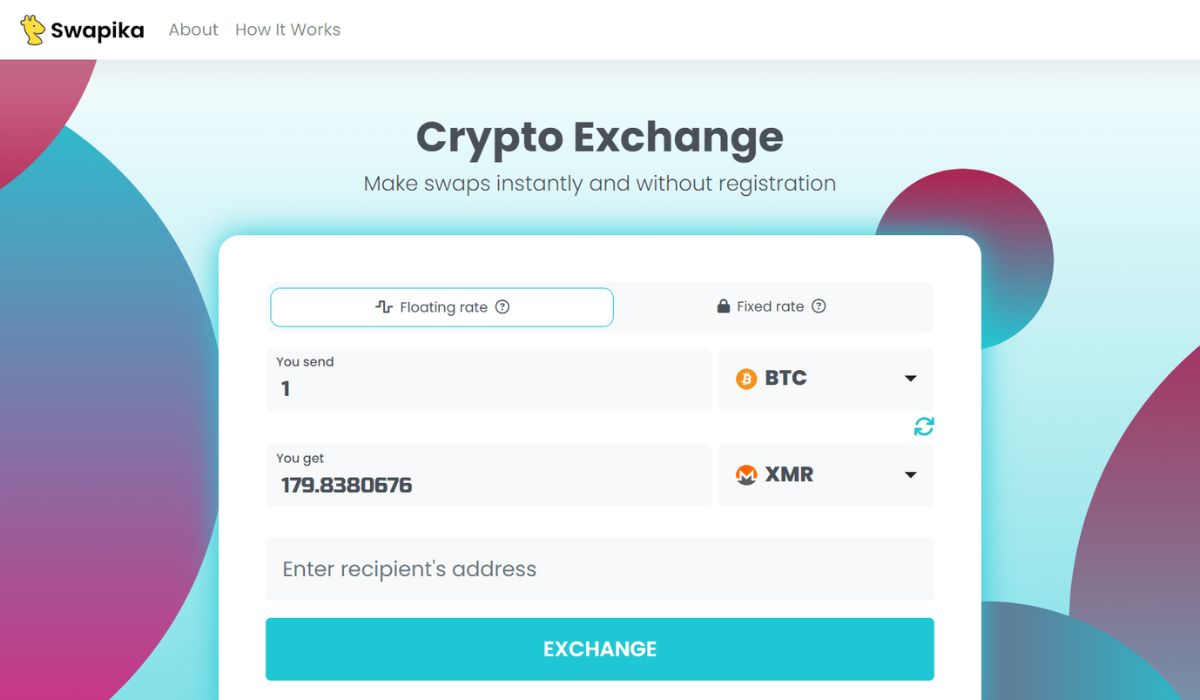

Crypto swapping focuses on exchanging assets for diversification or specific purposes rather than solely for profit. This is a more straightforward process that prioritizes speed and cost-effectiveness over complex trading strategies. Swapping cryptocurrencies typically involves locked-in prices, and one-click trading, making them ideal for users looking for hassle-free transactions without navigating the complexities of the spot market.

The Diversity of Crypto SwapThere are three main types of swaps:

Centralized exchanges (CEXs); Decentralized exchanges (DEXs); Automatic swap protocols.CEXs operate as platforms that are owned and managed by a third party. These exchanges facilitate the trading of cryptocurrencies through an intermediary, which controls the transactions and holds users’ funds in a centralized manner. CEXs are known for their user-friendly interfaces and high liquidity, making them popular among traders looking for efficiency and ease of use.

DEXs, on the other hand, function on blockchain networks without the need for a central authority. Users can trade directly with each other using smart contracts, which execute peer-to-peer transactions autonomously. DEXs offer increased security and privacy, as users retain control of their funds throughout the trading process. While they may have lower liquidity compared to CEXs, DEXs are favored by those seeking a decentralized and censorship-resistant trading environment.

Automatic swap protocols, also known as automated market makers (AMMs), are a type of decentralized exchange that utilizes smart contracts to facilitate token swaps. Users can trade cryptocurrencies with algorithmically determined prices, providing liquidity to the platform’s pools in exchange for a share of transaction fees. Automatic swap protocols offer seamless and efficient trading experiences, with users contributing to the protocol’s liquidity and earning rewards in return.

Purposes of Crypto SwapsNow that we have explored the different types of crypto swaps, let’s delve into their various purposes and how they cater to the needs of cryptocurrency traders.

Update the token. The issuer may decide to update its cryptocurrency, for example, by changing its ticker symbol or functionality. Replace the blockchain. A project can switch from one blockchain to another, and simultaneously transfer the entire cryptocurrency. Change the characteristics of the blockchain. Sometimes, developers change network functions without switching. Simultaneously, a new token can be created to replace the existing token. Merge or split projects. Two or more projects may decide whether to merge or split. A new cryptocurrency is then created, which can be obtained in exchange for the previous one. Change the economic model. The project may revise its economic model, for example, to change the issuance or conditions of staking. Simultaneously, new assets can be created.The primary purposes of crypto swaps include:

Liquidity Provision. Crypto swaps play a vital role in providing liquidity to the cryptocurrency market by enabling the exchange of assets between users. Liquidity is essential for efficient price discovery and smooth trading operations. Diversification. Crypto swaps allow traders to diversify their investment portfolios by easily swapping between different cryptocurrencies. This flexibility enables investors to manage risk and capitalize on market opportunities. Price Discovery. Swaps help establish accurate market prices for various cryptocurrencies by matching buy and sell orders. This price discovery mechanism contributes to a more transparent and efficient cryptocurrency market. Decentralization. Decentralized exchanges and automatic swap protocols promote decentralization by allowing users to trade peer-to-peer without the need for intermediaries. This eliminates single points of failure and enhances the security and privacy of transactions. Access to Unique Assets. Crypto swaps offer access to a wide range of digital assets that may not be available on traditional exchanges. Users can leverage swaps to access unique tokens, explore new investment opportunities, and engage with emerging blockchain projects. Earning Using Crypto SwapsThe decentralized nature not only provides greater security and privacy but also offers users opportunities to earn money through various strategies. Let us explore strategies to use cryptocurrency swaps and enhance profits.

Liquidity Provision is one of the most popular methods of earning money on cryptocurrency exchanges to provide liquidity to decentralized exchanges. By depositing assets in liquidity pools, one can earn a share of the trading fees generated on the platform. This strategy involves balancing the portfolio with various cryptocurrencies to maximize returns while minimizing risk. Yield Farming has taken the crypto world by storm, offering users the opportunity to earn passive income by staking their assets in liquidity pools or by participating in various DeFi protocols. By participating in yield farming on decentralized exchanges, rewards can be earned in the form of additional tokens or interest rates, thus increasing their earnings potential. Arbitrage trading involves exploiting the price differences in the same cryptocurrency across different exchanges. By leveraging cryptocurrency swaps, one can capitalize on these price differentials to buy low on one exchange and sell high on another, thereby pocketing profit in the process. This strategy requires quick decision-making and a keen eye for market trends. Token swapping is simple yet effective. It allows one cryptocurrency to be exchanged for another directly on decentralized exchanges. By monitoring market trends and identifying promising projects, one can capitalize on the potential price movements of various tokens and earn profits through strategic swaps. Staking and master nodes are offered by many crypto projects, enabling users to earn rewards by holding and validating network transactions. By participating in stacking or running a master node on decentralized exchanges, passive income can be earned in the form of additional tokens or transaction fees. In conclusion, cryptocurrency swaps offer numerous opportunities for individuals to generate income in the digital asset realm.Whether way you choose, the key to success lies in thorough research, strategic planning, and a willingness to adapt to the dynamic crypto landscape. By embracing these strategies and staying informed about market trends, one can unlock the full potential of cryptocurrency swaps and pave the way for financial success in the exciting world of digital assets.

Developing a Trading and Swapping StrategyTo achieve long-term success as a cryptocurrency trader, we need to find an optimal trading strategy that combines different skills and aspects of cryptocurrency trading:

Use of technical analysis. Understanding support and resistance levels, moving averages, and indicators such as the RSI can enhance trading strategies. Fundamental Analysis and studying market trends. Stay updated on market trends, news, and developments in blockchain technology. A fundamental analysis, which involves evaluating a cryptocurrency’s technology, team, and adoption, can provide valuable insights for making trading decisions. Setting financial goals and risk tolerance. Before diving into trading or swapping, we define your financial goals and assess your risk tolerance. Understanding how much one is willing to invest and potentially lose is crucial for developing sustainable strategies. Understanding how cryptocurrencies work. Before trading, one needs to understand how cryptocurrencies work. Obtain various coins and tokens, blockchain technology, and decentralized networks. Studying trading strategies. Explore different trading strategies to choose the one that suits you. Evaluate factors such as risk management, market analysis, and technical indicators Choosing a reliable exchange. Before trading or making swaps, we recommend you choose a safe and reliable exchange or exchange aggregator. When selecting a swap platform, consider factors like security, fees, liquidity, and user experience. SwapSpace, a leading crypto exchange aggregator, offers a seamless and secure platform for swapping cryptocurrencies with a wide range of supported coins and competitive rates. Use of automatic trading instruments. Use automated trading tools like bots and algorithmic systems to maximize your success. They allow you to save time and increase profitability by making transactions on your behalf. Choosing the right cryptocurrencies to trade or swap. Research on and selection of cryptocurrencies with strong fundamentals and growth potential. Diversifying a portfolio with a mix of established and emerging coins can help mitigate risk. Tips for Successful Trading and Swapping Stay informed about market news and developments. Keep a close eye on market news, regulatory updates, and technological advancements. Staying informed can help anticipate market movements and make timely decisions. Avoiding emotional decision-making. Emotions such as fear and greed can cloud judgments and lead to impulsive decisions. Stick to your trading plan and avoid making decisions based on emotions to maintain a disciplined approach. Use stop-loss orders to manage risks and implement stop-loss orders to automatically sell cryptocurrency at a predetermined price to limit potential losses. This risk-management tool can help protect capital under volatile market conditions. Diversify Your Portfolio to Spread Risk. Diversification is key to reducing the risk in your portfolio. Invest in a mix of cryptocurrencies across different sectors to spread risk and potentially increase returns. ConclusionTrading and swapping cryptocurrencies can be lucrative ventures with the right knowledge and strategies. By honing the craft, managing risks effectively, staying patient in turbulent times, and engaging with the vibrant crypto community, one can navigate the complexities of the market with confidence and resilience.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|