2021-3-29 10:39 |

Cryptocurrencies have been “a thing” since the inception of Bitcoin, more than a decade ago. It’s clear that cryptos and the blockchain are here to stay. Unlike fiat (non-digital) money, cryptocurrencies aren’t stored in bank accounts or in any physical manner, at least not in any commonly-known sense.

To store cryptocurrencies, the user needs to use a crypto wallet. Selecting the perfect type for you and understanding how to use it is the key to safe crypto use. In this article, we’re going to help you with this.

Wallet TypesBefore anything else, you should introduce yourself to the world of crypto wallet types. There are physical and software wallets, and most crypto holders use both types for extra safety.

Cryptocurrencies aren’t stored on any wallet. They can’t be moved from their blockchain ledger. A cryptocurrency will always be on its blockchain. The information necessary for owning any crypto is actually what the holder has. It is this information that is stored on crypto wallets. For the purpose of this article, though, we’re going to act as if the cryptocurrencies are stored directly on one’s wallet.

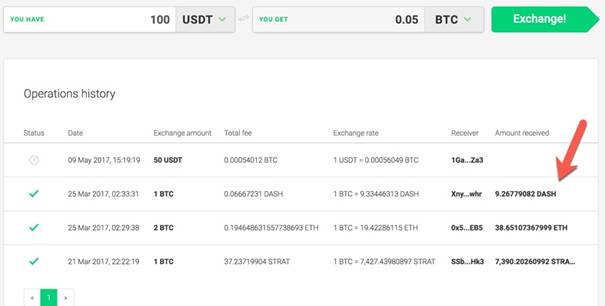

Software WalletsSoftware wallets are programs, apps, and extensions that store your crypto currencies. The simplest wallet type is the web app wallet. These are located on a domain. Safety measures do exist, but web app wallets are prone to various hacks and phishing scams. Exchange wallets are the most common web wallet type.

Extension browsers are located within your browser to decrease the risk of phishing. Desktop wallet apps are typically the safest software option, with minimal hack risks.

Physical WalletsPhysical wallets are somewhat more inconvenient than software wallets but are a much safer option. Paper wallets are the most straightforward physical wallet option. These are simple pieces of paper with QR codes for the user’s private and public key. They are unhackable but, like anything physical, can be lost.

Then, there are hardware and cold storage wallets. It’s normal to confuse the two terms, so let’s talk more about cold storage vs. hardware wallet options.

Cold storage wallets are pieces of hardware that resemble a wallet. This wallet type keeps your cryptocurrencies encrypted on it. The only way to access the valuable data stored on them is through authorization from the owner.

Hardware wallets, on the other hand, merely store the encryption keys that are necessary for accessing one’s crypto funds.

Whereas hardware wallets have hardware authorization options, cold storage wallets feature software and hardware authorization. As such, cold storage wallets are the safest crypto storage option available.

Which Wallet to Choose?Now that you know about the available types of crypto wallets, you’re probably wondering which one you should go with. As we mentioned earlier, most crypto holders use more than one wallet for their crypto funds.

Software wallets are always more convenient than hardware wallets, as they are easier to access. But hardware wallets are a safer option, overall. A combination of hardware and software crypto storage options is the safest and the easiest way to work with your funds.

For instance, without a software wallet, you won’t be able to transfer money to most locations, making crypto payments and trading difficult, if not impossible. A combination of both wallet types is a must.

You’re probably going to have to use multiple software wallets as well. Certain services support certain wallets, and most software wallets don’t support every single cryptocurrency on the market.

If you’re looking for the safest solution to store your cryptos, though, the cold storage option is the best one.

How to Use Crypto WalletsWe won’t be getting into the particulars on how to use each wallet, but we are going to help you understand how to use multiple wallets.

Let’s say you have a small amount of a cryptocurrency. You aren’t a trader, and you aren’t looking to earn money in crypto.The most straightforward way to use these funds is to keep them where you probably bought them in the first place – the exchange wallet. Now exchange-wide hacks have been known to happen and are a clear and present danger. However, for small amounts of money, the risk of losing the entiretyof your funds isn’t worth investing in more complex storage options.

But if you are a crypto holder with significant amounts of cryptocurrency, holding it all in one spot is pretty risky, not to mention holding it all on an exchange wallet. Investing in a hardware wallet and creating a software wallet is the best way to go.

The majority of your funds should be stored on a hardware storage solution, ideally on a cold storage wallet. Then, a much smaller portion of your funds should sit in your extension or desktop (mobile) wallet. This amount should be used for quick to-and-fro transactions with your exchange wallet. Finally, you should have a tiny amount of crypto on your exchange wallet for quick transactions.

The percentage of your funds for each of the three mentioned storage options depends on the nature of your crypto usage. If you are a HODL-er, you won’t need to worry about using a software wallet too much. If you are an active trader, you’re going to constantly have to teeter between convenience and security.

In SummaryIf you need to store a small amount of crypto that you wouldn’t cry over losing and are looking for ease of use, online wallets are your best option. Keep in mind, though, that software wallets aren’t the pillars of privacy or security.

Alternatively, if you have a large amount of crypto and security is an important factor for you, a physical storage option should go without saying. Be aware that the hardware storage options can set you back as much as a few hundred pounds. Still, an investment in your crypto safety and privacy is more than worth the money.

Ideally, you’ll want to use a combination of more wallets.

Author Bio: Hitesh is a digital marketing strategist and entrepreneur with more than 15 years of experience in digital marketing, start-ups, branding, and customer acquisition strategies. Hitesh is the CEO and Founder of Reposition Group, which specializes in digital growth strategies for companies in the cryptocurrency market, such as Bitamp.com.

The post How to Choose and Use a Crypto Wallet appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

ANYONE (ANY) на Currencies.ru

|

|