2020-7-20 18:44 |

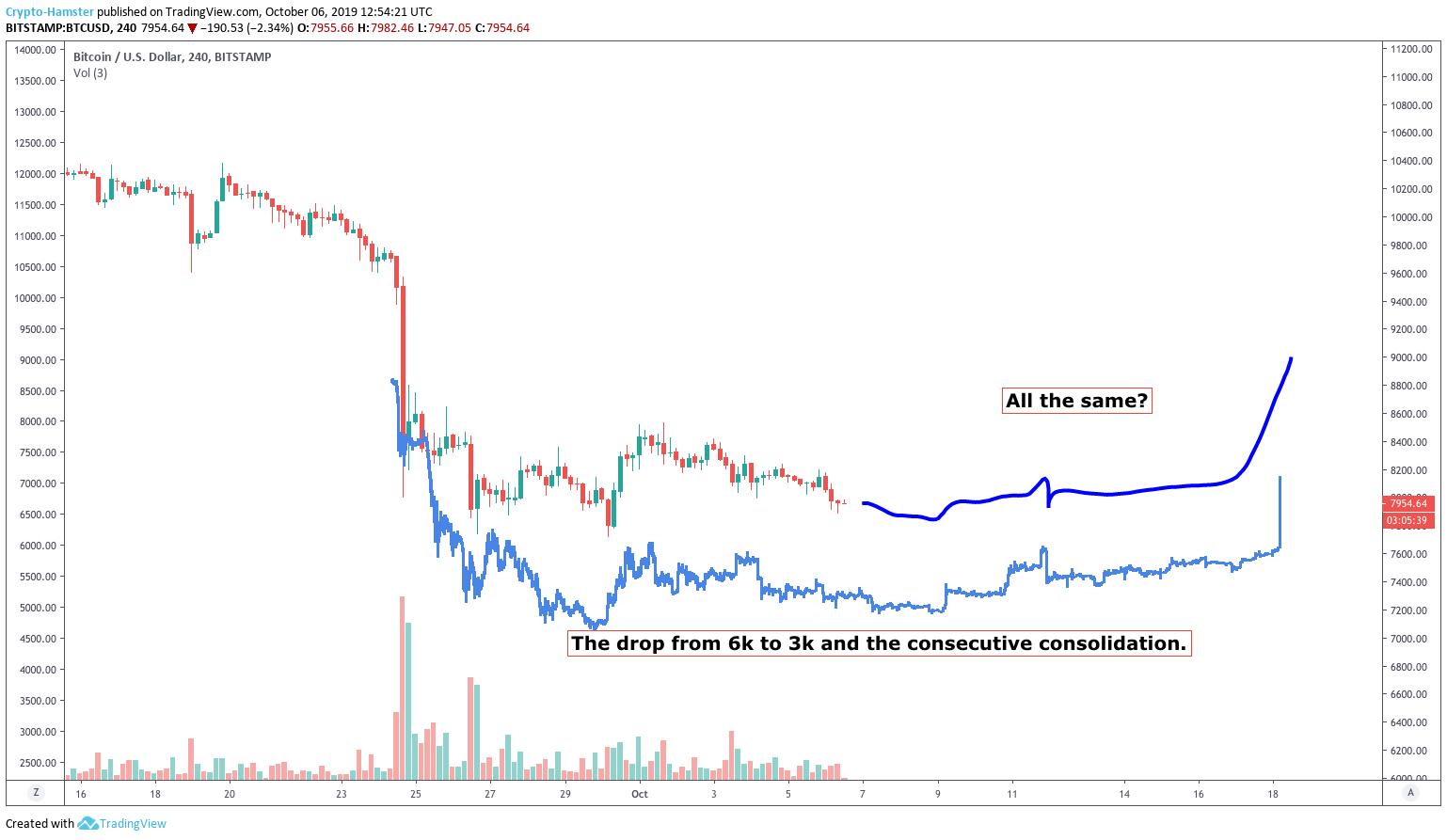

The S&P 500 just closed its strongest weekly performance against the Nasdaq Composite in the last four years in what analysts are calling a “Great Rotation.” The trend of shuffling capital closely resembles what’s taking place across the crypto market with Bitcoin and altcoins. Is this “Great Rotation” essentially the stock market’s version of alt season? And what are the factors driving this interesting investment phenomenon? S&P 500 Beats Nasdaq Composite For First Time In Four Years In “Great Rotation” This week there’s been a shakeup in the stock market, but it wasn’t the result of a selloff. Instead, the regular tech stock over-performance has taken a backseat, allowing other stocks and indices to shine as a result. The US tech industry has kept up the strongest growth out most other categories, reflected in the tech-heavy Nasdaq Composite regularly beating the S&P 500 and the Dow. After the Black Thursday market collapse, all major US indices fell to deep lows, but only the Nasdaq has since broken its previous record. The rise was primarily driven by individual tech stocks reaching new all-time highs, such as Amazon and Apple. RELATED READING | HOW BITCOIN OUTPERFORMED BOTH THE S&P 500 AND NASDAQ IN FIRST HALF 2020 But there’s since been profit-taking and a slow shift in the trend. This week, the S&P 500 closed with its first weekly outperformance over the Nasdaq composite in four years. Quincy Krosby, chief market strategist at Prudential, told MarketWatch although it’s not clear, investors could be taking profit and moving capital into other stocks they believe have more room for growth. Analysts call this phenomenon a “Great Rotation.” Rotating Capital From Bitcoin to Altcoins Leaves Room For Alt Season To Begin The primary market mover suddenly showing stagnancy and underperformance next to other indices that have underperformed over the last four years sounds eerily familiar. In the crypto market, the same sort of trend is taking place. The market over-performer, Bitcoin, is suddenly trading sideways after a strong rise from Black Thursday lows. Savvy investors who bought low, are now selling high and looking for assets with more room to run. This closely mimics the sentiment and price action taking place across the stock market. It also explains why there’s a sudden interest once again in altcoins. RELATED READING | THE WORLD’S WEALTHIEST ARE DUMPING STOCKS, HOW THIS CAN IMPACT BITCOIN Many altcoins remain down from their former highs by 90% or more. Bitcoin, however, is nearly halfway to its former record. Investors are recognizing that not only do they have BTC profits to take, but that moving that capital into altcoins could provide greater a return. Just like the Nasdaq and tech stocks suddenly leaving more wiggle room for the S&P 500 to surge, Bitcoin’s sideways allows altcoins to shine. Until either Bitcoin or tech stocks – two asset types that have shown a close correlation in the past – begin to set new highs, interest may remain high in these alternative investment choices. Featured image from Deposit Photos. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|