2022-6-9 21:00 |

The crypto market trends to the downside as major assets are unable to break above local resistance. As per usual, the dominant trend picks winners and losers and unfortunately, the altcoin markets have been amongst the latter.

Related Reading | As Bitcoin Slumps, BTC Miners Sell Of Their Tokens Creating Panic In The Market

In particular, decentralized finance (DeFi) protocols have been severely impacted by the crypto downtrend. Some of the most popular protocols in the Ethereum DeFi sector, perhaps the biggest ecosystem in the space, record as much as 92% in losses.

Jack Niewold, founder of Crypto Pragmatist, set out to dig deeper into the effects of the crypto winter in the DeFi sector. One of his objectives was to determine if DeFi protocols can stay profitable in this downtrend.

As seen below, protocols like MakerDAO, SushiSwap, Compound, and others saw a decrease in the price of their native tokens and an even more steep decline in their revenue. This evidence put into question the idea that DeFi and crypto, as Niewold said, “really reached an inflection point”.

Source: Jack Niewold via TwitterThere is evidence of maturity in the space, institutional adoption, and resistance to overall market declines in larger cryptocurrencies. However, most of the DeFi sector has been unable to retain its revenues. Niewold noted:

To be fair, most DeFi tokens have drawn by more than their fee rev, which is interesting–from a ‘fundamental’ perspective, stuff is trading at a discount. I think that’s the first takeaway for me, that projects with real product market fit are trading at a relative discount.

Additional data provided by DeFi Pulse indicates the total value locked (TVL) across DeFi protocols has been trending to the downside with revenues and token prices. This metric returned to its February 2021 levels and stands at around $50 billion.

DeFi TVL trends to the downside. Source: DeFi Pulse Crypto Bleeds As Ethereum Dominance RisesThe current downtrend is more palpable across the entire layer-1 ecosystem. While Solana (SOL), Avalanche (AVAX), and others experience a dropped in their prices and network activity, Ethereum (ETH) benefits.

The downside trend has translated into a decrease in Ethereum fees. These are currently priced at 2 Gwei or $0.13 for a fast transaction after averaging 100 Gwei or more during network congestion.

As Niewold said, L1 networks such as Solana and Avalanche benefited from a rise in Ethereum transaction fees, as these declines, users return to this network. Niewold said:

(…) in a period of decreased demand, it makes Ethereum a lot more attractive relative to alt-L1s (…). Alt-L1s do not benefit from this fee reflexivity, as their competitive advantage dies down in periods of lower activity.

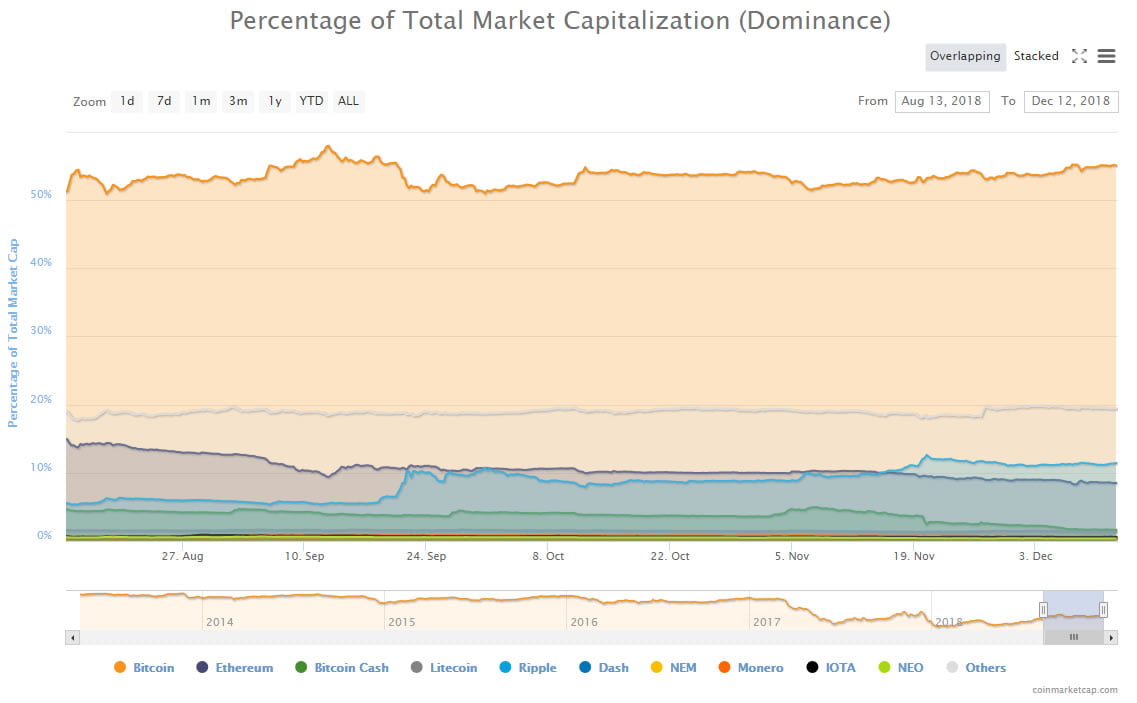

As NewsBTC noted yesterday, Bitcoin, Ethereum, and stablecoins USDT and USDC, form 77% of the total crypto market cap. BTC and ETH dominance has been on the rise during this downtrend and hints at an overall de-risking behavior from crypto investors.

Bitcoin, stablecoins, and Ethereum dominance are on the rise. Source: Arcane ResearchRelated Reading | Ethereum Market Cap Cut By Over $100 Billion Last Month

At the time of writing, ETH’s price trades at $1,800 with a 2% profit in the last 24-hours.

ETH moving sideways on the 4-hour chart. Source: ETHUSD Tradingview origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|