2023-3-24 13:00 |

Stablecoin operator Tether will announce profits of $700 million for the first quarter of the year after publishing its latest figures.

The issuer of the USDT stablecoin also revealed its assets outstripped its liabilities – by a total of $960 million. The company’s chief technology officer, Paolo Ardoino, expects the firm’s total reserves to reach $700 million by the end of the financial quarter next week.

Reserves Top $1 Billion for First TimeThis means for the first time, the firm’s excess reserves will top $1.66 billion – the first time they have exceeded the $1 billion threshold.

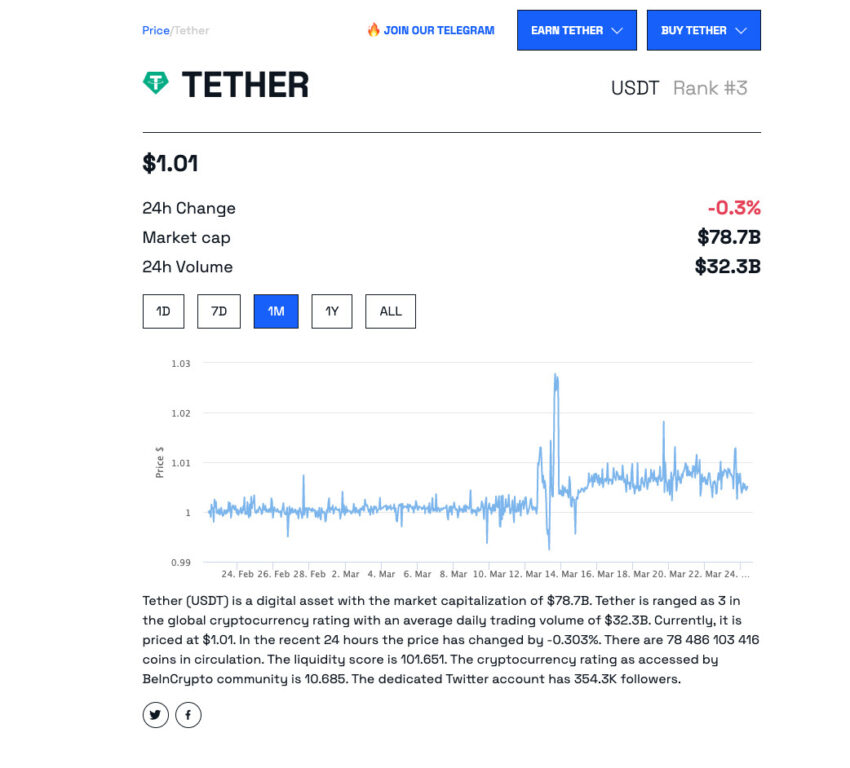

Price chart from BeInCrypto.comTether is the largest stablecoin with a market cap of over $78 billion. It is pegged to the U.S. dollar 1:1. Stablecoins are designed to protect against price volatility. One of the major criticisms of cryptocurrencies is that their rollercoaster price action can detract less experienced investors from using them.

Stablecoins deal with this perceived problem and to ensure value over time stay relatively stable. They can also be used to transfer funds between different cryptocurrencies without the need for fiat currencies.

USDT was first introduced in 2014 and has been the target of much criticism over the years. Much of the criticism concerns the transparency of its financing. Tether held commercial paper, a type of unsecured short-term debt. However, it failed to demonstrate which firms or where the companies it had bought the debt from were located.

Tether eventually transferred its holdings to more reliable U.S. Treasurys.

Tether makes money from charging fees and by issuing loans to institutions.

Tether Grows Following SVB CollapseTether’s use has expanded dramatically in recent weeks following the collapse of Silicon Valley Bank. Rival Circle, which issues the USDC stablecoin, admitted it had $3.3 billion exposure to the failed bank, which led to USDC briefly losing its dollar peg.

This occurred as investors worried about the coin’s stability. The U.S. government eventually assured customers their funds remained safe after guaranteeing their deposits. This led to the restoration of the peg.

When asked if Tether would be able to withstand a shock like the SVB crisis, Ardoino pointed to Credit Suisse as a sign of instability in the traditional markets.

““Tether is making money and banks are failing. So if you have to put money somewhere, I guess that Tether is the most safe among all the choices,” he said.

The post How Tether (USDT) Benefited from the Silicon Valley Bank Collapse appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Tether (USDT) íà Currencies.ru

|

|