2021-11-4 17:20 |

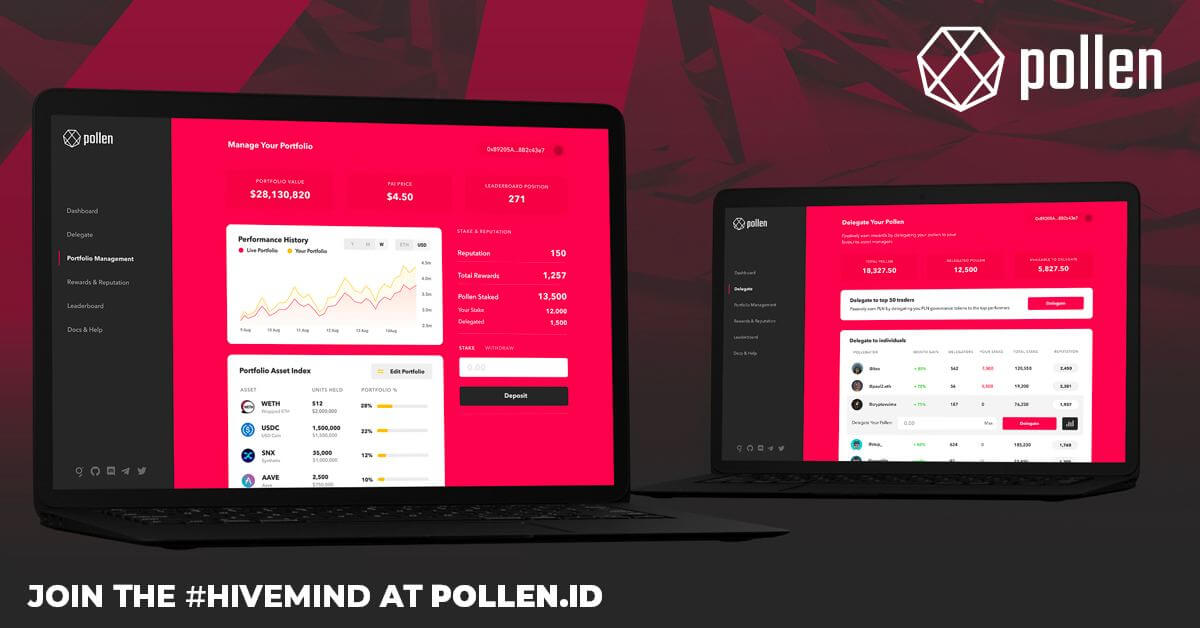

Pollen DeFi, the decentralized protocol that facilitates ‘hivemind’ weighting of asset pools that back up market-tradable tokens, today revealed their upcoming ‘Incentivised Beta’ platform release and details on how the ‘DeFi 2.0’ protocol will enable its unique community-managed financial instrument.

The ‘Beta’ release, which goes live in December, will initially enable users to contribute to the continual balancing and rebalancing of a singular central asset pool that will back up a tradable asset token.

The protocol will be open to whitelisted users who can begin building community credibility (in the form of a ‘reputation’ score), compete for a position on the community leaderboard, and, in turn, will have a chance to earn mainnet Pollen ($PLN) governance tokens.

Inside Pollen DeFiPollen DeFi aims to push ‘DeFi’ into the ‘DeFi 2.0’ era by moving beyond institutional imitation and removing centralized “middlemen”; the platform instead empowers user-curated cryptocurrency asset pools that are constantly refined via a merit-based balancing of users’ portfolio suggestions.

Community members are rewarded for making good decisions and subsequently gain more influence over the dynamically-rebalancing portfolio. Alternatively, users who would prefer to turn to more qualified traders (based on proven reputation, scored by the platform) can delegate their voting power accordingly.

These ‘hivemind approved’ asset portfolios then back up ‘asset pool tokens’ listed as easily accessible financial instruments capable of outperforming market fluctuations.

Boosted earlier this year by strategic backers, The Graph and AlphaBit, Pollen DeFi is focused on building the ultimate ‘crypto meritocracy’; the salient, DAO-driven ‘DeFi 2.0’ experience leans on the fact that the leadership team merely creates and hones the core technology and UI, ensures platform security, and facilitates user governance and ease of accessibility, while the diversity of opportunities presented within the financial instrument itself result from decentralized, community-contributed portfolio suggestions.

Pollen DApp users either contribute portfolio recommendations and try to top the leaderboard to earn rewards, or simply choose to delegate their governance tokens to the best performing traders and share the rewards.Pollen DeFi is powered by two new tokenized assets built specifically with DeFi 2.0 in mind, the Pollen ($PLN) governance token and the native Portfolio Asset Index token ($PAI) which is backed by the total value locked (TVL) of the first and core asset pool on the platform.

Other crypto-communities, influencers, and even top-ranking Pollen DeFi users will be able to propose additional asset pools that will be continually re-balanced by user proposals and support new asset-backed tokens, similar to the $PAI token.

Pollen DeFi’s move from Alpha to Beta with a dramatically upgraded protocol design is supported by an already strong community of followers wishing to begin the process of actively contributing to the balancing of the asset pool.

Pollen DeFi’s open-source protocol and merit-based system empower the brightest minds in its community and incentivizes them to continually contribute. This means that the $PAI token is backed by a continually rebalanced and optimized asset pool that aims to out-smart market fluctuations with overall global community intelligence ideal for the 24/7 nature of the cryptocurrency market.

Pollen DeFi Project Lead and Co-Founder, Philip Verrien, explained in a statement:

“Our focus has been on rebuilding asset management from the ground up; reducing risk and volatility, while also maximizing yield and creating dynamic opportunity for anyone, regardless of their experience level; [Pollen DeFi] aims to be the embodiment of what we believe will be the next step in DeFi, and reflect the core principles of truly decentralized finance.”

How tokens $PAI and $PLN workPollen DeFi focuses on user participation and utility. It is designed to tackle governance and centralization issues commonplace in today’s DeFi ecosystem. Focusing heavily on developing community participation incentives, and processes that build toward true decentralization, using the hivemind to put the community in control.

The $PAI token will be the first index token to be launched on the platform with its value tied to the TVL of the core asset pool. $PAI is designed to be a less volatile asset that provides a safer way to participate in the DeFi ecosystem and is designed to weather any market storm as it will be dynamically managed by the community 24/7.

$PLN, on the other hand, is the governance token that allows participants to interact with the platform and is rewarded to community members who actively manage the portfolio successfully or delegate to those that do (from a leaderboard).

Beginning in December, whitelisted users will be able to actively contribute suggestions to Pollen DeFi’s first community-managed portfolio and associated asset pool token, Portfolio Asset Index ($PAI); reputation points earned during this part-testnet, part-mainnet ‘Community Release Incentivised Beta’ will be ported over as part of full mainnet launch in Q1 2022.

For more information, visit pollen.id.

The post How Pollen DeFi’s community curated Asset Index embodies ‘DeFi 2.0’ and creates ‘Crypto Meritocracy’ appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) íà Currencies.ru

|

|