2021-9-17 16:02 |

NFTs and DeFi are two of the biggest trends the investment world has seen this year. While non-fungible tokens (NFTs) have given rise to a whole new digital marketplace for art investors, decentralized finance (DeFi) has provided investors with a brand new landscape for using currencies free of conventional limitations.

While NFTs have gained groundbreaking momentum for their unique approach to digital collecting—investors now have the opportunity to own exclusive one-off pieces of art from their favourite artist digitally—cryptocurrency has liberated those living in countries with anti-democratic governments that allow banks to have complete control over transactions. It only makes sense that the two could eventually combine to even further disrupt the rapidly evolving investing space.

There’s no stopping the vast array of potential that NFTs hold. The new form of digital collectibles can span the spectrum from gifs of sports memorabilia, to photos of esteemed visual artists, to photos of Shiba Inus. Noteworthy NFTs of 2021 include Beeple’s artwork that sold for $69 million, the DogeCoin meme that just this week flew in value from $4 million to $220 million in the space of one day as the meme was split into 17 billion pieces, and famous artist Max Denison-Pender’s live painting that was thrown into a volcano shortly after its photo was taken.

Typically, banks receive deposits and lend money to account holders. DeFi uses code to secure a contract so borrowers are able to borrow at much lower rates, while those depositing are able to also get more bang for their buck. This is made possible by removing the middleman, the bank, out of the picture.

The DeFi sector has grown exponentially over the past year and seems set for steady growth in years to come. With the rise of meme coins, stable coins, altcoins, it’s a time where tokens are taking over from traditional forms of finance.

As with all burgeoning industries, the DeFi and NFT spaces are progressing rapidly. So it comes as no surprise that the two would eventually merge together.

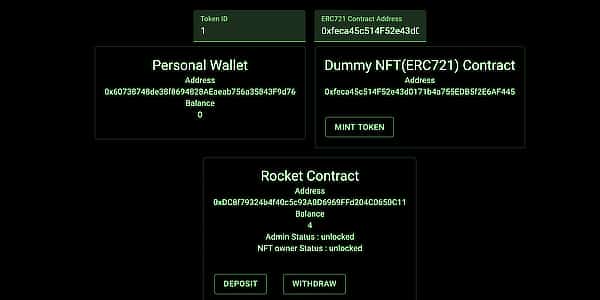

While NFTs are an asset, DeFi can mobilize their value through secondary platforms. With DeFi, a lender can determine the value of the collateral of the NFT. Unlike traditional banks who decide how much the collateral is, DeFi platforms allow the lender to make this decision. The loan is only distributed once the owner decides on a price, market value, and calculations.

With the recent soar in DeFi technology that supports loaning and financing of NFTs, it’s no wonder that Momento was born, a platform dedicated to hosting memorable NFTs. One of the most crucial components of Momento’s project is its commitment to NFT staking.

With the sales of NFTs accelerating faster than ever before, it’s easy to see how the space would evolve into needing a platform that was free from the control of banks and centralized finance.

origin »

Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|