2024-12-13 20:04 |

Key Takeaways:

The U.S. consumer price index was up 2.7% year-over-year for November, above the Fed’s target of 2%. Markets currently expect a rate cut of 0.25 percentage point in the forthcoming meeting. The positive news on the CPI resulted in a crypto market where several tokens rose in price. US November CPI and Its Impact on the MarketsThe US consumer price index increased by 0.2% from the previous month, according to the latest November CPI data released, in line with economists’ expectations. The core also jumped 0.3% MoM and kept steady its YoY rise at 3.3%. Although it’s far below almost 9% in June 2022, the newest figures indicate that the inflation pace stabilizes above the Fed target.

This stability, along with the releasing of the November job report showing solid job growth of 227,000 new jobs, has further bolstered the case for monetary easing. This figure was also higher than what analysts had predicted and shows a strong recovery from the figure posted in October, which was less encouraging. The three-month job growth average was 173,000 jobs, a better outlook for the economy.

Influence on Fed’s Rate ExpectationsMarkets are quite confident that the Fed will cut rates at its December 17-18 meeting. The CME Group’s FedWatch tool puts the probability of a 0.25 percentage point rate cut at 86%. This is a positive indication, reflecting an increase in confidence in economic recovery. A rate cut by the Fed would boost economic growth and provide a conducive environment for investment activities. However, it should be underlined that too rapid rate cuts could re-introduce risks of inflation.

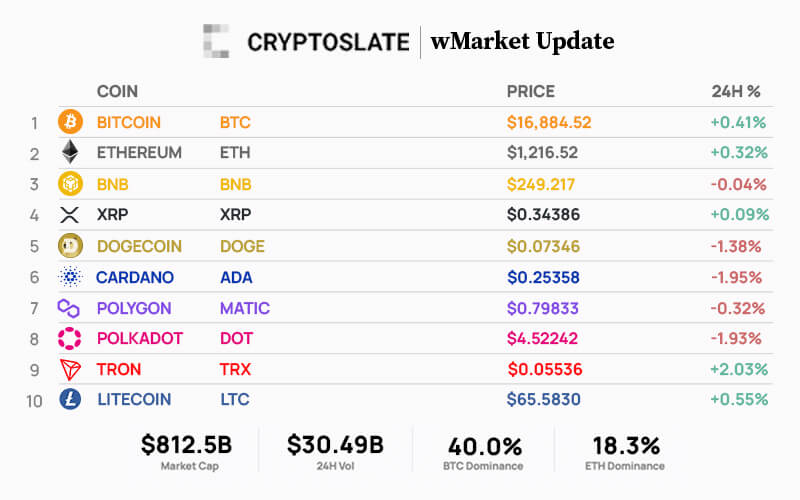

Reaction of the Cryptocurrency MarketBitcoin was trading above $98,000 ahead of the CPI data release after it rebounded from a dip below $94,000. This reportedly reflects investors’ optimism in the cryptocurrency market following upbeat macroeconomic news. Bitcoin has risen 2% over the week, according to data from CoinGecko. Moreover, Bitcoin is not the only one in this trend, as many other cryptocurrencies also reported massive gains. Such as:

Bitcoin (BTC): +2.1% | $99,464.00 Ethereum (ETH): +0.8% | $3,728.16 XRP: +9.6% | $2.36 Solana (SOL): +5.9% | $225.32Growth in the cryptocurrency market underlines a tight linkage between macroeconomic conditions and the value of digital assets. This is just a short-term reaction, and the cryptocurrency market is still full of risks.

More News: Bitcoin Hits $100,000 – Sets an All-Time High Record

Deeper Analysis of the Cryptocurrency MarketAccording to statistics from Farside Investors, inflows into US Bitcoin Spot ETF products reached $439 million on Tuesday, demonstrating increasing institutional interest in Bitcoin. The growth of Bitcoin Spot ETF products has contributed to increasing the price of Bitcoin.

Bitcoin Spot ETF

Not only Bitcoin, but Ethereum, XRP, Solana, and other cryptocurrencies also recorded remarkable growth, reflecting the general optimism of the market after the release of positive CPI news.

Overall AssessmentThe November US CPI data indicates that the inflation rate is within the tolerable range, which also paved the way for the Fed to cut rates in the near future. This sounds good for both the stock market and cryptocurrency market. However, to any investor, caution is an essential ingredient of informed decision-making, and monitoring the development in the market becomes rather important. Inflation is the biggest concern still, while the excessively rapid rate cuts raise the risk of inflation. While the cryptocurrency market is very promising and huge, it is still very volatile, full of risks. Thus, investors should have sufficient knowledge and experience before entering this market.

In a nutshell, the US November CPI data has been received well by both the stock and cryptocurrency markets. At the same time, investment is always subject to risks, and investors should make their decisions with due care. The market may be volatile at any time, so it is very important to keep an eye on economic indicators and market news.

The post How Does This Latest US Inflation News (CPI at 2.7%) Reflect at The Crypto market? appeared first on CryptoNinjas.

origin »Bitcoin price in Telegram @btc_price_every_hour

Fedora Gold (FED) на Currencies.ru

|

|