2018-12-22 21:57 |

How Cryptocurrency Miners Are Adjusting And Trying To Pull Through The Bear Market

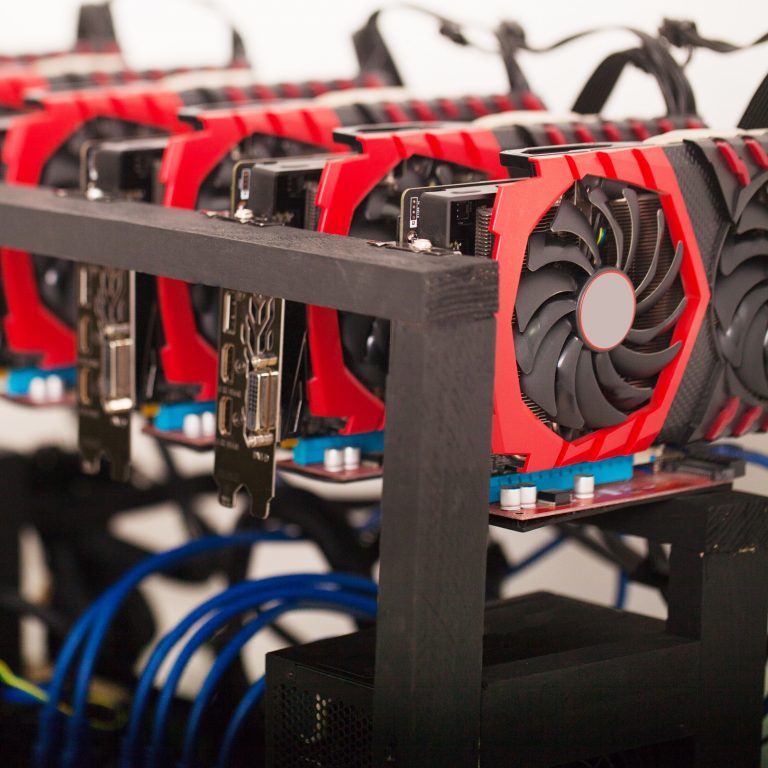

The recent state of the market has really been a bad experience for crypto miners and investors. For some time now, many crypto miners have been striving to make little profits in the bear market. Some crypto miners have lost hope and hence left the crypto market. But despite all the happenings in the crypto market, skilled miners still make huge profits daily.

The crypto-Market Is Taking Its Toll On Crypto-MinersTop crypto miners in the cryptocurrency industry aren’t finding it easy. However, Bitman, a crypto-mining company based in China that has been gunning for an IPO push recently announced that it would officially close the operation of its Israeli development center.

Bitman’s VP of International Sales and Branch manager Israel, Gadi Glikberg, states,

“The crypto-market is under a shake-up in the past few months; as a result, it has forced Bitman to take a look at its activities around the world and to reinforce its business in accordance with the current market situation.”

It is important to know that Bitman’s new decision has made the future of its IPO push to look bleak.

Bitman is not the only crypto-mining company that has been affected by the current trend of the crypto-market, many mining operations and rigs have also been closed in China as a result of the bear market.

With that in mind, Matt D’Souza, the co-founder of Blockware solutions, who also holds the charge of one of the biggest mining pools for Aion Network stated that the bear market has caused lots of mishaps for crypto miners, but the highly-skilled ones are getting larger profits despite the bear market.

He further emphasized that the miners who purchased mining rigs between the third quarter of 2017 to the second quarter of 2018 are the ones facing big losses in the market now. He also noted that back then when these miners were purchasing large oil rigs, Bitcoin was worth more than $9000; S9s were worth more than $2000.

The Crypto Market Is Now A Place For The Strongest OnlyWith the current trend in the market, it is now a game of the strongest as inventive individuals/miners observe the past mistakes of others and then, not making the same mistakes. These innovative individuals now limit their cost of operations so as to stay competitive in the market, till there is a turnaround in the market.

Normally, individual miners pay $0.13 per kWh to mine cryptocurrencies. A report by Blockware US states that these innovative individuals have now reduced their cost of operation to about 40% in the current bear market. D’Souza said:

“Miners reducing their cost of operations and moving into a 2-year contract at the present market rate is equivalent to an investor buys Bitcoin at $3,500 with the 2-year hosting contract.” He further added that “miners are securing an average of $60-$75/month per S9 and paying $265-$340 for the mining rigs they buy.”

Geopolitical Tariff Between The US And The Chinese GovernmentSubsequently, a significant point to consider is the geo-political tariff that exists between the United States and the Chinese government. These tariffs could make mining operations unprofitable. Nevertheless, it’s hopeful that when the market gets to its momentum, miners might be able to thrive again.

origin »Bitcoin price in Telegram @btc_price_every_hour

Miners' Reward Token (MRT) на Currencies.ru

|

|