2020-10-26 17:13 |

The bitcoin price has returned to top $13k once again. A supply shock theory following the halving suggests that the next major bull cycle could be about to begin.

There is no denying that bitcoin has been in its most bullish state for 16 months, and it is just a few hundred dollars away from breaking its 2019 price peak, which could lead to major upside.

Since the same time last weekend, the asset has gained an impressive 15%, outperforming most of its crypto brethren. Market dominance has also returned to a three-month high of around 62%, according to TradingView.

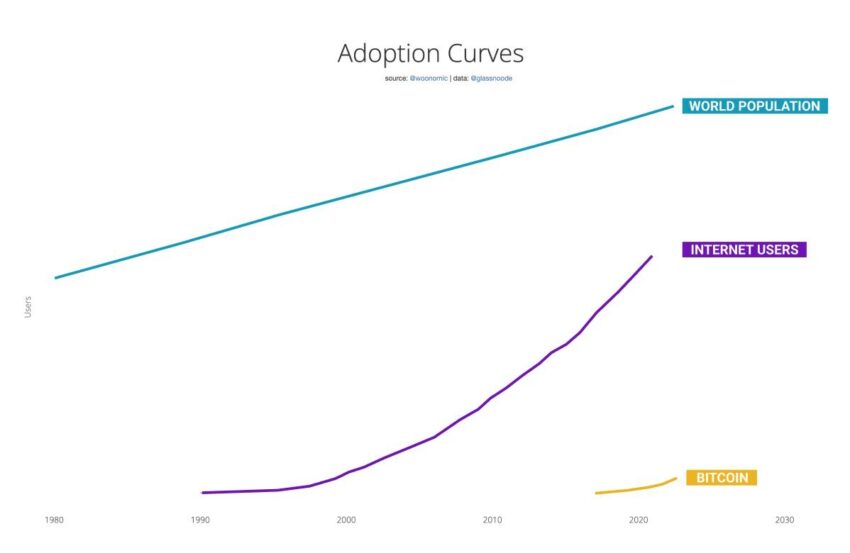

Halving Supply ShockAnalyst and chart guru Willy Woo has observed that we are now five months past the halving. He added that this was the amount of time in previous cycles that it took for supply shocks to kick in to cause the bitcoin price to surge into the next cycle.

A timely explainer on Bitcoin halvenings, and supply shock.

It’s timely because we are now 5 months past the halvening; in the last cycle that was roughly the time needed for the supply shock to cause BTC price to teleport upwards into a full on, FOMO induced, bull run. https://t.co/vhz4GYATMR

— Willy Woo (@woonomic) October 25, 2020

The notion is built on the theory that the bitcoin halving event, which occurred in mid-May, causes new supply to be cut in half. But net demand remains the same, so from that point on a supply-shortage accumulates.

The model was detailed by Twitter user ‘Croesus’ [@Croesus_BTC], who added:

“As market participants bid for significantly reduced ‘available for sale’ supply, price drifts upwards. In a typical market, this induces new supply production to increase and selling from existing holders to increase.”

He added that because of bitcoin’s characteristics as a startup store of value, the majority of people do not have significant positions in it yet, which results in price and demand increasing. New demand increases faster than ‘hodlers’ are willing to sell, which causes a sharp increase in the rate of supply shortage accumulation, he continued.

The analyst concluded that a mania phase then ensues, which ends when hodlers’ willingness to sell flips demand.

“I believe this is the signal underneath the noise — the mechanics at the heart of how halvings drive 18-month parabolic bull markets.”

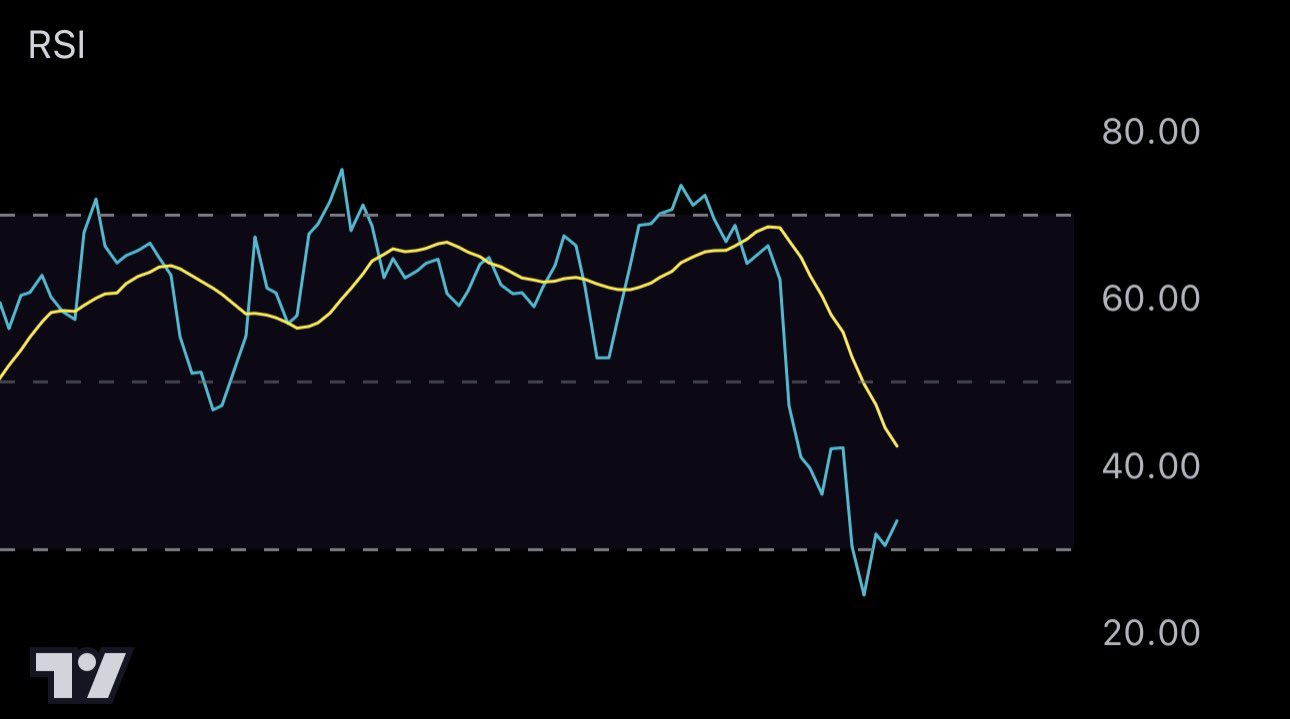

BTC at a Key JunctureCurrently, the bitcoin price is at a key inflection point. The last major cycle saw BTC gain almost 200% in only a month or so as it surged from below $6k to top $20k in a very short time.

The post How Bitcoin Supply Shock Could Drive Next Major Rally: Analyst appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|