2019-11-6 00:23 |

Last year, there was much excitement as Hong Kong took active steps to clarify the rules for crypto fund managers, which allowed them to apply for a license to trade in the space. However, it appears as if the barriers to entry for such licenses are too high and slowing the drive for fledgling crypto fund managers.

It has been reported that the Hong Kong’ Securities and Futures Commission, much like the US’s SEC, has been tight-fisted when it comes to granting these licenses to fund managers. According to reports, only a handful have been issued to players operating under its jurisdiction, which would allow them to manage digital currencies-related funds.

It comes at a time when there is huge turmoil and political tension in the region, which has led to money outages and a new appreciation of Bitcoin as a decentralized financial system, as BeInCrypto has previously reported on.

Hard to Come By in Hong KongIt is an interesting realization as those in Hong Kong feel as if the barrier to entry for these fund managers is not because the regulators are obstructive; instead, it is because the process of applying is so rigorous, especially for a nascent and emerging industry.

“My take is that it is more an operational and infrastructure issue, than the regulator being obstructive,” Rocky Mui, a partner at Clifford Chance in Hong Kong, said.

While the exact number of licenses issued is unknown, there is a very similar feeling to this as to the infamous BitLicence of New York. This license, and the difficulty in obtaining it, forced many cryptocurrency businesses to look elsewhere to establish their endeavors – and the same could be happening in Hong Kong.

It has been noted that the rigorous process of the application is forcing multiple fund managers to move their base away from the area even with these clear rules and regulations.

Not Enough ExperienceThe law firm of one company that has obtained a license, Diginex, which manages a cryptocurrency “fund of funds,” has explained that there is not enough crypto experience to allow regulators to dish out licenses.

“Last year there was a lot of excitement, but since then we haven’t seen much activity,” Gaven Cheong, a partner at Diginex’s law firm Simmons & Simmons, said about Hong Kong. “Not many new managers in this area have the background, experience or support to mount such an undertaking, and this has meant that many applications never even get started.”

That being said, there were more factors at play that lead to a low turnout of these licenses, and some are now predicting that more positive factors could turn things around.

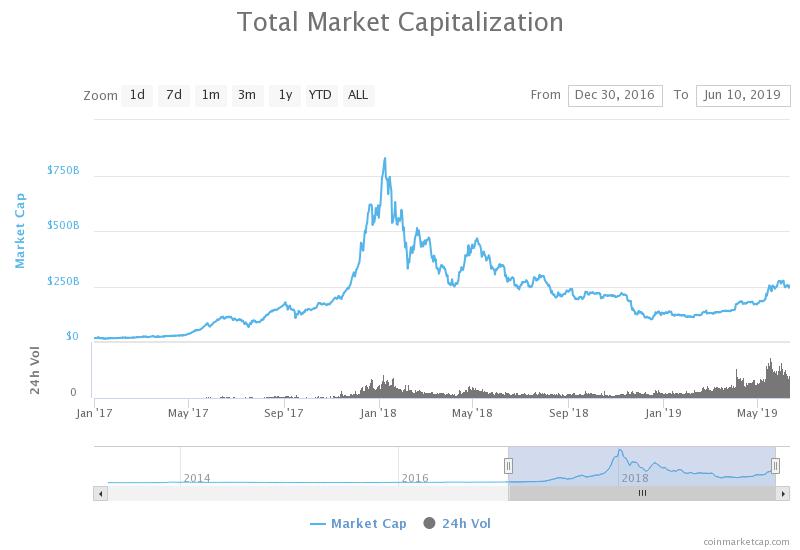

“The volatility and poor returns in 2018 scared large institutions away from allocating to crypto funds, causing those who survived to shelve their licensing plan,” Jehan Chu, a partner at Kenetic Capital, added. “As institutional investors step into the market, crypto funds will dust off their licensing applications and take a fully regulated approach.”

Images courtesy of Shutterstock.

Did you know you can trade sign-up to trade Bitcoin and many leading altcoins with a multiplier of up to 100x on a safe and secure exchange with the lowest fees — with only an email address? Well, now you do! Click here to get started on StormGain!

The post Hong Kong Licence Process Forces Crypto Fund Managers to Jump Through Hoops appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) íà Currencies.ru

|

|