2024-4-15 13:53 |

Cryptocurrencies rose early Monday after news that the Hong Kong Securities and Futures Commission (SFC) had approved two applications for spot Bitcoin and Ethereum ETFs.

BTC rose above $66k as bulls recouped losses seen when the market sold-off over the weekend. ETH also traded higher, tagging gains near $3,300.

Elsewhere in the market, the positive sentiment helped drive fresh interest in new token Bitbot.

Hong Kong gives nod to BTC and ETH ETFsEarly Monday, reports emerged that Hong Kong’s SFC had approved spot ETF applications by HashKey Capital Limited and Bosera Capital.

The news buoyed a market that had struggled after BTC dumped to lows of $62k over the weekend amid tensions in the Middle East.

As investors cheer the Hong Kong development, Bitcoin’s price has moved higher. This too is the trend across the altcoin market, with ETH seeing 7.3% upward flip.

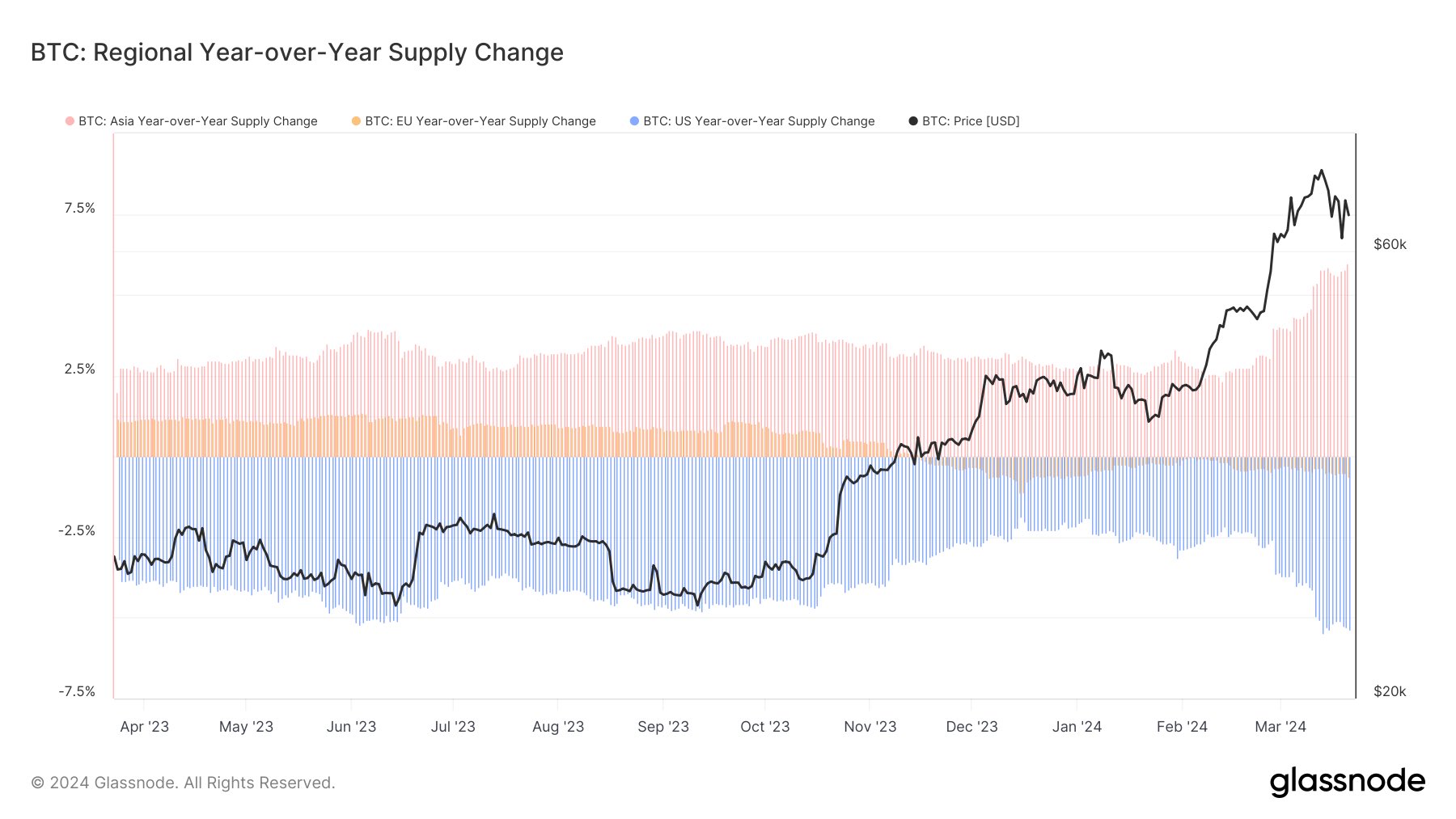

The anticipation is that Bitcoin could see increased buyside pressure after the SFC nod. Estimates put the potential inflows at $25 billion worth of Hong Kong ETFs is ready. Crypto investors have already pushed more than $57 billion into spot ETFs, a sizable amount of this in BlackRock’s outperforming IBIT.

Something similar to what the bellwether crypto asset recorded after the US Securities and Exchange Commission (SEC) approved several spot Bitcoin ETFs, could be in the offing for Ethereum.

Specifically, Ethereum could also see significant traction after Hong Kong’s move to allow Ether ETFs

ETH price has jumped above $3,200 and could ride new momentum in coming months to target a new all-time high.

Notably, though, there are several spot Ethereum ETF applications before the SEC. Top analysts say the regulator is unlikely to greenlight any in May, which could present a potential headwind.

Bitbot gets into position amid crypto enthusiasmAs crypto traders and investors eye the potential bullish injection that Hong Kong’s spot ETFs approval brings to the market, Bitbot could emerge as a stand out project.

Bitbot brings the world’s first-ever non-custodial trading bot to Telegram, positioning itself at the top of a market segment predicted to see notable growth.

The trading bot’s integration of a non-custodial trading feature coupled with the ease of access and use of institutional-grade trading tools is what could drive Bitbot to dominance.

Other roadmap milestones such as cross support, liquidity enhancement and mobile app launch are also exciting the Telegram crypto trading community.

Should you buy Bitbot after Hong Kong’s ETFs approval?Ahead of its launch, Bitbot’s native token BITBOT is in presale and is currently one of the hottest in the market. BITBOT will offer holders benefits such as revenue sharing, trading discounts and other exclusive perks.

Early investors are bullish Bitbot will dominate the space and have raised more than $2.3 million in the presale so far.

Currently, one can purchase tokens at a discounted $0.0155 in stage 10 of the presale. After this level, there’s only five more stages before BITBOT hits top exchanges. Buying at current presale prices may therefore present a good opportunity.

Learn more about Bitbot here.

The post Hong Kong approves spot crypto ETFs; what does it mean Bitbot? appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Hong Kong Dollar (HKD) на Currencies.ru

|

|