2020-9-5 17:54 |

Bitcoin has started September on a bad note.

The digital currency failed to keep above $12,000 and went down to almost $10,000 level on Wednesday.

This resulted in the market sentiments getting overturned fast, from “extreme greed” to “fear.”

Up 38% YTD, bitcoin is down about 50% from its all-time high of $20,000.

Yesterday, the market had relief as BTC stepped up to $10,645, which led investors to expect the weekend to bring good news for the market.

But the market is moving back down today.

At the time of writing, BTC/USD has been hovering around the key psychological level $10,000.

For a brief moment, the digital asset dropped under $10k to $9,975 on Bitstamp.

This isn’t a surprise for two reasons, one – dring the last bull market, bitcoin saw several, as much as nine, pullbacks of 30% to 40% on its way to the peak.

Second – this month isn’t good for bitcoin.

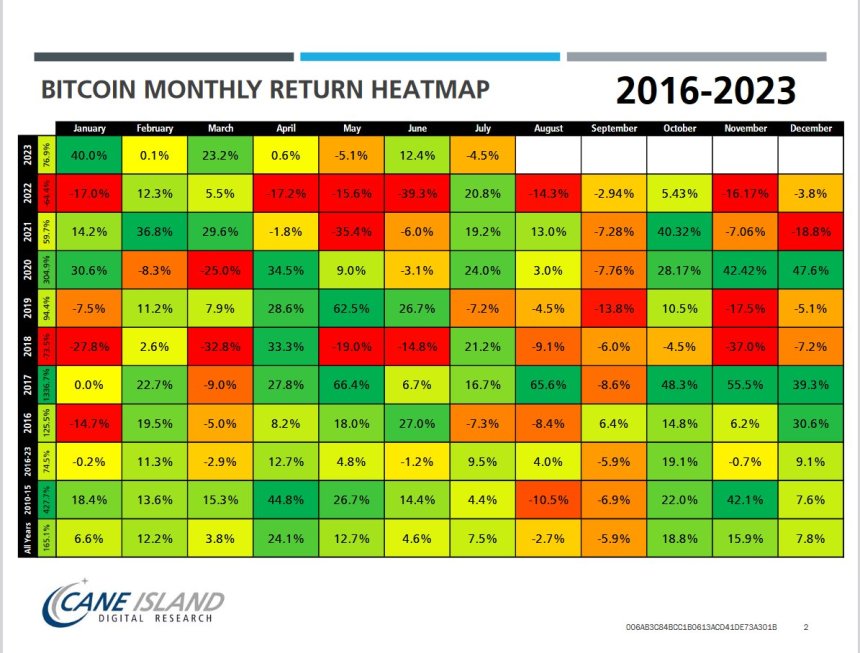

After March and January, September is the worst month for the leading cryptocurrency in terms of average log returns. Five out of seven times, this month has been a red one for Bitcoin and the other two times, it was barely in the green.

So, expectations for greens should be low in September while being prepared to grab the buy the dip opportunities.

The quarter fourth could bring the much-needed reprieve, filled with more green than red.

Bitcoin really hates September pic.twitter.com/Bk07ACRINE

— Avi IS RIGHT (@AviFelman) September 4, 2020

Historically, September isn’t bad just for bitcoin but also for the stock market.

As a matter of fact, the three leading indexes of the stock market have performed the poorest during the month of September, which got it dubbed as the “September Effect.”

It first happened in the late 1800s when the Dow Jones Industrial Average fell an average of 0.8%. And the S&P 500 has been dropping about 1% on average this month since 1950.

There is no plausible theory for this other than that these corrections are caused by tax-loss selling from mutual funds or pent-up suffering from investors who just returned from their summer vacations.

This time, however, lockdown due to coronavirus has people working and vacationing right at their home.

For stock markets, the fear doubles because of the election-related uncertainty. Reportedly, S&P 500 sheds 0.2% on average in the election year.

So, with bitcoin still being a risk-on asset, the stock market expecting more losses, and the month not being bullish for the digital assets either, pains could be ahead for the digital asset.

Bitcoin (BTC) Live Price 1 BTC/USD =10,062.0668 change ~ -4.34Coin Market Cap

185.95 Billion24 Hour Volume

39.05 Billion24 Hour Change

-4.34 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD");The post Historically, Bitcoin Really Hates September; What Should Traders Expect? first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|