2019-1-25 19:27 |

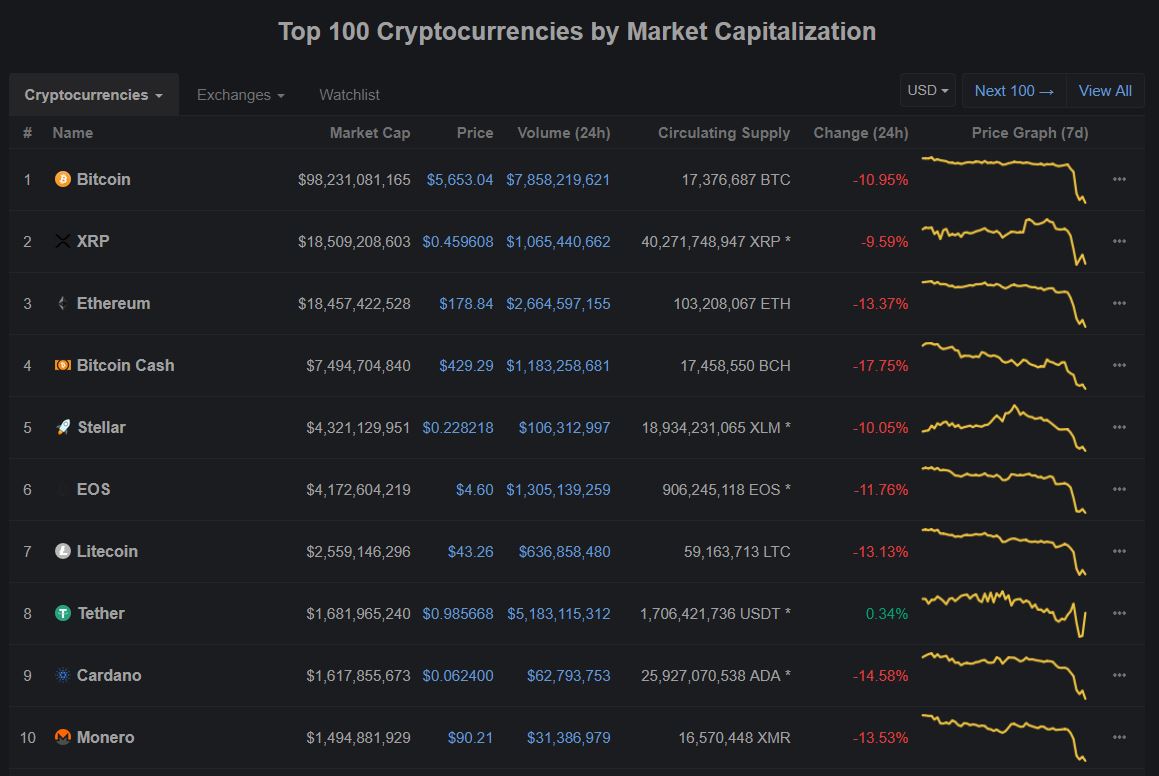

2018 was a tough year for anyone involved in crypto. The crypto world is now set to reach a point that will market the longest BTC price correction ever. For investors who have stuck around since BTC hit its highest price point ever in December 2017, they will be able to claim they survived the longest crypto market correction ever. This one might be a badge of honor that separates those who believe in the crypto project and those that were here for the quick gains.

The Record will Break in Early FebruaryCurrently, the longest bear market lasted from November 2013 to January 2015. At the time, BTC reached a high of $1,100 before it fell to a low of $178. While this 85% drop was huge, BTC soon after climbed steadily to reach a high of $19,000 in December 2017.

The first drop starting in 2013 lasted for 410 days. The current bear market is just days away from breaking this record. A popular crypto analyst on Twitter recently tweeted about the issue. Josh Rager talked about the length of this bear market.

He said that the BTC correction record was going to be set on February 2. He told those that had held on they would soon be able to brag about holding on the longest in a crypto bear market.

Will BTC Follow the Market Pattern of 2015?Although the crypto market is in a very different state than it was in 2015, if the current bear market does not end and closely mirrors that of 2015, the market could replicate what it did in 2015. This will lead to it hitting a long-term bottom, followed by a lengthy accumulation period and then another rise.

A popular crypto analyst on Twitter called Galaxy also weighed in on the issue. He spoke about the possibility of the market mirroring the pattern of 2015. He noted that there was a striking parallel between today and the events of 2015. In his estimate, the market will experience a period of accumulation before a bull run starts in mid to late 2019. He made his statement while showing a 2014 crypto markets chart that showed the bear market ending in 2015. He concluded the tweet by telling his followers that understanding the future lay in studying the past. He also mentioned that the market was approaching the 420-day mark, which saw the end of the bear market in 2015.

What it Means for CryptoIf this new theory on the end of the bear run turns out to be even remotely true, BTC will see a long period of sideways trading. This will then be replaced by skyrocketing prices. Additionally, if history is the basis for the future, BTC price could surpass its past high of $19,000. Right now, not very many people are confident that will happen. The bear market seems to be getting worse and each passing day, BTC seems to set a new low.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|