2020-4-25 23:16 |

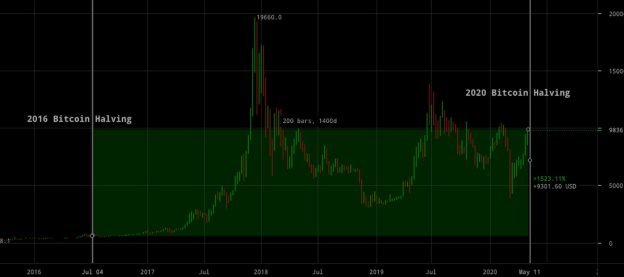

With the latest gains, the price of bitcoin has turned green on a year-to-date basis. Ahead of the third bitcoin halving which is just 17 days away, the price of the leading digital asset has jumped to six weeks high at $7,500 just before the crash on Black Thursday.

Bitcoin recovered all the losses since the violent sell-off in mid-March while in the macro backdrop the balance sheet of the Federal Reserve has reached its all-time high at $6.57 trillion. Fed’s assets started to increase in September 2019 after normalization programs contracted it between October 2017 and August 2019.

In the last 2 months, the Fed has expanded their balance sheet more than they did during the first 5 years of QE, from September 2008 through July 2013.

Inflation is coming. #BuyBitcoin pic.twitter.com/9m9yecn7GY

— Mati Greenspan (tweets are not trading advice) (@MatiGreenspan) April 24, 2020

While the Fed is busy increasing the money supply by constantly printing trillions of dollars, about $3 trillion in monetary stimulus, the halving next month would cut down Bitcoins’ inflation into half.

just print 484 Trillion and see if that helps end this fiat fiasco faster

— Fibliminal Thinking (@FiboSwanny) April 24, 2020

As per the stock-to-flow model, this halving would double Bitcoin’s SF ratio to 52 and bring it closer to gold’s 60, the highest ever. The annual inflation rate of Bitcoin at 1.8% will actually fall lower than gold’s 2.5%, shared Electrical capital founder.

Ahead of halving retail interest could already be seen surging with the addresses holding less than 1 BTC on a sharp incline and hitting new highs. Bitcoin whales have also reached levels not seen since the bull rally of 2017.

Bitcoin getting new friends every day. It’s happening.

— Michael Novogratz (@novogratz) April 23, 2020

Halving TrendingWith halving just around the corner and price picking up speed, the mentions of halving continue to surge. Over the last 30 days, the mentions of the halving are close to overtaking mentions of coronavirus.

Although mentions of gold on social media are increasing, even they have started to take a back seat.

“For the first time since at least July 2017, the halving is the most mentioned word in Bitcoin tweets. Overall there have been 1,160 halving tweets in the last 24 hours, and 66% of those tweets have been positive,” noted The Tie.

Source: TheTIEOn Google Trends, the term “Bitcoin halving” has already surged to new highs and expected to go even higher.

Interestingly, a new participant has entered the mining scene, Binance. Its mining pool, though still in closed-beta has mined its first-ever block and claims to have the lowest fees of any mining pool.

This also sparked concern about the lack of decentralization in the bitcoin hashrate distribution by the entry of Binance.

This either ends super good for bitcoin with multiple competing mining pools offering mass decentralisation

or…. well I guess you can figure out the flipside of the coin ._.

— loomdart (@loomdart) April 24, 2020

What to Expect?The halving, however, brings the fear of miner capitulation as Maxime Boonen, founder of cryptocurrency market-making firm B2C2 said, “mining costs do not operate as a floor on bitcoin’s price. If the costs of miners increase, some will have to cease operating.”

As per TradeBlock, the breakeven cost of mining one bitcoin will be over $15,000 with the growing hash rate, this means miners will be extremely unprofitable and will dump their BTC.

Source: TradeBlockHowever, analyst PlanB points out that the last two halvings of 2012 and 2016 show that difficulty will not adjust downward rather will keep rising post halving as well. After 2016, price did fall but it was because of the Bitfinex exchange hack and Ethereum DAO hack and nothing to do with difficulty dropping and small inefficient miners exiting.

Miners have already invested in new hardware and prepared for this known event as such for a loss of 50% revenue.

“March 12th already wiped out a ton of over-leveraged miners. I see the halving from the supply reduction standpoint fairly neutral, but increased mainstream media attention could be bullish. Google trends have been picking up as well, which surprised me,” said analyst Ceteris Paribus.

Even if some inefficient miners exit, they will be replaced by efficient miners and recover the hash rate if it plummets. Mati Greenspan, in his daily newsletter Quantum Economics wrote:

“Many mining rigs that are barely profitable at this price will be switched off, likely for good. Some miners may even be forced to sell their stash in order to upgrade their machinery, but as far as I see, that only increases distribution, and even if it does happen to send the price down in the short term, it only provides an opportunity to accumulate at lower prices for the long term.”

Moreover, in the macro backdrop where the money supply is dramatically increasing, the world needs a stable asset that can hold its value over time.

And Bitcoin is that asset — “easily transferable, scarce by design, and decentralized in nature,” whose inevitable halving would increase its scarcity.

Bitcoin is the most powerful disinfectant in the world.

— Pierrrrrrrrrrrrre Rrrrrrrrrrrrocharrrrrrrrrrrrrrrd (@pierre_rochard) April 24, 2020

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|