2026-1-5 21:30 |

Zcash is breaking into the week following a brief reprieve from a strong move that saw it burst past $540, but then retreat back to the $500 level.

The strong move caught a lot of attention, but it is apparent that the momentum certainly isn’t there anymore.

Traders are starting to weigh risk more carefully, especially with whale activity picking up and key resistance levels coming back into play.

So far, there’s no major breakdown, but ZEC isn’t charging higher either. That puts the spotlight on price structure, liquidity, and how the market behaves around these important levels.

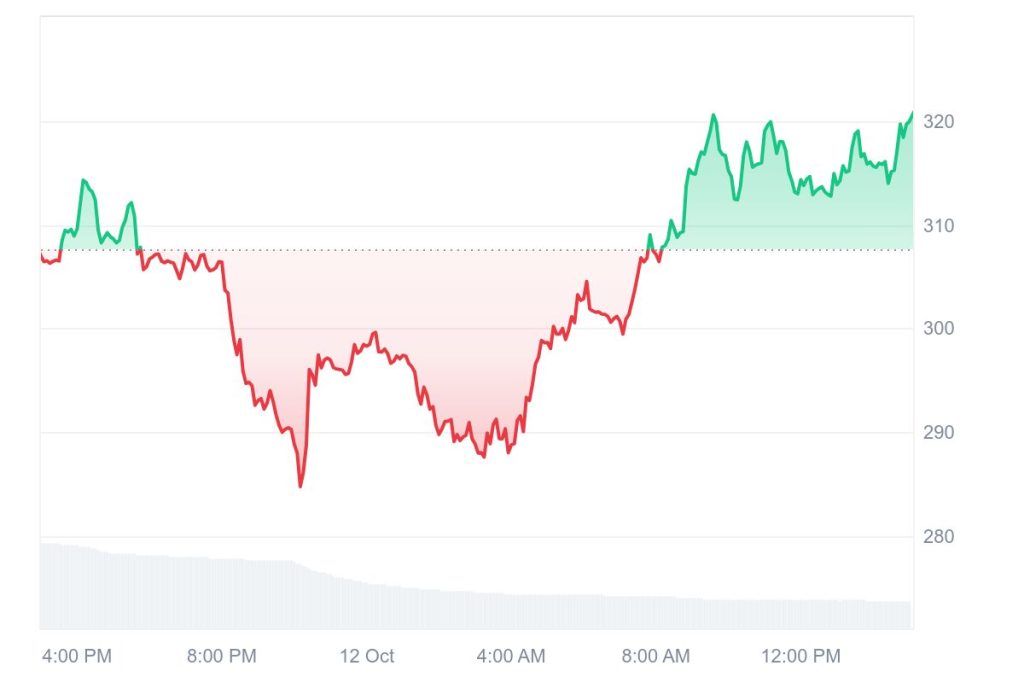

What the Zcash Chart Is ShowingOn the 4-hour chart, the ZEC price looks like it’s digesting its recent gains rather than rolling over. At exactly around the $500 level, which has become a significant short-term benchmark, the action has momentarily paused.

Source: CoinAnkThe advancement towards $550 has happened suddenly and convincingly; however, what happened in its wake seems more like sound normalization rather than selling.

Currently, ZEC is touching the lower part of the ascending wedge. This typically indicates a period of correction rather than a trend reversal. So long as price remains above the area around the high 480s and low 490s, the major buy pattern is still in place.

ZEC Market Indicators Suggest Momentum Is CoolingThe RSI has moved into the mid-to-high 40s, which means that instead of being under strong upward pressure, the market environment remains neutral. This corresponds to the price action scenario, which has moved from strong towards sideways grinding.

On-balance volume has also flattened out. Accumulation hasn’t disappeared, but it’s clearly paused. Volume spikes are still happening, they’re just no longer favoring buyers the way they did during the breakout. That usually means the market is waiting for fresh information before choosing a direction.

Whale Activity Adds a Layer of RiskOne development that stands out is a whale depositing 74,002 ZEC, worth roughly $35.75 million, to Binance on January 3. This was the largest single exchange inflow since ZEC’s 2025 rally began.

Moves like this always grab attention because they can signal potential selling. Even though price has held steady near $500 since the transfer, the deposit indicates extra supply could be sitting overhead.

With ZEC’s liquidity only moderate, any aggressive selling could quickly increase volatility. For now, traders are watching Binance’s order book closely to see whether that supply gets absorbed or turns into pressure.

Read Also: Why Trump Moved on Venezuela and What It Could Mean for Bitcoin and Crypto

Institutional Interest Meets Regulatory UncertaintyOn the longer term side, Zcash continues to attract institutional interest. Bitwise’s recent filing for a Zcash ETF adds credibility to the broader narrative, even if approval is far from guaranteed.

Cypherpunk Technologies’ $28 million ZEC purchase also shows confidence in privacy-focused assets.

At the same time, regulatory uncertainty still hangs over privacy coins. While real-world use cases strengthen ZEC’s appeal, skepticism around altcoin ETFs keeps some traders on the sidelines. That tension helps explain why price is consolidating instead of pushing straight higher.

ZEC Price Short-Term Outlook for the WeekLooking ahead, the ZEC price needs to reclaim and hold above the $520 area to bring bullish momentum back into the picture.

A strong daily close above that level would likely open the door for another move toward $540 and possibly $550.

On the downside, losing the $490–$480 support zone would raise the risk of a deeper pullback toward the mid-$460s.

For now, Zcash is holding its ground. This week looks less about fireworks and more about resolution. The next move will come down to whether buyers can keep absorbing supply without giving up key support.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Here’s Where Zcash (ZEC) Price Is Headed This Week appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Zcash (ZEC) на Currencies.ru

|

|