2021-3-4 11:53 |

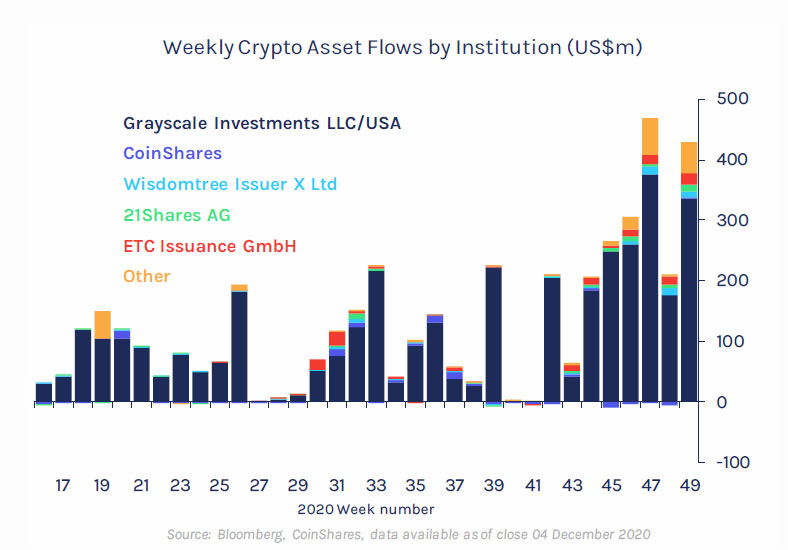

Largest buyer of Bitcoin and other cryptocurrencies, Grayscale, has added more Litecoin, Bitcoin Cash and Ethereum Classic, pushing its total AUM to $39.2 billion origin »

Bitcoin price in Telegram @btc_price_every_hour

Alexium (AUM) на Currencies.ru

|

|