2023-9-16 22:00 |

Here’s what data says regarding how correlated Dogecoin, Shiba Inu, and other altcoins have been to Bitcoin during the past month.

The Correlation Matrix Between Various Assets And BitcoinIn a new post on X, the market intelligence platform IntoTheBlock has looked into the correlation between Bitcoin and the different top coins in the digital asset sector.

The relevant indicator here is the “correlation coefficient,” a statistical tool that tracks how much two given quantities have been tied to each other over a given period.

In the context of the current discussion, the 30-day version of the metric is of interest, meaning that it tells us about the correlation between the assets over the past month.

The coins in question have been moving together when this indicator has a value greater than zero. The closer the metric gets to the 1 mark, the stronger this positive correlation becomes.

On the other hand, the metric having a value below the mark implies there has been a negative correlation between the assets during the last 30 days. What this means is that the movements in the price of one coin are being reflected in the opposite direction in the other one.

Naturally, whenever the correlation coefficient is exactly zero for two quantities, it suggests that no correlation whatsoever, whether positive or negative, exists between the amounts given.

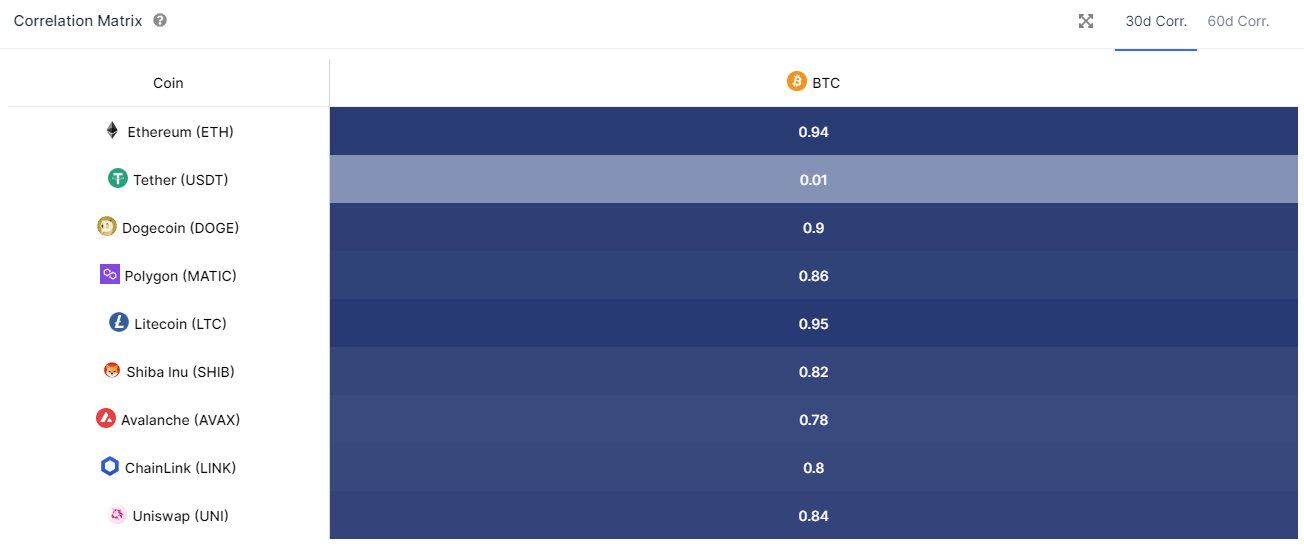

Now, here is a table that shows the 30-day correlation coefficient between Bitcoin and various altcoins, including the memecoins Dogecoin (DOGE) and Shiba Inu (SHIB):

As displayed above, Ethereum (ETH) and Litecoin (LTC) are the assets most strongly correlated to Bitcoin during the past month, as the indicator’s value has been 0.94 and 0.95, respectively.

Dogecoin is also very tied to the number one cryptocurrency, as the correlation coefficient has been 0.9 for the memecoin in the last 30 days. Its cousin, Shiba Inu, also has a solid relationship to the asset, although the correlation is slightly less extreme (0.82).

Overall, it would appear that all the altcoins on this list have a correlation of at least 0.78, which suggests that Bitcoin has been the market leader. The one exception is the stablecoin Tether (USDT), which is tied to the dollar and thus does not correlate with the volatile BTC.

Generally, if portfolio diversification is the aim, an investor may only choose to invest in assets that don’t have much correlation with each other. The assets in this list all have a relatively strong correlation with Bitcoin, but those with the lower coefficient would still be better for diversification than others, like ETH.

Dogecoin PriceWhile the relationship between Dogecoin and Bitcoin has been strong in the past month, it would appear that the memecoin isn’t following BTC on its latest surge, as its price is still trading around $0.06.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|