2024-4-8 19:33 |

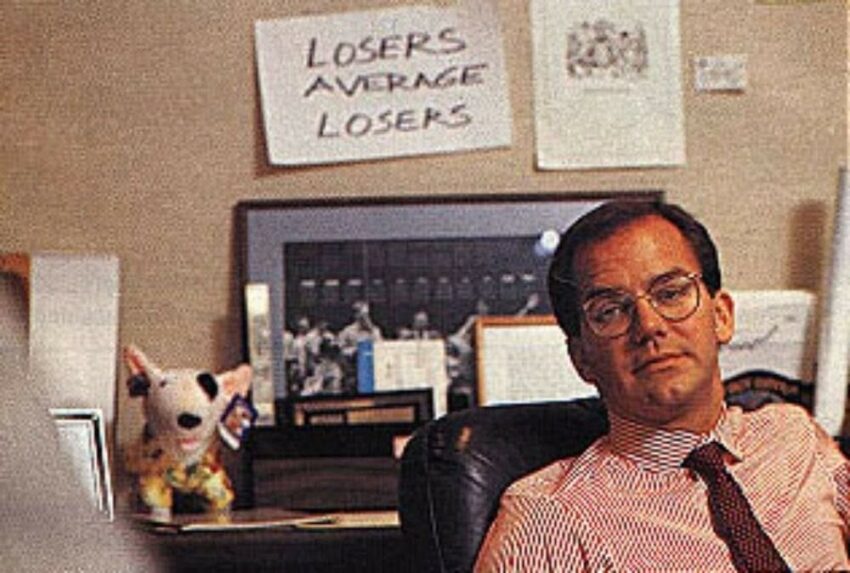

Hedge funds are betting massively on a Bitcoin (BTC) price drop in the coming weeks in what experts are describing as a “carry trade strategy.”

According to available data, hedge funds and commodity trading firms are significantly increasing their short positions in the Chicago Mercantile Exchange’s (CME) bitcoin futures contracts. Presently, short positions have reached a seven-year high of 16,102, showing little to no signs of slowing down.

Several reasons have been put forward to rationalize the trend, with pundits attributing the spike in short positions to carry traders.

Carry trading is a strategy employed by hedge funds involving borrowing at a low interest rate to purchase and hold an asset with a higher interest rate. According to industry experts, hedge funds are propping themselves to profit from the difference between BTC’s spot and futures market.

Carry trades have traditionally outperformed the 10-year Treasury note while offering a low-risk alternative for hedge funds and other institutional traders.

“There is a massive demand from hedge funds to put on carry trades,” said 10x Research CEO. “Despite bitcoin’s 10% decline from the all-time high, the futures premium has remained in double digits, and hedge funds are taking advantage of these high rates.”

Apart from carry traders and arbitrageurs, experts also attribute the buildup of short positions to the BTC’s recent price action. After hitting an all-time high of $73.8K, BTC’s price has been on a steady slide, hanging on to the $65K mark, with a chunk of traders predicting a steeper drop for the leading cryptocurrency.

JPMorgan’s analysts have urged traders to brace for a price drop to $42K after BTC’s halving event. Contrary to previous halving events, JPMorgan’s research posits that the halving event will negatively affect the profitability of miners, driving down prices to pre-2024 levels.

“This $42k estimate is also the level we envisage bitcoin prices drifting towards once bitcoin-having-induced euphoria subsides after April,” read the report. “Bitcoin miners with below-average electricity costs and more efficient rigs are likely to survive while those with high production costs would struggle.”

Yawning trading opportunitiesOn-chain analysts have identified a trend of BTC’s daily gains outside US trading hours, offering investors a window to rack up impressive profits. Since the launch of spot Bitcoin ETFs, 40% of BTC gains have come outside US trading hours, a reversal from the trend of gains made during US trading hours in 2022 and 2023.

According to Thielen, savvy investors are purchasing BTC before the start of US trading hours and selling after a few hours.

“We also noticed through our data analysis that Bitcoin tends to rise during the 1-4 hours before US ETFs start trading on that day, a sign that there is likely front running of the ETF flow occurring,” said Thielen.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|