2020-9-26 21:53 |

Decentralized finance has grown from small beginnings with less than $700 million in total value locked across all platforms in January 2020, to a thriving ecosystem of over $10 billion in TVL by September of the same year.

This rapid expansion of over 1,300% has given rise to a number of yield farming, or liquidity providing, opportunities for investors wanting to earn interest on their crypto assets. It has also spawned the birth of a number of decentralized exchanges (DEX) where traders can swap tokens on a peer-to-peer (P2P) basis with no corporation taking spreads or commissions.

The nature and ethos of many of these DeFi protocols mean that their code is open-source. This allows anyone to access their smart contracts and fork the platform, or even just clone it completely to launch their own version of it.

One of the most popular DEXes of the year has been Uniswap which provides an automated market maker (AMM) for seamless token swapping. It has been such a success that it was forked in August to create SushiSwap, which managed to drain it of liquidity over the weeks that followed.

Understanding UniswapTo understand what SushiSwap is and how it works, you must have some knowledge of Uniswap, which is from where it was spawned in late August 2020. Uniswap uses an AMM which works with algorithmic equations to dynamically calculate the swap rates depending on the token supply and demand, and liquidity on the platform.

Users can also provide liquidity to the platform in order to earn a share of the 0.3% trading fee that Uniswap charges. However, these rewards can quickly get diluted when whales also join the pools with their heavy bags.

SushiSwap aimed to improve on this by offering more than just a cut of the trading fees. It also offered a native token called SUSHI to encourage liquidity providers and, at the time, Uniswap had yet to launch its own native UNI token.

SushiSwap’s Brief HistorySushiSwap started to gain initial momentum around Aug. 28, when crypto twitter awoke to the premise of using liquidity provider tokens from Uniswap to deposit on a forked platform offering far greater returns. Some industry experts termed it “vampire mining” at the time.

The initial announcement explaining how it would operate was published on Aug. 26, but has since been removed following the big shakeup that would happen over the next couple of weeks. The revised version of that announcement was reposted here on Sept. 9.

The DeFi doppelganger initially offered three liquidity pools (SUSHI/ETH, USDT/ETH, USDC/ETH, using UNI-V2 LP tokens) which have been expanded to 19 pools, at the time of writing. Unlike Uniswap, liquidity providers could continue to earn a portion of the protocol’s fee, accumulated in SUSHI, even if they decide to no longer participate in the liquidity provision.

For the first two weeks, 10 times the amount, or 1,000 SUSHI tokens, was rewarded per block, with the SUSHI/ETH pool receiving an added multiplier of two to encourage more liquidity. Additionally, a fee of 0.25% went directly to the active liquidity providers, while the remaining 0.05% got converted back to SUSHI and distributed to token holders.

The grand plan was to take all of this liquidity and migrate it onto its own platform after the two weeks expired. It worked, and SushiSwap managed to accumulate over $1.2 billion in liquidity in the days that followed.

By Tuesday, Sept. 1, those “worthless” SUSHI tokens had surged from nothing to over $11 in just four days and the farming frenzy was in full swing. The liquidity movement equated to around 80% of the liquidity on Uniswap being moved in just 96 hours after SUSHI rewards were launched.

The team behind SushiSwap was largely anonymous with the protocol being operated by a pseudonym called “Chef Nomi.” This was the beginning of the problems as the admin wallet with a lot of funds in it was under the control of the anonymous founder, as observed by industry experts at the time.

On Sept. 6, Chef Nomi sold $8 million worth of SUSHI tokens causing the coin price to collapse. Many in the industry somewhat gloatingly said “I told you so,” but Chef Nomi maintained his innocence at the time stating that he did not intend to scam anyone and that the funds were legitimately accrued through the 10% devshare allocation. This did not help SUSHI holders who were looking at a 50% loss, at the time.

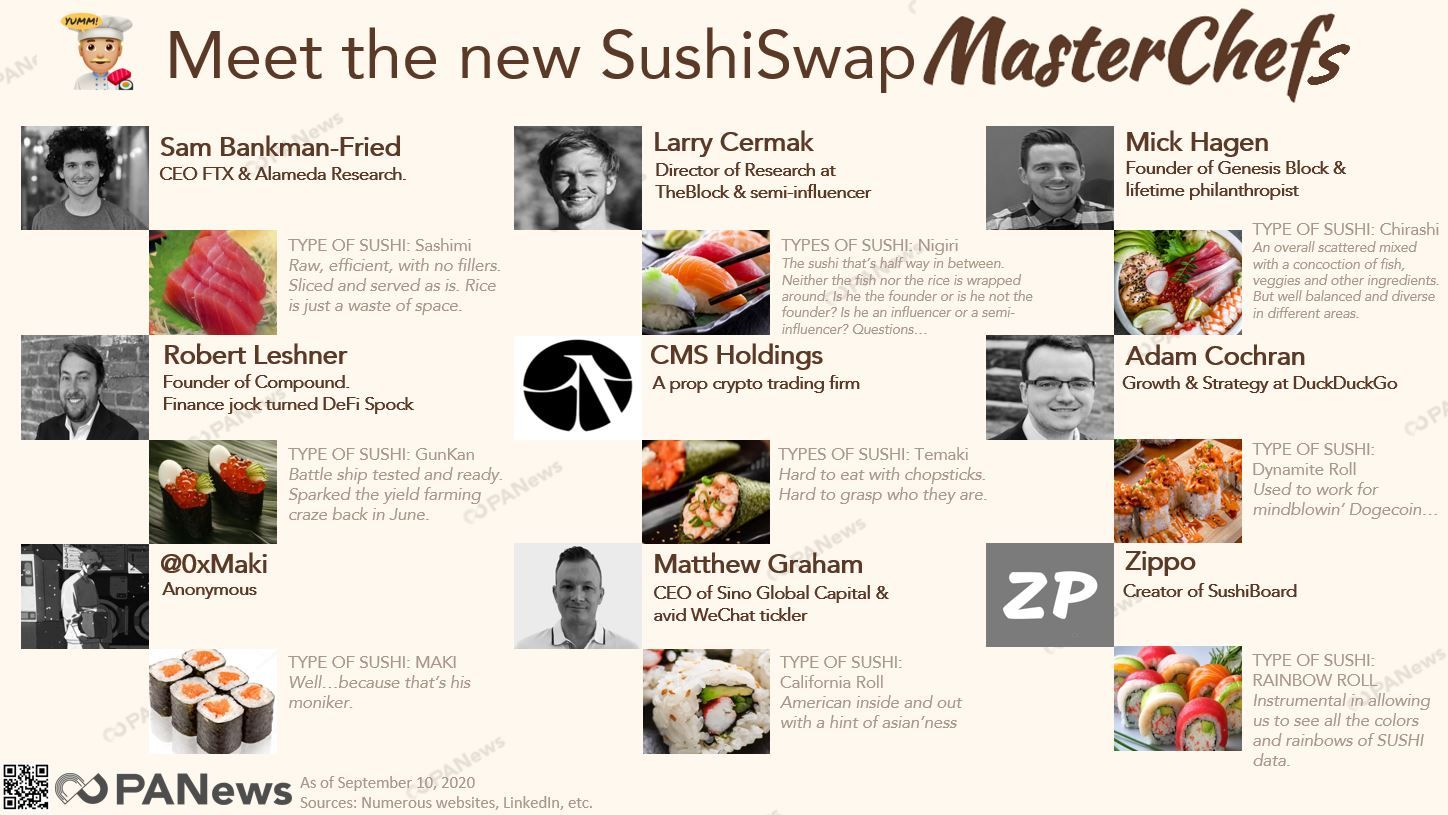

By Sept. 7, Chef Nomi had handed over control of the project to FTX derivatives exchange CEO Sam Bankman-Fried (SBF). The new “chef” deployed a multi-signature wallet into SushiSwap smart contracts in order to move the control into the community’s hands. What ended up happening was that a number of SUSHI whales gained control of the protocol through a governance vote heavily weighted towards the biggest bag holders.

Source: PANewsA report by on-chain analytics platform Glassnode published on Sept. 8 took a deep dive into the tokenomics of SushiSwap, concluding that it was way overvalued and would need monumental trading volumes to justify the rewards paid out and token prices. A week after its giddy peak, SUSHI prices had dumped around 80% to $2.20 and confidence in the project was waning.

By Sept. 10, just under two weeks after the platform was spawned, it successfully migrated away from Uniswap taking over a billion dollars in liquidity with it. To incentivize liquidity providers to keep their collateral on the new version, SBF threw an additional two million SUSHI tokens into the pot to be divided among the farmers, and the incentive clearly had the desired effect. The website and user interface were relaunched as sushiswapclassic.org and a new analytics dashboard called sushiswap.vision appeared.

Over $1.2 billion had left Uniswap, dropping its TVL back to around $350 million which, in all fairness, was the same level it was before the SushiSwap frenzy took off.

On Sept.11, the original Chef Nomi publically apologized stating that he had returned $14 million in ETH back to the treasury and wanted to let the community decide how much he deserved as the original creator.

The SushiSwap saga has been a little reminiscent of the initial coin offering (ICO) boom, where projects with very little backing them but hype were propelled into the stratosphere by profit-driven altcoin traders (called “degens” in DeFi terms after degenerate farmers). Bankman-Fried has maintained that his intentions are purely altruistic and the protocol should remain for the community rather than the head chefs.

By Sept. 23, SUSHI token prices had slumped to $1.27 and liquidity on the platform, and its various pools had fallen to just around $450 million. It was Uniswap’s turn to strike back.

Uniswap Strikes BackThe main reason that DeFi farmers flocked to SushiSwap apparently was that it offered better returns than Uniswap from which the concept germinated. Uniswap needed its own native token and UNI was announced on Sept. 17 causing the biggest frenzy of the year, and grinding the Ethereum network to a halt in the process.

DeFi yield hunters returned to Uniswap to claim their share of 15 million airdropped tokens, and participate in the four ETH-based liquidity pools that would offer token rewards for the following two months.

Uniswap total value locked surged to almost $2 billion, sucking the life out of SushiSwap and any other DeFi farming protocols that didn’t offer such lofty profit promises. This new breed of “Degen farmers” are a fickle bunch and yield jumping appears to be their modus operandi, with very little in the way of loyalty to any platform in particular.

How to Use SushiSwapDepositing liquidity in SushiSwap pools is very similar to using Uniswap, a crypto wallet such as Metamask must be connected in order to proceed. From the main home page, clicking “see the menu” will display the farms, or liquidity pools, available and their projected annual returns.

Source: sushiswapclassic.orgOnce a pool is selected you will need to approve the SLP which is the liquidity provider token for the pool. These tokens represent a proportional share of the pooled assets, allowing a user to reclaim their funds at any point.

There will be a network transaction gas fee associated with this. Once this step is done, you can pick the two crypto assets you want to add to the pool and add them, which will incur another gas fee.

Once deposited, earnings in SUSHI will be displayed along with any other earnings depending on the pool. Staking is also an option at what it calls the “Sushi Bar,” but tokens must be converted to xSushi first. As with Uniswap, a 0.3% fee is charged for trades, or token swaps, with 0.05% of this fee gets added to the SushiBar pool.

Liquidity providers for the relative pools on the exchange part of the protocol will earn 0.25% of that trading fee.

The Road ForwardThe latest post on the SushiSwap blog at the time of writing acknowledges that simply “copying the recipe’” is not enough, and it needs to develop new features and tools in order to become “the best DEX.”

Some of these upgrades in the pipeline include more language support (Chinese specifically mentioned), mobile support, limit and stop-loss trading, profit and loss history, improved harvesting, and general bug fixes.

It added that it wanted to compete on long-tail assets or so-called “gems” currently being deployed on Uniswap and to prevent spamming and fake tokens. There was also a specification for governance with a lot of tweaks in it to further decentralize the protocol.

The post A Guide and Short History of SushiSwap appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

INS Ecosystem (INS) на Currencies.ru

|

|