2026-1-15 18:30 |

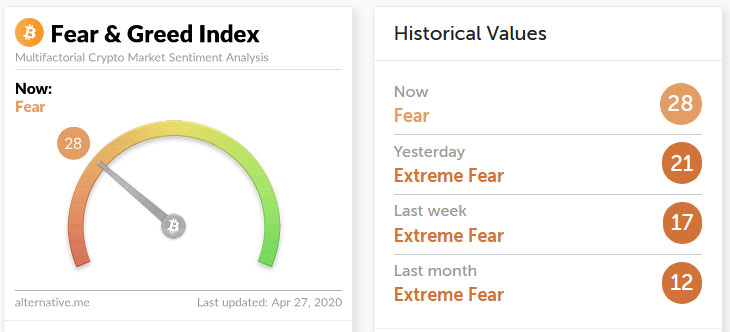

According to the Crypto Fear & Greed Index, investor mood has swung back toward optimism, registering a score of 61 on Thursday. That is the first time the gauge has moved into the “greed” zone since the large market fallout on Oct. 11, when roughly $19 billion in liquidations drove many traders from altcoins. The index had climbed to 48 just a day earlier, moving out of “neutral” and signaling a quick change in sentiment.

Crypto Fear And Greed ShiftsThe index combines several signals — price moves, trading activity, momentum, Google search interest and social media chatter — to produce a single reading. Based on reports, the measure fell into low double digits several times during November and December after the October sell-off. A score of 61 does not imply euphoria, but it does show growing confidence among traders after weeks of anxiety and patience being tested.

Bitcoin Price ReboundsBitcoin’s price has been moving in step with the improving mood. In the past seven days, Bitcoin rose from $89,750 to a two-month high of $97,720 on Wednesday, according to data from CoinMarketCap. That level was last seen on Nov. 14, when the market was still struggling and sentiment readings were weak even as prices briefly touched similar highs. Market watchers say the recent rally has helped lift trader confidence and is one of the main reasons the index improved so fast.

Retail Exit And Exchange SupplyAccording to market intelligence firm Santiment, there was a net drop of 47,244 Bitcoin holders over a three-day stretch. Reports have disclosed that many small investors left their positions, a reaction blamed on FUD and impatience. At the same time, the amount of Bitcoin held on exchanges fell to a seven-month low of 1.18 million BTC. Less supply sitting on exchange platforms tends to lower the immediate risk of a large, sudden sell-off.

What This Means For TradersTraders use sentiment tools as one input among many when deciding whether to buy, sell or wait. A return to “greed” suggests more people are willing to buy, which can push prices higher if buying pressure continues. On the other hand, sentiment can flip quickly; a sharp move back down would likely make some traders nervous again. Analysts point out that a shrinking pool of retail participants can leave the market in the hands of more committed holders, which often supports steadier price action.

From Anxiety To OptimismBased on reports and current readings, the market has shifted from anxiety toward a more upbeat mood, backed by Bitcoin’s recent gains and lower exchange balances. That combination is seen by many former skeptics as a healthier setup than the panic-filled trading seen after the October liquidations. The picture is cautiously positive: optimism is rising, but the swings that define crypto markets have not disappeared.

Featured image from Unsplash, chart from TradingView

origin »Greed (GREED) на Currencies.ru

|

|