2021-1-1 23:44 |

World’s leading digital assets manager Grayscale has recorded a new all-time high of $19 billion crypto assets under management in tandem with BTC’s spectacular rise to its historically highest price above $28,000.

The new record is up 16% from the previous week’s all-time high of $16.4 billion. On December 15, Grayscale’s total assets under management (AUM) stood at $13 billion, representing a 71% tremendous increase in value in one and a half months from $7.6 billion on November 1.

Grayscale’s Bitcoin Trust is by far its largest holding, accounting for 85% ($16.3 billion) of the total AUM, followed by its also aggressively growing Ethereum Trust which is currently valued at $2.1 billion.

Its other crypto trusts with significant gains are Litecoin (LTC), Bitcoin Cash (BCH), and Ethereum Classic valued at approximately $151 million, $85.5 million, and $72.9 million, respectively. Meanwhile, trusts for XRP, Stellar Lumens (XLM), and privacy coin Zcash have much fewer investments and are Grayscale’s poorly performing crypto portfolios.

Grayscale: Resilience in digital currencies in 2020The new-York based investments fund is invested in offering a safe and insured gateway to the adoption of the digital currency class, to both individuals and institutional investors. The firm believes that if the future is digital, investments should be digital too.

Grayscale stated that 2020 has brought out the resilient side of cryptocurrencies and more market growth is to be expected as more institutional investors flock in to invest in Bitcoin and other cryptocurrencies.

“Digital currencies showed resilience in 2020. Investors are turning to #DigitalCurrencies as a way to further diversify their portfolios.”

Betting heavily on the bright future of the digital assets class, Grayscale has chosen millennials as its primary target market. They currently form the largest group of the upcoming investor class, are tech-savvy and innovative, distrustful of the traditional financial structures, and therefore the most likely to adopt cryptocurrencies.

Furthermore, millennials are the direct beneficiaries of up to $3 trillion in wealth transfer from baby boomers. Grayscale counts on most of the money being invested directly into the crypto market.

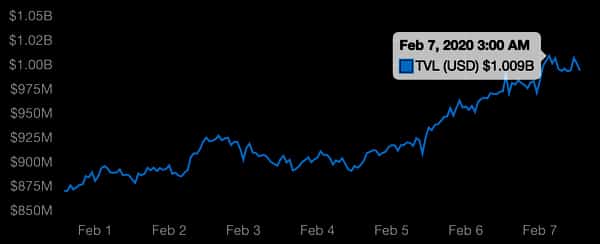

Grayscale and BitcoinGrayscale’s AUM is heavily influenced by volatility in the crypto market, often mirroring Bitcoin’s price movement. Following the new record.

Commenting on Grayscale’s new milestone, Economist Nouriel Roubini pointed out that Grayscale’s ballooning AUM is a direct reflection of what’s happening to Bitcoin and the crypto market.

“Market value of Grayscale’s assets has ballooned given the current BTC bubble. But that doesn’t mean that investors have forked $19bn in that Biz.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Decentralize Currency Assets (DCA) на Currencies.ru

|

|