2021-1-1 22:04 |

Grayscale, the New York-based investment company, has sold massive amounts of XRP and XLM tokens from their respective Trust products.

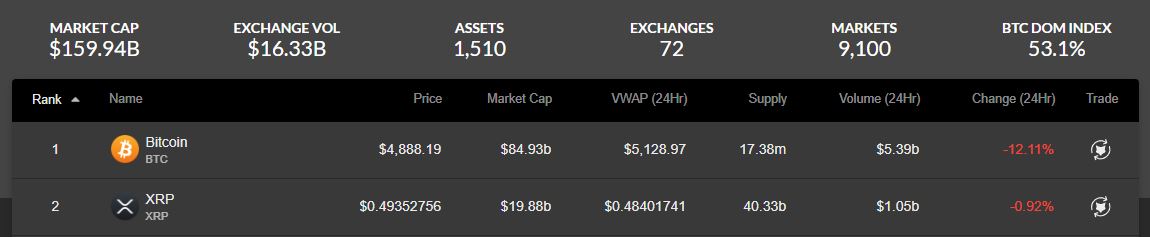

Grayscale Deals XRP, XLM BlowAccording to data from Bybt, the investment firm has reduced its XRP holding by 9,189,031, worth ~$2.02 million at press time. Its XLM holding also saw a reduction of 9,743,886, worth ~$1.26 million at press time.

At present, Grayscale investment holds 26.46 million XRP in its XRP Trust, amounting to ~$5.82 million. Its Stellar Lumens Trust holds 9.19 million XLM, worth roughly ~$1.19 million.

Ripple Inc. is being sued by the SEC for selling XRP tokens. The SEC has charged Ripple and its executives for selling 14.6 billion XRP ($1.38 billion).

The pre-trial will begin on Feb. 22. Meanwhile, Ripple has stated that they will continue to operate in the United States despite the lawsuit. Since then, exchanges like Coinbase, Bitstamp, Binance.US, and more have halted XRP trading. Thus, it makes sense for Grayscale to reduce its XRP holdings.

While Stellar is under no such regulatory scrutiny, Grayscale seems to have pre-emptively taken precautionary measures, as Stellar was co-founded by Jed McCaleb, who was also the founder of Ripple before leaving the company in July 2013.

Besides XLM and XRP, the firm gives investors the ability to invest in Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Ethereum Classic, Zcash, XRP, and Horizen. Grayscale also offers a diversified market-cap-weighted fund called Grayscale Digital Large Cap Fund (GDLC). This fund comprises Bitcoin, Ethereum, XRP, Bitcoin Cash, and Litecoin.

Grayscale has $20.14 billion in assets under management (AUM), with its Grayscale Bitcoin Trust (GBTC) amounting to $17.61 billion, thus constituting 87% of its total AUM.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|