2021-2-12 16:52 |

Grayscale Investment, the world’s largest digital asset manager with $36.65 billion in assets under management (AUM), is getting increasingly interested in decentralized finance (DeFi) projects.

The firm is now looking to provide its institutional clients’ exposure to more DeFi blue chips, including SushiSwap (SUSHI) and Synthetix (SNX).

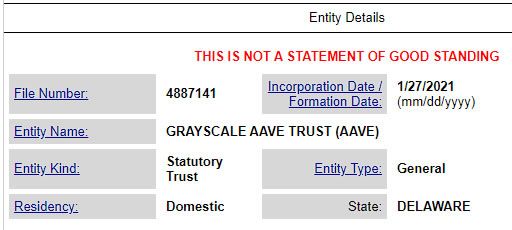

Grayscale’s “statutory trustee” for the US states Delaware Trust Company has now filed for launching the trusts for the hot DeFi projects.

SushiSwap is a popular DEX that does more than half a billion dollars worth of volume daily to capture over 23% of the DEX volume market share. The project sees a whole host of positive developments, with Coinbase Custody also announcing that it will support deposits and withdrawals for SushiSwap.

Recently, xSushi was allowed to be borrowed and lent on AAVE v2 that will allow xSushi holders to access the liquidity of their platform. Moreover, the BentoBox contract, the token vault with flash loans, and strategies went live on Ethereum, Ropsten, Kovan, Rinkeby, Goerli, Moonbeam testnet (Polkadot sidechain), and Arbitrum testnet (L2).

Synthetix, the decentralized synthetic asset platform records under $50 million in daily volume with a 1.27% market share.

The tokens SUSHI

SUSHI 10.27%

SushiSwap / USD

SUSHIUSD

$ 16.48

$1.69

10.27%

Volume 1.06 b

Change $1.69

Open $16.48

Circulating 127.24 m

Market Cap 2.1 b

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[scripts.length - 1];

var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}};

(function () {

var appName = encodeURIComponent(window.location.hostname);

if (appName == "") {

appName = "local";

}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=SUSHI&tsym=USD';

s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

3 h

Grayscale Now Eyeing SushiSwap (SUSHI) & Synthetix (SNX) for its Institutional Clients

1 d

DEX Balancer Raises $5 Million Ahead of its V2 Launch Next Month

2 d

Binance Smart Chain Flips Ethereum in Daily Transactions; PancakeSwap Trumps Sushiswap

and SNX

SNX 1.13%

Synthetix / USD

SNXUSD

$ 26.45

$0.30

1.13%

Volume 362.48 m

Change $0.30

Open $26.45

Circulating 114.84 m

Market Cap 3.04 b

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[scripts.length - 1];

var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}};

(function () {

var appName = encodeURIComponent(window.location.hostname);

if (appName == "") {

appName = "local";

}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=SNX&tsym=USD';

s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

3 h

Grayscale Now Eyeing SushiSwap (SUSHI) & Synthetix (SNX) for its Institutional Clients

4 d

Celebrities from All Industries Were Pumping DOGE to the Moon Over the Weekend

1 w

The Graph Now Exploring Support for Bitcoin, Polkadot, Solana, BSC & Other Layer 1 Blockchains

have been enjoying a bull rally along with the broad cryptocurrency market, up 400% and 220% YTD, respectively.

Grayscale has also filed for other popular DeFi projects like Polkadot

DOT 12.21%

Polkadot / USD

DOTUSD

$ 28.57

$3.49

12.21%

Volume 3.63 b

Change $3.49

Open $28.57

Circulating 907.55 m

Market Cap 25.93 b

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[scripts.length - 1];

var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}};

(function () {

var appName = encodeURIComponent(window.location.hostname);

if (appName == "") {

appName = "local";

}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=DOT&tsym=USD';

s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

3 h

Grayscale Now Eyeing SushiSwap (SUSHI) & Synthetix (SNX) for its Institutional Clients

1 d

Matic Network Strategically Rebrands to ‘Polygon’ in a Bid to Build the Best Ethereum Layer 2 Solutions

2 d

Binance Backs Parachain Candidate, Plasm Network; Making First Investment in Polkadot Ecosystem

, AAVE

AAVE -2.14%

Aave / USD

AAVEUSD

$ 519.49

-$11.12

-2.14%

Volume 932.27 m

Change -$11.12

Open $519.49

Circulating 12.38 m

Market Cap 6.43 b

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[scripts.length - 1];

var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}};

(function () {

var appName = encodeURIComponent(window.location.hostname);

if (appName == "") {

appName = "local";

}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=AAVE&tsym=USD';

s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

3 h

Grayscale Now Eyeing SushiSwap (SUSHI) & Synthetix (SNX) for its Institutional Clients

3 d

Bitwise Files Application to Launch Exchange Traded Fund (ETF) for ‘Crypto Innovators’

3 d

"Everything Going Up" Season Sees Cardano (ADA) Trumping Polkadot (DOT)

, Chainlink

LINK 6.56%

Chainlink / USD

LINKUSD

$ 30.00

$1.97

6.56%

Volume 3.48 b

Change $1.97

Open $30.00

Circulating 406.51 m

Market Cap 12.2 b

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[scripts.length - 1];

var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}};

(function () {

var appName = encodeURIComponent(window.location.hostname);

if (appName == "") {

appName = "local";

}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=LINK&tsym=USD';

s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

3 h

Grayscale Now Eyeing SushiSwap (SUSHI) & Synthetix (SNX) for its Institutional Clients

1 w

Kraken Launches Chainlink Node to Provide Spot Price Data for DeFi Markets

1 w

Bitwise 10 Large Cap Index Adds AAVE and Uniswap; CIO Calls DeFi Inclusion a 'Milestone Event'

, and many other cryptocurrencies but the asset manager has yet to launch any of these trusts.

Meanwhile, the firm continues to buy for its other trust, currently holding 650.36k BTC and 3.13 million ETH, adding just over 1,230 BTC and 52,730 ETH respectively this week.

The post Grayscale Now Eyeing SushiSwap (SUSHI) & Synthetix (SNX) for its Institutional Clients first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

SushiSwap (SUSHI) на Currencies.ru

|

|