2022-12-20 21:30 |

Grayscale Investments could appeal to GBTC shareholders to sell some of their shares at a higher price to return investor capital.

Grayscale may offer to buy up to 20% of outstanding GBTC shares at a premium to help close the gap between the GBTC share price and the company’s underlying Bitcoin holdings. This comes after the company failed to secure approval for a spot Bitcoin ETF earlier this year.

Grayscale Must Get Shareholder ApprovalIn a letter to investors seen by the Wall Street Journal, CEO Michael Sonnenshein said that Grayscale would also consider issuing further tender offers should its application receive SEC and shareholder approval, adding that there is no timeline for the first tender offer.

For Grayscale to issue a tender offer, GBTC shareholders must approve whether they want to sell their shares at the proposed price. GBTC’s status as a closed-ended fund means that shareholders can only liquidate their holdings on the open market.

Strict SEC laws in the United States govern tender offers. Under the Williams Act, which is part of the Securities Exchange Act of 1934, an investor tendering for a security must disclose their source of funds, reasons for the offer, and any existing legal agreements related to the offer.

If it cannot return investor funds through a tender offer, Grayscale will continue offering GBTC shares until the SEC approves the conversion of GBTC to an ETF.

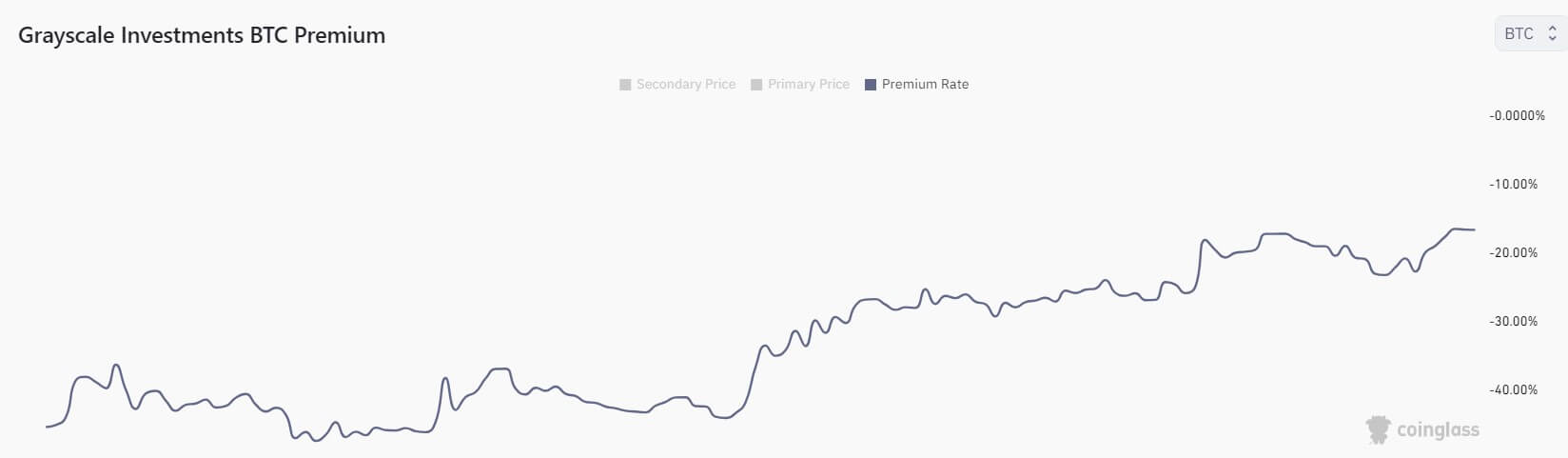

Grayscale Under Pressure From DiscountGrayscale’s Bitcoin Trust, with roughly $10.78 billion in assets under management (approximately 633,000 BTC), aims for its shares’ value to represent the Bitcoin it holds, less fees and expenses. To date, the fund has failed to meet its goal, currently changing hands at a 48.8% discount to Bitcoin.

Source: YChartsGrayscale hoped to use an exchange-traded fund to reduce the discount but faced SEC pushback as the agency rejected its application to convert GBTC to an exchange-traded fund. Grayscale later sued the SEC for allegedly inconsistently applying securities legislation.

In response, the SEC filed a brief on Dec. 13, 2022, denying Grayscale’s allegations that its rejection was arbitrary, capricious, and discriminatory.

In the filing, the regulatory agency defended its stance, rehashing concerns about market manipulation by whales and the risk of fraud at centralized exchanges like Coinbase and Binance.

Grayscale CEO Reassures Public About Regulatory ComplianceGrayscale faces an uphill battle to soothe investor concern following the collapses of at least five major crypto companies in 2022, including the Bahamian exchange FTX.

In a bid to distance himself and Grayscale from claims that crypto companies have difficulty securing auditors, Sonneshein said that the company had audited financial statements of all of its crypto products, including its GBTC and Ethereum trusts, since roughly 2014.

While he didn’t offer clues about whether Grayscale could potentially sell its Bitcoin holdings amid a deepening crypto winter. A market dump like Grayscale could see Bitcoin break away from correlation with traditional equities markets and strengthen the SEC’s market manipulation argument. A reduction in the Bitcoin price could also cause the GBTC share price to trade closer to Bitcoin’s net asset value. Which is Grayscale’s goal in pursuing an ETF.

It could also result in significant liquidations for those engaged in bitcoin derivatives markets and drive down confidence in crypto, given Grayscale’s standing amongst traditional investors. Such a move could further hurt trading crypto volumes suffering from unprecedented macroeconomic headwinds in 2022.

Grayscale has until Jan. 13, 2023 to respond to the filing, while the due date for the SEC’s response is on Feb. 3, 2022. After that, a judge will rule on the SEC’s rejection.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

The post Grayscale May Be Preparing to Liquidate 600,000 BTC Stash After Failed GBTC ETF appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Theresa May Coin (MAY) на Currencies.ru

|

|