2021-3-14 16:57 |

Grayscale Investments, the world’s largest digital asset manager, is betting on the approval of a US Bitcoin exchange-traded fund (ETF) in the near future.

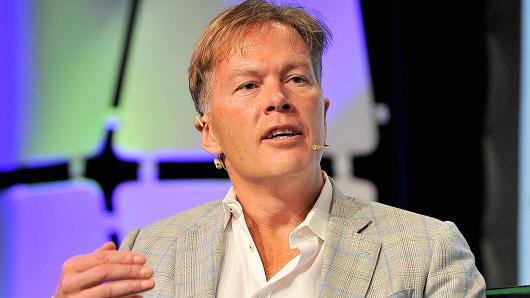

The company is interested in launching a Bitcoin ETF, that is if the authorities give it the green light to do so. Chief executive Michael Sonnenshein told Insider,

“When we get the signal that perhaps they have greater comfort and have seen some of [the] elements in the market mature, we would continue to look to be engaged in those discussions.”

The asset manager has $43.55 billion in AUM, of which north of $37 billion is in Grayscale Bitcoin Trust (GBTC).

GBTC has been trading at a discount for over ten days now, currently at 7%, as per YCharts.

As we reported, the company has posted a number of ETF-related jobs, which has been in response to “customer demand,” sparking the speculation that Grayscale is planning to file for an ETF. Zac Prince, co-founder and CEO of BlockFi, one of the largest holders of the Grayscale Bitcoin Trust (GBTC), called Grayscale’s ETF job postings’ “an interesting signal.”

“The race to launch the first Bitcoin ETF is heating up,” said Todd Rosenbluth, director of ETF research for CFRA Research.

As we saw in Canada, the first-mover advantage is “tremendous” in the ETF space, and “whichever comes out of the gate first will have a leg up,” Rosenbluth said.

While several such proposals have been filed in the past, the US Securities and Exchange Commission (SEC) has yet to approve one. Canada has already listed three Bitcoin ETFs. Jake Chervinksy, General Counsel at Compound Finance said,

“Although several proposals have been submitted, most are still incomplete & none have been published in the Federal Register yet. Publication is the event that triggers the SEC's deadlines to evaluate a proposal (240 days maximum).”

And while Grayscale is interested in applying for approvals for an ETF, the company is waiting for a stronger signal from the regulators before taking action.

Still, it is a “matter of when, not if” US regulators approve a Bitcoin ETF, said Sonnenshein. But he doesn't want to second-guess the SEC, as “ultimately those decisions are in the hands of regulators.”

Back in 2017, Grayscale made the push to convert its close-ended GBTC fund into an exchange-traded fund but pulled out of the process voluntarily. According to the CEO, a Bitcoin ETF would be “well-received by the investment community” because of the product structure, which is popular, and their familiarity with it.

“We're certainly seeing positive receptivity from our investors… and as a result of that, we certainly want to make sure we can continue to stay in front of investor demand.”

Bitcoin/USD BTCUSD 61,150.8913 $5,252.86 8.59% Volume 60.05 b Change $5,252.86 Open$61,150.8913 Circulating 18.65 m Market Cap 1.14 t baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=BTC&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); The post Grayscale Is Interested in Launching A US Bitcoin ETF and So Are Its Investors, says CEO first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

EthereumFog (ETF) íà Currencies.ru

|

|