2023-7-11 23:57 |

Crypto asset manager Grayscale has questioned the U.S. Securities and Exchange Commission’s decision to approve a leveraged Bitcoin (BTC) exchange-traded fund (ETF) in a July 10 letter.

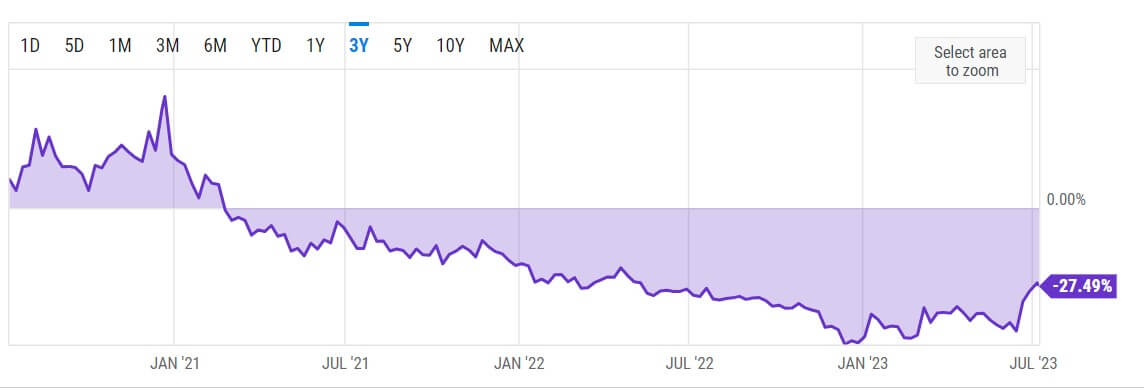

The firm’s Bitcoin Trust (GBTC) also narrowed to its lowest point since May 2022, according to ycharts data,

GBTC discount narrowsGBTC’s discount to its net asset value (NAV) narrowed to 27.49%, and its shares were trading near $20, according to ycharts data.

Source: YchartsDuring the past few weeks, GBTC’s discount has increasingly narrowed, and the value of its shares has outperformed that of Bitcoin. For context, while GBTC shares have risen by nearly 43% during the past month, BTC’s value gained only 17% during the same time frame, according to CryptoSlate’s data.

Market observers have attributed GBTC’s improved performance to BlackRock’s application for a Bitcoin spot ETF. Since the asset manager applied for a spot BTC ETF on June 15, other traditional financial institutions, including Fidelity and others, have applied for a similar ETF.

Grayscale questions SEC over BTC leverage ETFOn July 10, Grayscale criticized the U.S. financial regulator’s decision to approve a leveraged BTC ETF—an investment fund that aims to generate amplified returns by using financial derivatives and debt—arguing that the SEC’s actions prove it is acting arbitrarily.

The firm wrote:

“The 2x levered bitcoin futures ETF employs leverage with the goal of doubling the performance of the S&P CME Bitcoin Futures Daily Roll Index each day. This exposes investors to an even riskier investment product than traditional bitcoin futures exchange-traded products.”

Grayscale pointed out that the excitement generated by this leveraged BTC ETF shows that “investors are eager for BTC exposure with the protections of the ETF wrapper.”

The firm added that the SEC had no good reason to deny the approval of spot products while approving leveraged futures products.

Last year, the SEC rejected Grayscale’s plan to convert its Bitcoin Trust into an ETF, forcing the firm to file a lawsuit against the SEC, arguing that a spot ETF was not different from a futures ETF—which the SEC had previously approved.

The post Grayscale challenges SEC’s decision on leveraged Bitcoin ETF as GBTC discount narrows appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|