2024-1-25 14:17 |

Quick Take

The digital asset market recently observed a significant shift in capital. On day 9, the Grayscale Bitcoin Trust (GBTC) experienced outflows of $429 million, marking the lowest level since day one and, intriguingly, indicating a downward trend, according to Eric Balchunas. Despite the decrease, this figure is noteworthy. GBTC’s total outflows have amassed an alarming $4.4 billion.

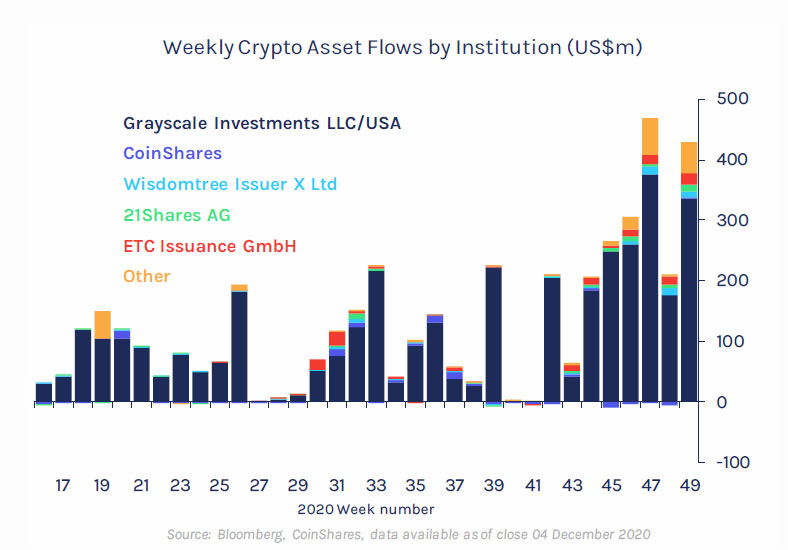

Total Flows: (Source: Bloomberg, James SeyffartSimultaneously, an interesting contrast is seen with BlackRock iShares Bitcoin ETF (IBIT), which experienced inflows totaling $66 million on Jan. 24. This is attributed to an addition of an estimated 1,659 BTC at a net asset value of $22.66 per share. This figure is below the average inflow of $227 million and the lowest since the fund opened, with a peak inflow of $371 million on Jan. 17.

Overall, the spot Bitcoin ETFs boasted inflows of $271 million, excluding Grayscale (GBTC), and a net outflow of $158 million, including GBTC. Over the past nine days, inflows across all the spot Bitcoin ETFs sit at $824 million, excluding GBTC inflows are $5.21 billion.

The post Grayscale Bitcoin Trust hits new low for outflows with $429 million leaving fund appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|