2020-4-11 21:08 |

Bitcoin Halving is just around 35 days away and despite the ongoing coronavirus pandemic, it seems the interest towards halving hasn’t dipped. In fact, as per the recent Google metrics, the interest in Bitcoin halving is on the rise. While most of the traditional financial market has come to a standstill and governments around the globe are on a money printing spree due to the outbreak of coronavirus, despite these factors Bitcoin seems to stand its ground as a decentralized form of currency.

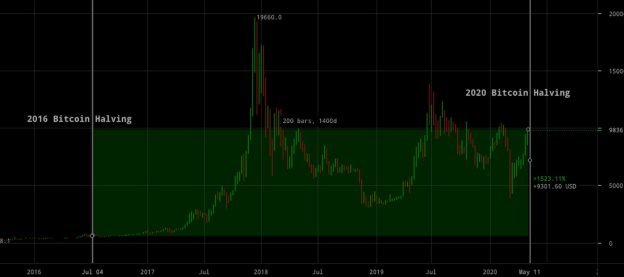

Bitcoin halving is considered as a highly bullish event given the supply-demand factor. After each halving the rate of new Bitcoin coming into the market get reduced by half. When Bitcoin was launched back in 2009, the block reward was 50 BTC per Block, and approximately after 4 years, this supply has been reduced from 50 to 25, then 25 to 12.5 and the next halving would bring it down to 6.25.

In the past Bitcoin has shown jumps in upwards of 1000% prior to the halving, but that was mainly because Bitcoin was highly volatile being a new asset class, however, the volatility has been significantly reduced in the following years and the next halving might not see that big of a jump. Irrespective of that, Bitcoin proponents are quite confident that the scarcity factor would kick in and BTC price might reach as high as $100,000 within 2 years of halving.

Google Trends Show Significant Rise In Interest Towards Bitcoin HalvingThe next Bitcoin Halving is going to be the third event of its kind and probably the first with attention from people of all walks of life. The recent Google Metrics Data is the witness of the same as the trends suggest a significant peak in the searches of ‘Bitcoin Halving’ and ‘Halving’ in the past couple of months.

A data compiled by LongHash suggest that the interest levels for Bitcoin Halving have grown from 19 in April to 78 in the present time, and even reached 100 for a short period in the month of March.

Google measures the search volume for particular terms on the scale of 0-100. So, looking at the chart it’s quite clear that the interest in Bitcoin halving was at its highest in Mid-March which has dropped by almost 22% at the start of April. While the decline is significant it can be attributed to the growing tension due to COVID-19 which has infected over 1.5 million people across the globe and has killed over 10k people worldwide.

A majority of the search volume started to spike with the start of the new year which also saw Bitcoin gain some lost grounds and reach around $10,500 mark by mid-February. The traditional markets were already in the turmoil and COVID-19 outbreak led to a series of market crashes which also made many Crypto Institutional investors to panic sell, resulting in Bitcoin crashing to as low as $3,800 in March.

Other metrics suggested Americans being highly interested in Bitcoin Halving, as granular data for the U.S. suggests American citizens will be searching Bitcoin Halving Twice of what they did last week.

Price Predictions and Recent Halvings of Altcoins Haven’t Resulted in Bullish RunPrice predictions in the crypto space is an outright bad idea, as man self-proclaimed pundits have not just got it wrong but way off the mark. The primary example is 2018 bear market, where many of the likes of Charlie Lee and Tim Draper predicted 6-figure price rise after the massive bull run towards the end of December 2017 which saw Bitcoin attain its all-time-high price of near $20k. However, since that prie rise, Bitcoin has not able to go anywhere near that price even when many believed that 2018’s bear market will be followed by another bull run and effects of halving would kick-in by mid-2019 or early 2020.

PlanB, who has attained fame with his stock-to-flow charts predicting Bitcoin to reach over $100K by December 2022 believe the scarcity would be the biggest factor behind Bitcoin’s rise. However, looking at the current scenario and the price predictions in the past, that seems to be quite far-fetched.

Many altcoins such as Litecoin, and most recently Bitcoin Cash and Bitcoin SV has undergone halving, and none of them showed any signs of bullish price movement either prior to halving or in the aftermath, so it would be interesting to see if Bitcoin behaves the same or indeed sees the long-awaited Bull run.

Bitcoin (BTC) Live Price 1 BTC/USD =$6,855.4142 change ~ 0.90%Coin Market Cap

$125.58 Billion24 Hour Volume

$6.02 Billion24 Hour VWAP

$6.89 K24 Hour Change

$61.7090 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin Interest (BCI) на Currencies.ru

|

|