2022-5-24 15:56 |

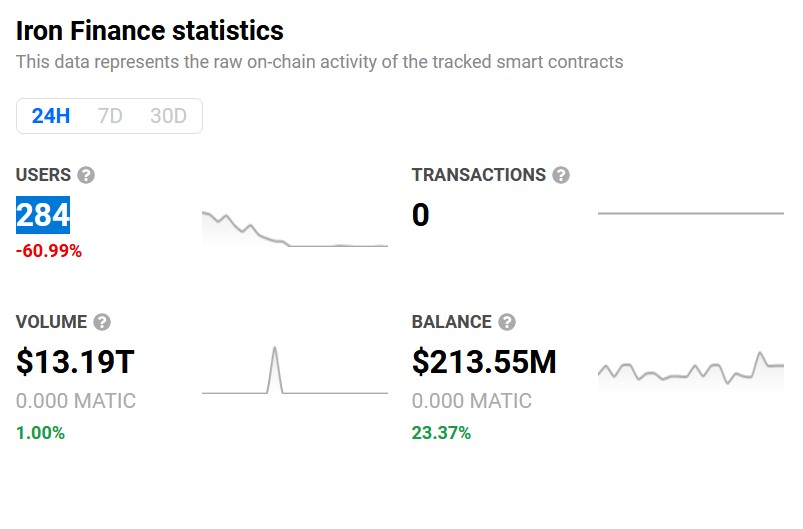

One little-noticed effect of the terraUSD (UST) collapse relates to Lido and shows how the connections between decentralized finance (DeFi) applications amplify systemic risk. origin »

Bitcoin price in Telegram @btc_price_every_hour

RiskCoin (RISK) на Currencies.ru

|

|