2020-8-21 23:09 |

The global COVID-19 crisis has created a currency vacuum that will drive the price of gold up, according to analysts at SkyBridge Capital.

The team believes the global currency market will implode, and gold will fill the gap left behind. The argument is mainly driven by current concerns over the U.S. dollar. The coronavirus has resulted in unprecedented stimulus payments and a significant loss in dollar strength in 2020.

The difficulty, per SkyBridge, is that no other currency has the fortitude to fill the reserve gap the dollar has long held. According to Troy Gayeski, co-chief investment officer and senior portfolio manager:

When you think of currency debasement the question is, what is the dollar going to weaken against, and when you look around the globe, it’s hard to be excited about alternative currencies. So, gold is obviously a natural alternative currency.

Buying the Gold BugThe report was coupled with news that the company would be buying the precious metal for the first time since 2011. Warren Buffett, a long time gold naysayer, also bought heavily into the gold market this week.

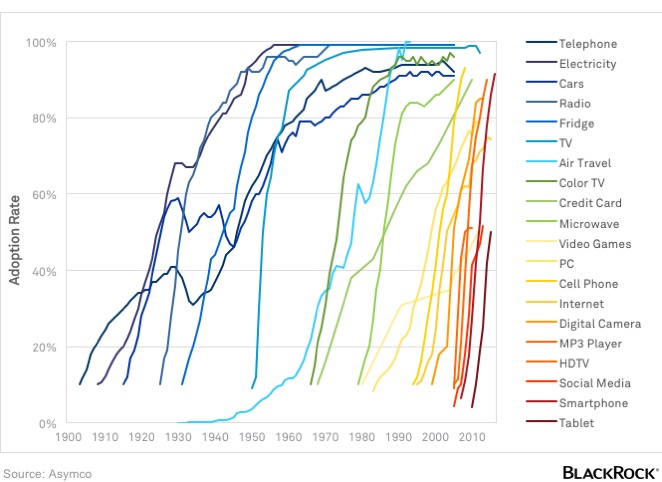

Source: BloombergThe allocation of large amounts of capital into the alpha metal represents a significant shift in trading strategy. Investors generally seek out interest-bearing or dividend positions. When inflation makes those returns negligible or negative, gold becomes a good option.

Additionally, gold offers the advantage that it functions as a currency, though is somewhat illiquid. This provides the dual advantage of stability and value, which has likely led to sustained price rises in recent times.

Will Bitcoin Follow Suit?The new gold rush may also provide some insight into the rise of Bitcoin. The ‘digital gold’ has witnessed dramatic gains to over $12,000 a coin in recent days. To date, it’s still holding above $11,800.

Some would argue that the run-up is being spurred by a rush into assets that can act as an alternative currency, but is divested from dollars. Bitcoin may be perceived as offering this dual functionality.

However, while gold is remarkably difficult to spend, bitcoin has the added advantage of liquidity. The difference between scanning a QR code, and carrying a bar of gold should be obvious. Either way, investors continue to flee the ailing dollar.

The post Gold Will Rise on Currency Collapse, Say Analysts appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Golos Gold (GBG) на Currencies.ru

|

|