2026-1-26 18:00 |

Gold shone brightly today, racing to a new high while crypto took the back seat, and the gap between the two assets opened wide.

On Monday, the precious metal moved past the $5,000 mark, registering a price point market sentinels had not witnessed before. Bitcoin, by contrast, failed to keep pace and traded well below its recent highs.

Gold Hits Record LevelsSafe-haven demand pushed gold sharply higher. Prices were up above $5k an ounce and inked roughly $5,110 at the peak. Silver, for its part, did not go unnoticed, jumping to fresh peaks near $107/ounce.

Traders pointed to simmering geopolitical friction and talk of tougher trade moves led by US President Donald Trump as fuel for the rally.

A weaker greenback made metals more attractive to customers overseas, and central bank buying provided steady backing. Liquidity in some corners were thin as investors rushed to shift cash into things that feel stable when risk elevates.

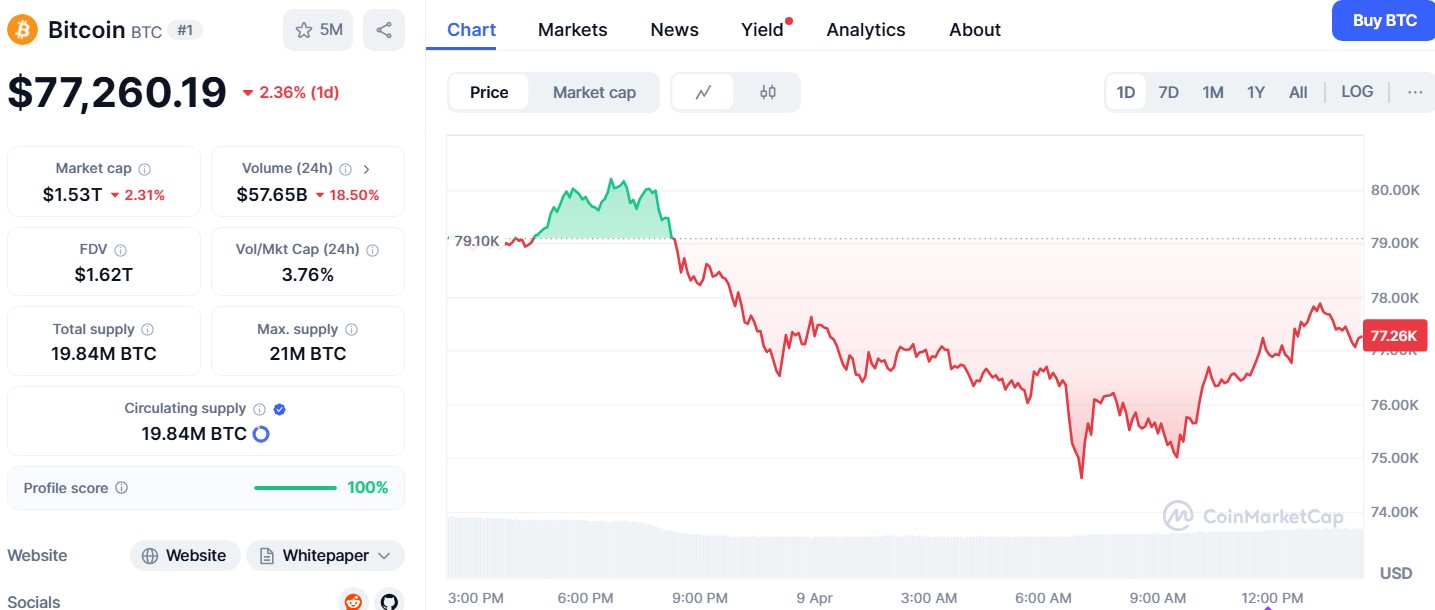

Bitcoin Falls BehindMarket numbers show Bitcoin hovering in the mid-$80,000s range, retreating from peaks seen late last year. Reports note the alpha crypto is roughly 30% below the highest level it hit reached in October 2025, leaving some holders quite jittery.

Volatility was another factor. Where bullion is being sought for safety, Bitcoin is viewed more as a growth or speculative play, and that difference in investor application becomes clear when markets tighten. Some funds slashed their crypto exposure, signaling a short reroute away from high-risk gambits.

Why Investors Are ShiftingAnalysts and traders described a simple choice: shelter or swing for gains. When headlines push worry, money flows into assets that are widely trusted across markets and governments.

Metals fit that ticket. Based on market chatter, fears of a US government funding clash and fresh tariff announcements stacked pressure on stocks and added a sense of urgency to safe-haven acquisition.

Options and futures trading hinted at a more cautious perpective, with volatility indexes rising and bond yields behaving in ways that made the yellow metal look more appealing by comparison.

What Traders Are WatchingMarket watchers said eyes will be glued on a few key metrics: The dollar’s path, moves by major central banks, and any sign that US politics escalates could keep metals elevated.

For Bitcoin, network activity, large wallet flows, and regulatory headlines will likely set the tone. Some traders expect swings both ways. Others caution that when risk appetite is back, crypto may bounce hard, but that outcome is not a sure thing and will be dependent on a string of policy and macro moves.

Featured image from Unsplash, chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|