2019-5-18 09:44 |

Some crypto enthusiasts see Bitcoin three directions; as a store of value or as a digital currency, that is a medium of exchange, or as both.

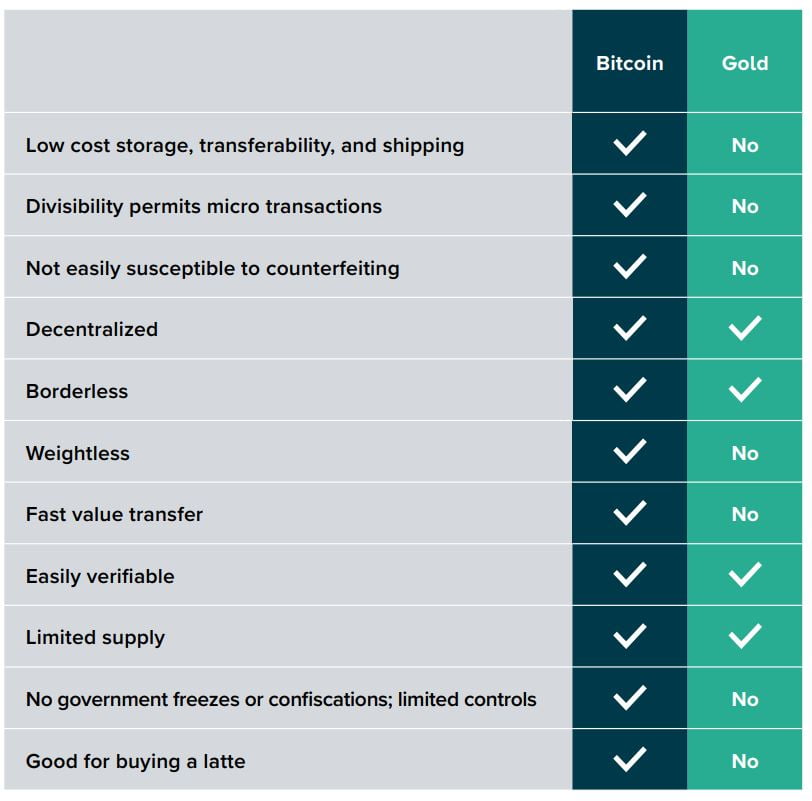

For Tyler Winklevoss, the co-founder of Gemini, a cryptocurrency exchange, Bitcoin is a store of value that has better features than Gold. He also seems to conclude that with differing market caps, Bitcoin is undervalued. In a tweet he says:

“Bitcoin is Gold 2.0. It matches or beats Gold across the board. Its market cap is approximately 140 billion; Gold’s market cap is approximately 7 trillion. Do the math.”

Bitcoin is gold 2.0. It matches or beats gold across the board. It’s market cap is ~140bil, gold’s market cap is ~7tril. Do the math!

— Tyler Winklevoss (@tylerwinklevoss) May 16, 2019Making such comparisons on Twitter attracted opinions from both Gold and Bitcoin supporters.

For instance, Mati Greenspan, a senior market analyst at eToro, chose to point the strengths in both Gold and Bitcoin.

According to Greenspan:

“Bitcoin is digital Gold and has advantages over regular Gold. However, physical Gold also has advantages over Bitcoin. It can be used to make jewelry or technology and can be used in the event of a total system meltdown. If the power goes out, you can’t use Bitcoin.”

Are there Similarities?But do the two have a resemblance? Yes, to some degree. Comparing Bitcoin and Gold indicates that in terms of investment opportunities, both are speculative in nature. Additionally, both attract attention globally, they have a limited supply, they are impossible to counterfeit, and they are expensive to mine.

Another significant similarity between Bitcoin and Gold is they are capable of helping their owners to sail safely through an economic crisis. Due to the two being seemingly identical stores of value, Bitcoin became digital Gold.

Despite being twins, they have qualities that set them apart. Fortunately, their differences help propel Bitcoin to a higher level than Gold. For instance, Gold is low risk followed by low returns while Bitcoin is high risk followed by high returns. Also, Gold is controlled by the futures market while digital Gold is not controlled by any government. Bitcoin is hard to confiscate compared to Gold. Additionally, Bitcoin can be sent and received with ease compared to Gold.

Gold wins, But it will be Short-livedHowever, Gold is not all trodden by Bitcoin. It wins on grounds such as volatility, being physical, and having a longer history compared to Bitcoin.

There is another reason why Bitcoin beats Gold across the board; its growth. Gold has a 10 percent annual growth, but Bitcoin’s growth has been exponential and always increasing.

In 2010, Bitcoin recorded over 20,000 percent growth. In 2011, 2012, 2013, 2015, 2016, 2017, and 2018, Bitcoin recorded an increase of over 1.9K, 117, 5.5K, 52, and 118 percent respectively.

While quoting Bitcoin statistics from Coinmetrics and Gold transaction statistics from IBMA, Kevin Rooke, a twitter user, noted:

“Bitcoin has been clearing more TX volume that global Gold markets since early 2017. BTC is on pace to process $1.1 trillion in 2018 transactions. Meanwhile, Gold is on pace to process $0.4 trillion in 2018 transactions.”

On a lighter note, TuurDemeester, while replying to Winklevoss, noted:

“Still, unlike Bitcoin, a Gold shield will protect the wearer against nuclear radiation.”

The post Gemini Owner: “Bitcoin (BTC) Is Gold 2.0. It Matches or Beats Gold across the Board” appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Golos Gold (GBG) на Currencies.ru

|

|