2021-2-3 21:30 |

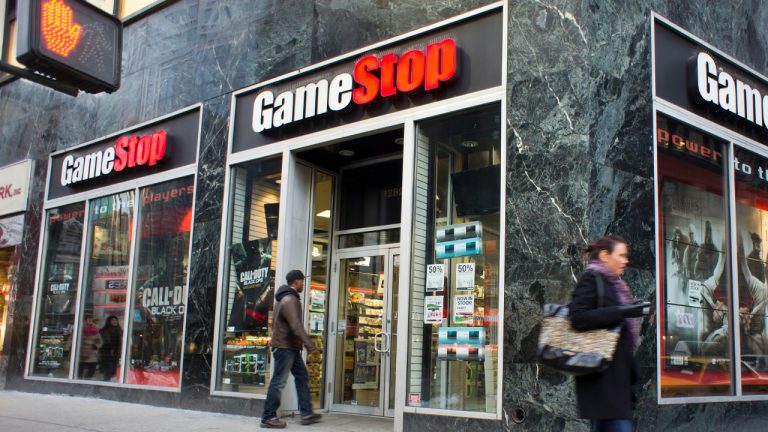

Following the Wallstreetbets saga last week, a great number of the popular shares being fueled by social media have started to tank in value. Gamestop shares dropped over 60% on Tuesday, while AMC dropped more than 49% shaking investors who bought into these stocks to the core. Meanwhile, a number of cryptocurrency advocates believe the only true way to stick it to the bankers and Wall Street is to leverage digital assets like bitcoin.

Reddit’s Favorite Stocks Begin to Feel PainLast week, news.Bitcoin.com published numerous reports on the fiasco that started on the Reddit forum r/wallstreetbets and then went viral across the internet. Redditors, meme lords, and retail investors attempted to short squeeze Gamestop (GME) shares and at first they were successful in shaking out billions from hedge funds.

The trend also moved into a few other stocks like AMC theaters and the mobile company Nokia. However, after a few days of headlines, these stocks and even silver started to feel the weight of people offloading their shares in order to escape.

Both GME and AMC have rebounded since the initial dives in price during the morning trading sessions and have regained some of the losses felt after dropping 49% and over 60% in value. At the time of publication, (1:30 p.m. EST, Tuesday) GME is trading for $114 and is down 49% during the afternoon trading sessions. AMC shares are trading for $7.96 which is down over 40% on Tuesday afternoon.Shares of Gamestop Corp. (GME) dropped significantly in pre-markets sliding over 60% and on Tuesday morning GME continued to slide. Even after the controversial ‘silver squeeze,’ the precious metal dropped 5% after touching $30 per ounce breaking an eight-year record. AMC Entertainment Holdings Inc. lost 49% on Tuesday, and stocks from the Russell 3000 Index (RUA) have slid massively.

Even the cryptocurrencies dogecoin and XRP have not been able to hold up, dropping between -11% (XRP) to -16% (DOGE) today. Meanwhile, brokers like TD Ameritrade and Robinhood have loosened restrictions on some of the stocks that saw significant demand last week.

Bitcoin Is the Free Market’s Last Bastion of HopeMeanwhile, cryptocurrency fans have been telling wallstreetbets (WSB) participants that the true battle will be fought with digital assets and securities that are onchain. For instance, the popular Twitter account dubbed “The Chairman” (@wsbchairman) tweeted on February 1: “The only way to truly stick it to Wall Street is to use Bitcoin.”

There are a number of reasons why crypto-asset fans are telling WSB participants that the real deal is with censorship-resistant cryptocurrencies. For one, they consider the stock market game “rigged” for only the big players to win, and it has been that way for decades on end. Wall Street, Nasdaq, New York Stock Exchange, and all the markets that allow the trading of shares can halt trading at any time.

If GameStop put bitcoin on their balance sheet, the internet would break.

— Documenting Bitcoin 📄 (@DocumentingBTC) February 1, 2021

These negative aspects were clearly shown last week when Nasdaq’s Adena Friedman told CNBC, the firm would be monitoring social media chatter and will halt stocks, if they match chatter with unusual activity in stocks. That same day last week, the WSB Discord channel was censored and removed. The bigwig traders also pushed brokers to cease the trading of GME, AMC, and many other popular shares during the fiasco.

On Wednesday morning, exchanges like E-Trade, Robinhood, and TD-Ameritrade customers couldn’t access these platforms. Then exchanges like Robinhood and others explained that certain shares would not be available and were limited. These manipulative moves are not beneficial to the retail trader, and the big stock whales and hedge funds called the shots.

Crypto proponents believe digital assets backed by cryptography and peer-to-peer networks are the future of free markets and exchange. The Gamestop (GME) game was rigged to begin with, and people still wonder why the stock was well over 100% shorts showing that there’s more borrowing than issued stocks. The CEO of Chainstone Labs and bitcoin proponent Bruce Fenton highlighted this fact on Twitter.

“Business as usual on Wall St is broken,” Fenton said. “If you are in charge of a ledger for securities and you loan 138% of something then you are incompetent, should never be trusted again, and should be put out of business by a better free-market solution.”

Imagine if Coinbase did an IPO with 1:1 exchange for an onchain Ethereum security token. It could onboard a lot of traditional stock traders into the DeFi ecosystem and be the first of many traditional equities/securities getting tokenised. 🚀

— Pickle ⬡ (@Pickle_cRypto) January 3, 2021

Censorship-Resistant Onchain SecuritiesMeanwhile, a number of people have been talking about commodities and securities being traded onchain using a censorship-resistant and immutable blockchain. The libertarian influencer dubbed, ‘Sal the Agorist,’ tweeted: “Robinhood won’t be able to suspend trading once securities are tokenized.” Some exchanges and even decentralized finance (defi) platforms have already created blockchain-based securities and commodities. For instance, Mirror Finance has tokenized silver on Uniswap, FTX has tokenized securities, and Bittrex Global has also tokenized popular stocks.

if (!window.GrowJs) { (function () { var s = document.createElement('script'); s.async = true; s.type = 'text/javascript'; s.src = 'https://bitcoinads.growadvertising.com/adserve/app'; var n = document.getElementsByTagName("script")[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

Many other cryptocurrency supporters have shared the same sentiment that bitcoin is the last bastion of hope for free-market supporters. “Hearing so many reports of orders not going through for GME or AMC, even before circuit breakers, the brokers were up to funny business,” an individual tweeted. “The house will always find a way to screw you. Bitcoin is the last free market. Apply your pressure there @wallstreetbets,” he added.

It’s quite clear that most people understand that the stock market game is manipulated and there are far superior avenues available today, ones that can really squeeze the financial system. Paper stocks and fiat are short term games, while cryptocurrency supporters believe digital assets are the long game.

What do you think about the people saying that the GME game is short term and the only way to truly stick it to Wall Street is to use crypto assets? Let us know what you think about this subject in the comments section below.

origin »Bitcoin price in Telegram @btc_price_every_hour

KuCoin Shares (KCS) на Currencies.ru

|

|