2020-2-14 17:57 |

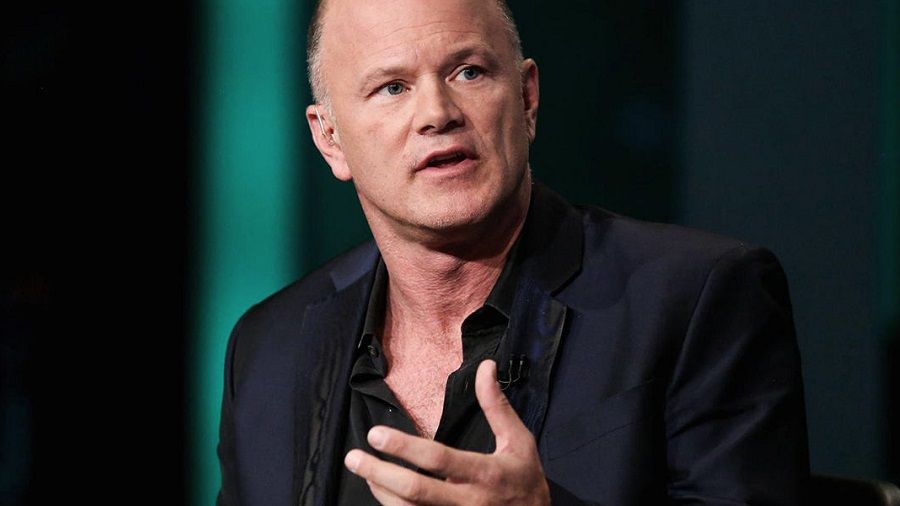

Mike Novogratz’ Galaxy Digital announced a workforce cut of 13 employees in the coming days, as the company faces challenges on its profits table. The news comes at a time the cryptocurrency market is booming with Bitcoin (BTC) having breached the psychological resistance at $10,000 USD.

Reports have emerged that close to 13 employees of cryptocurrency bank Galaxy Digital have lost their jobs. Galaxy Digital founded in 2018 by CEO Michael Novogratz, is a diversified merchant bank dedicated to the digital assets and Blockchain technology industry according to their website.

The layoffs were extensive but structured in a way that would not disrupt their key operations. With all the main departments, asset management, trading, principal investments, and advisory services not directly strained by the layoffs. They still enjoy the support of almost 80 staff.

With no clear reasons as to what led to the layoffs there has been speculation from insiders indicating that the company’s hiring process strategy was largely based on exaggerated projections of the potential of the digital markets. Other sources indicate that it was a standard end of year routine with another insider source stating the CEO, Michael Novogratz had mentioned the layoffs in a previous all-inclusive staff meeting.

This is despite the BTC’s upward spike to over $10000 USD from a mere $7300 at the start of the year. The BTC is notably the main traded asset in the digital market that Galaxy Digital operates in.

Notably Galaxy digital’s finances are not in order as they are yet to realise profits. According to a previous Management’s Discussion and Analysis which is essentially the financial condition of Galaxy Digital holdings, they reduced their losses by $8.5 million from $76.7 million to $68.2 million in the last quarter.

Due to their equity-based compensation approach they took up in 2018 their operating overheads have reduced. They have also nearly doubled their digital assets from $69.8 million to $133.5 million. This is largely because of the price increases of the various assets they own. Meanwhile they trading volumes tanked.

origin »Bitcoin price in Telegram @btc_price_every_hour

Galaxy eSolutions (GES) на Currencies.ru

|

|