2020-5-1 22:00 |

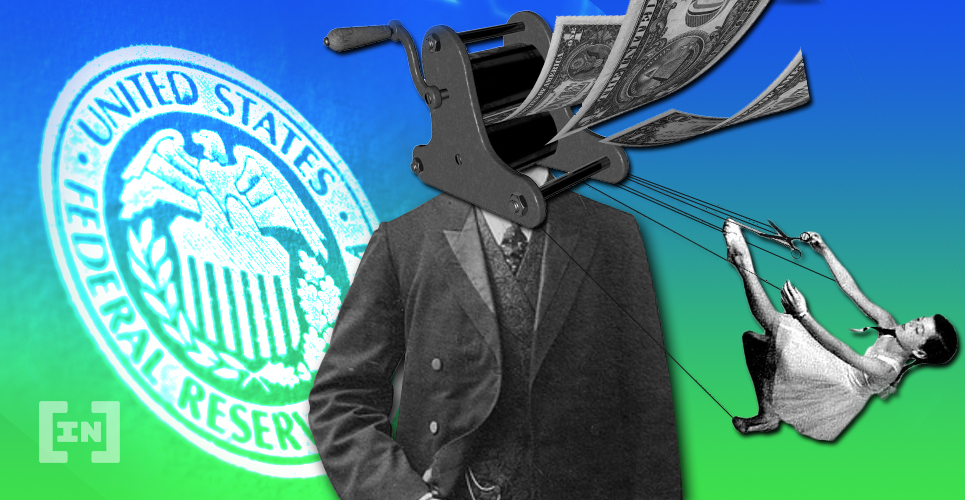

An advisor to the Fed through the Great Financial Crisis to 2015 examines the latest in the largest monetary policy experiment in human history. origin »

Bitcoin price in Telegram @btc_price_every_hour

2015 coin (2015) на Currencies.ru

|

|