2023-11-7 01:00 |

Chainlink’s recent price surge of 63% has turned heads in the cryptocurrency community. This uptrend begs the question: what’s driving investor confidence in Chainlink? Let’s dive into four key reasons that might be contributing to this bullish trend.

#1 Chainlink Dominance In The Oracle SpaceOracles act as a bridge between blockchain networks and the external world, fetching data that decentralized applications (dApps) rely on to function. This data can vary widely, from cryptocurrency price feeds essential for decentralized financial (DeFi) platforms to weather information or the results of real-world events for betting platforms.

Related Reading: November Outlook For Bitcoin Price: Another Pump Or Retrace?

Chainlink has emerged as the leader in this pivotal market, capturing a 47% share with its extensive network of over 1,000 oracles and support for 14+ blockchain platforms. By positioning itself as the primary provider of external data integration, Chainlink has become an essential component of the blockchain infrastructure.

#2 Other Products By ChainlinkExpanding beyond its initial focus on data feeds, Chainlink now offers a broad spectrum of blockchain services that have significantly strengthened its market presence:

Verifiable Random Function (VRF) – a verifiable method of producing complete randomness at a low cost, particularly useful to create random outcomes within gaming and gambling applications, as well as for any application requiring unpredictability in its protocol. Automation – allows smart contract developers to utilize Chainlink’s infrastructure to automate their smart contracts cost-effectively and securely, which is crucial for the scalability and efficiency of decentralized applications (dApps). Cross-Chain Interoperability Protocol (CCIP) – enabling seamless interaction and transfer of data and value across blockchain networks. This interconnectivity is pivotal for a more integrated and accessible blockchain ecosystem.The introduction of CCIP, especially, underscores Chainlink’s commitment to driving the industry forward. It simplifies the user experience and broadens the potential use cases for blockchain technology, aspects that are highly attractive to institutional investors looking to enter the space.

#3 Institutional InterestChainlink’s CCIP and other products have allowed it to collaborate with big institutions, such as:

SWIFT – a global financial network that 11,000+ financial institutions use to securely transmit information and value, up to trillions of dollars. DTCC – a global financial entity that processes and settles security transactions totaling quadrillions of dollars. ANZ – one of the big four banks in the Asia-Pacific region, handling billions of dollars annually. Other notable institutions working with Chainlink are BNP Paribas, Citi, and PwC Germany.These partnerships highlight that institutions see the potential opportunity for blockchains and real-world systems to interact effectively. Chainlink’s co-founder Sergey Nazarov says:

It’s now clear that both top global banks and leading market infrastructures believe there will be greater adoption of digital assets across the entire banking industry, and that this adoption will happen using multiple different blockchain technologies at the same time.

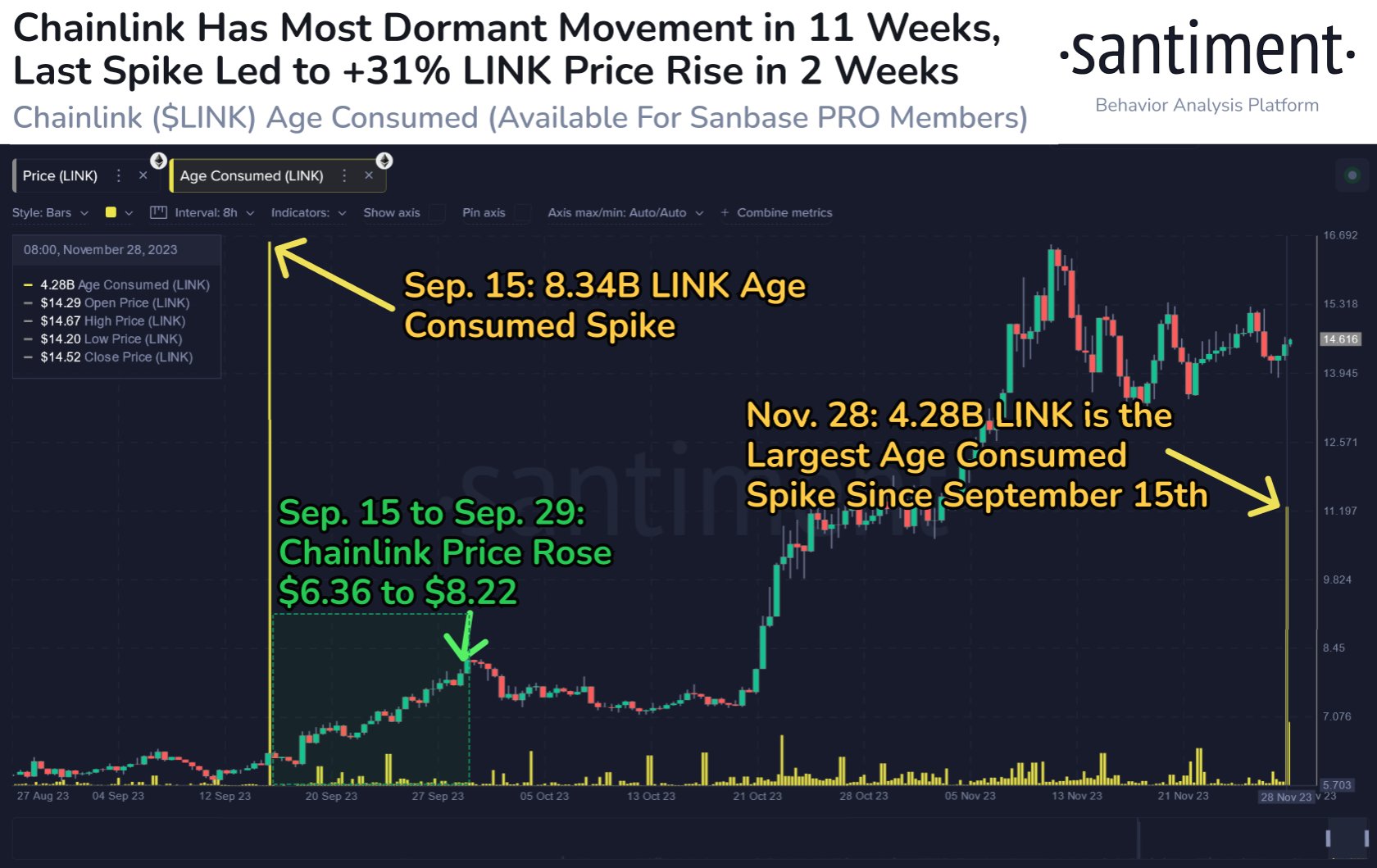

#4 Bullish Price ActionChainlink had traded between $5 and $9 between June 2022 and September 2023. In October, its price finally managed to break out of this range after an increase of 63%, reaching $12. This price increase was one of the largest within the cryptocurrency market, highlighting the faith investors have in this token.

Related Reading: Bitcoin Season: Leading The Charge In The Crypto Market

The price currently sits in a previous trading range between $11 and $17. For the price to reach the top of this range, it would have to climb another 50%.

With its previous all-time highs of $53, it suggests there is still much room for Chainlink’s price to grow. Specifically, a 340% increase would have to occur for it to reach its previous highs.

Predycto is the author of a cryptocurrency newsletter. Sign up for free. Follow @Predycto on Twitter. origin »Bitcoin price in Telegram @btc_price_every_hour

ChainLink (LINK) на Currencies.ru

|

|