2021-5-26 22:29 |

Formation Fi, the chain agnostic smart yield farming 2.0 protocol, has partnered up with Polygon (Matic) to create a secret ‘dark pool’ automated market (AMM).

The partnership will use Polygon’s layer 2 solutions allowing Formation Fi to actualize its vision for chain agonistic 0yield farming 2.0

The cross-chain liquidity partnership will allow Formation Fi users to get numerous benefits including, reduced transaction fees and improves user experience.

Through this partnership, Matic token holders, the native token on the Polygon platform will be able to deposit their MATIC tokens into Formation Fi single side cross-chain pool. This offer will be open for a limited time, allowing them to benefit from early double rewards in the form of $Form and $Matic. One-sided liquidity pools contain a single token, in this case giving investors 100% exposure to MATIC, which protects them from the impermanent loss risk.

Notably, the reward system provides a good opportunity for MATIC holders to gain back losses experienced during the recent market turmoil when thousands of positions were liquidated.

The $FORM token is a triple-utility token that provides profit-sharing, governance, and helps grow the DeFi ecosystem on the Formation Fi platform. It does this by harnessing the wisdom of the crowd to identify and fund the most promising projects.

To become an early liquidity provider and benefit from the swap fees and generous mining rewards, participants must hold both MATIC and $Form tokens in their wallets before the official pool launch. Participants should already be holding MATIC, to get $Form tokens. Having these tokens makes the participant eligible to enter the Form whitelist raffle available to Matic users only.

The Formation Fi-Polygon partnership is reportedly geared towards retail investors and sophisticated funds. The partnership is keen to leverage smart yield farming 2.0 to earn a favorable rate of return.

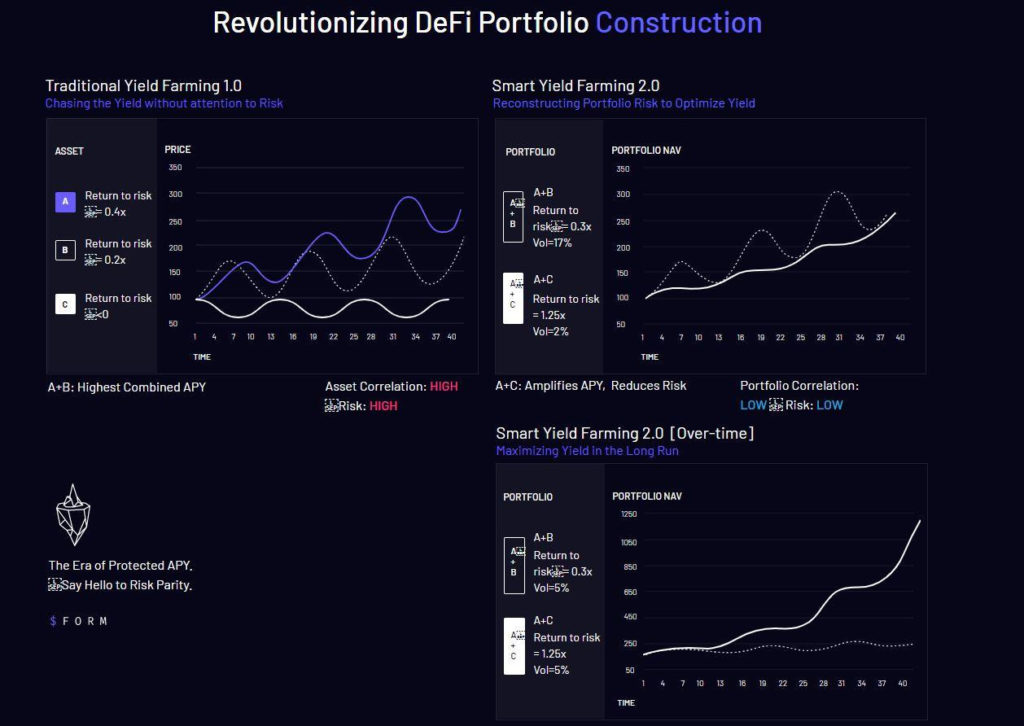

Formation Fi is a DeFi project that seeks to take yield farming to another. The platform wants to integrate the risk parity strategy which was first implemented by Ray Dali, a billionaire hedge fund manager for stock markets. The yield farming protocol developed by Formation Fi distributes risk across multiple uncorrelated assets within the crypto space. The protocol is community-oriented, chain-agnostic, and targets long-term success. Formation Fi’s Risk Parity Protocol delivers four index coins including ALPHA, BETA, GAMMA, and FORM.

origin »Bitcoin price in Telegram @btc_price_every_hour

Rocket Pool (RPL) на Currencies.ru

|

|