2021-9-22 01:00 |

A former drug and alcohol addict discusses our addiction to fiat money, debt slavery and how Bitcoin inspires him for the future.

Watch This Episode On YouTube

Listen To This Episode:

BitcoinTVAppleSpotifyGoogleLibsynOvercastAlthough the general sentiment of the Bitcoin community and that of Bitcoin Magazine is one of hope and optimism, the real world is often not so straightforward.

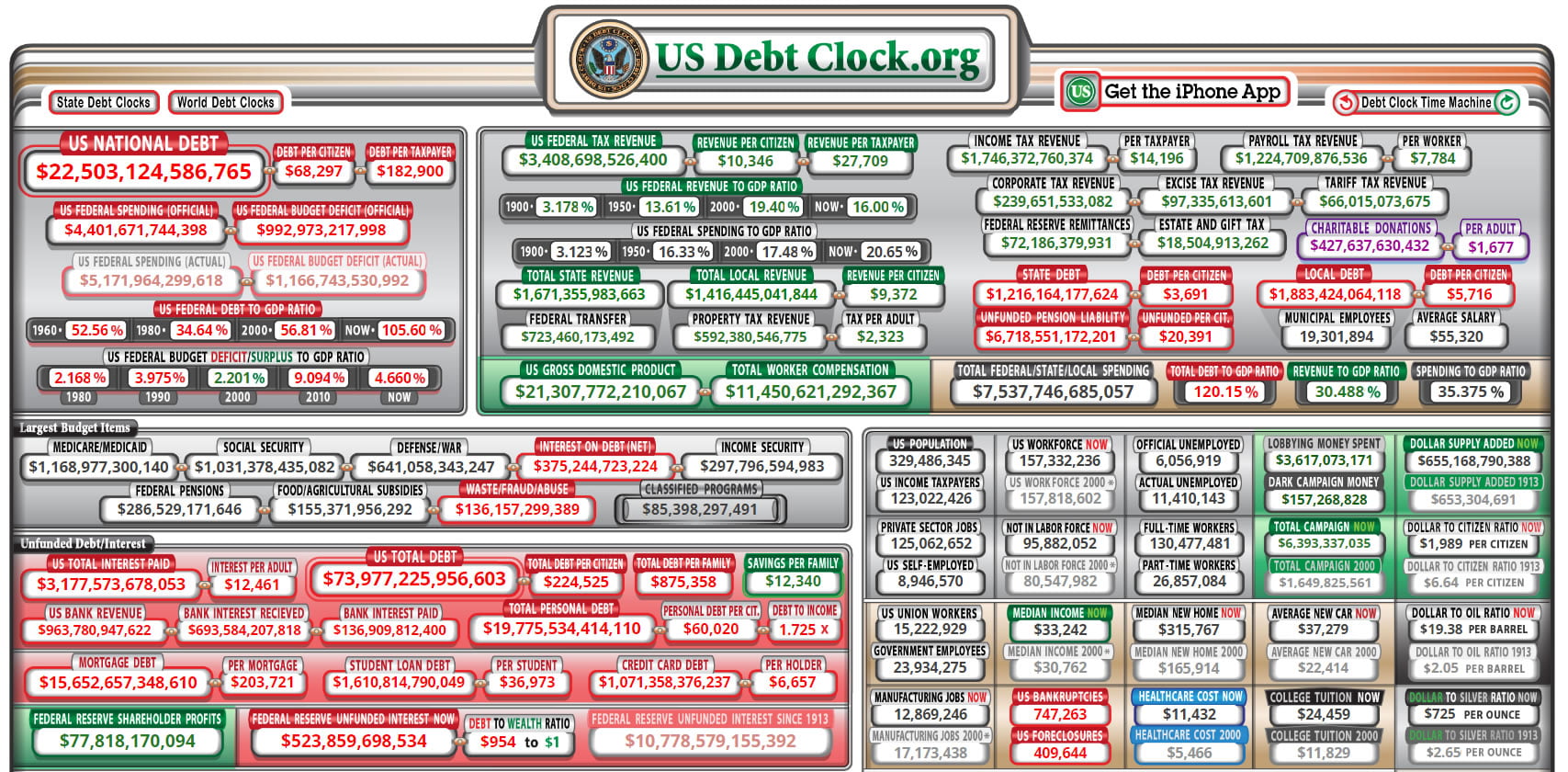

One of our recent posts discussed the reality of addiction, and how this relates to the fiat world and debt. I believe that this is an important topic that touches nearly everyone. With drug and alcohol addiction widespread in the United States, almost everyone knows a friend or family member impacted. Addiction can also be found, in a way, in our fiat monetary system and the debt cycle it proliferates.

OtterBTC, a former durg and alcohol addict himself, and I discussed both of these topics in this podcast episode, so be sure to give it a listen, check out his article and read our interview below.

What’s your Bitcoin rabbit hole story?

I was fully introduced to Bitcoin during the mania of the bull run in late 2017. I bought a little coin and then watched the price fall into the bear market of 2018. At some point, I wanted to know more.

I started trying to find content in the space where I could learn. I remember listening to a podcast with Tim Ferris, Naval Ravikant and Nick Szabo and then another where Wences Casares was interviewed. I fell down the rabbit hole hard. I felt like a veil was being lifted from my eyes. I had previously been interested in gold and silver coins as valuable collectables, but this was different. The implications of widespread bitcoin adoption as a benefit to every person on the planet has kept me enamored ever since.

How has Bitcoin changed your life?

I am more hopeful and optimistic for the future today because of bitcoin. Even in all of the chaos around us, I still tend to have a glimmer in my eye knowing that bitcoin exists and there are advocates everywhere and more people being enlightened every moment. I always intuitively believed that centralized control over anything valuable — money, goods, services or even humans themselves, was the cause of much oppression in the world, but I never dug deep enough to understand the mechanisms behind how this control was wielded. And it all starts with the money.

My eyes are more open today. I take even more responsibility for my reaction to life today and I absolutely prefer to verify before trusting in what any person or institution puts forth as fact. Show me the incentives...

Your recent piece on addiction, fiat, debt and bitcoin was really interesting. Could you discuss some of the parallels you see between these things and what led you to write this article?

As I lay out in the article, our global economy is addicted to cheap fiat debt in an unsustainable way. The consequences cause huge distortions in markets that have rippling effects across society. Much of the populous acts with the objective of fulfilling high time preference (short-term gratification) goals. We are ever in fear that the prices of the things we want will go up, therefore we must get them now, so we take on debt to acquire such things.

Being in debt can be perceived as another form of slavery. Being underneath debt can feel like getting on a hamster wheel inside of a cage, where you stay active but do not realize your main objective is only to service the liability that you've been saddled with. This is a soul-sucking endeavor and leads to the degradation of the individual.

I was once enslaved to drugs and alcohol. It's a desperate and demoralizing place to be. At many points I was only living to service the spell of the addiction that I was under. I had a moment of grace and took the opportunity to change my life, which I'll forever be grateful for.

In writing the article, I wanted to share a bit of my story and give back and contribute a perspective to the community. Societal ills affect us all. Misinformation around money and the negative effects of debt seem to be shrouded in ignorance similarly to the way we as a society address drug/alcohol addiction and its associated stigma. I'd love to help shed light on both.

What are you most looking forward to in the Bitcoin space?

I'm looking forward to more widespread adoption and education. Millions more "lightbulb" moments. I want more people to feel their minds being blown as they interact with bitcoin, send their first transaction, and watch their savings increase over time. I'm looking forward to seeing people place more value on their time and in turn, spend that time with their families or doing what they love.

Price prediction for the end of 2021, and the end of 2030?

I'd say we see $100,000 before January 1, 2022. (I'm purposefully being bearish so as to not have any dashed expectations, haha.) Easy $1.5 million bitcoin price by 2030.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|