2020-7-27 21:03 |

Bitcoin is flying, and exchanges are crashing down.

Bitcoin is having an eventful day after breaking through $10,000 over the weekend. Currently, BTC is just inches away from hitting $11,000 as the digital asset jumps over 10% to climb to $10,950 on Bitstamp.

But the numbers are fading fast in Bitcoin’s eagerness to hit $11k and chasing $12k.

“This rally just feels way more sustainable than last year. Started at lowest caps and progressively moved up to mids, then ETH, now BTC (and still ETH),” said analyst Ceteris Paribus. “At the same time, historic levels of stimulus and precious metals hitting ATH's. Way different vibe.”

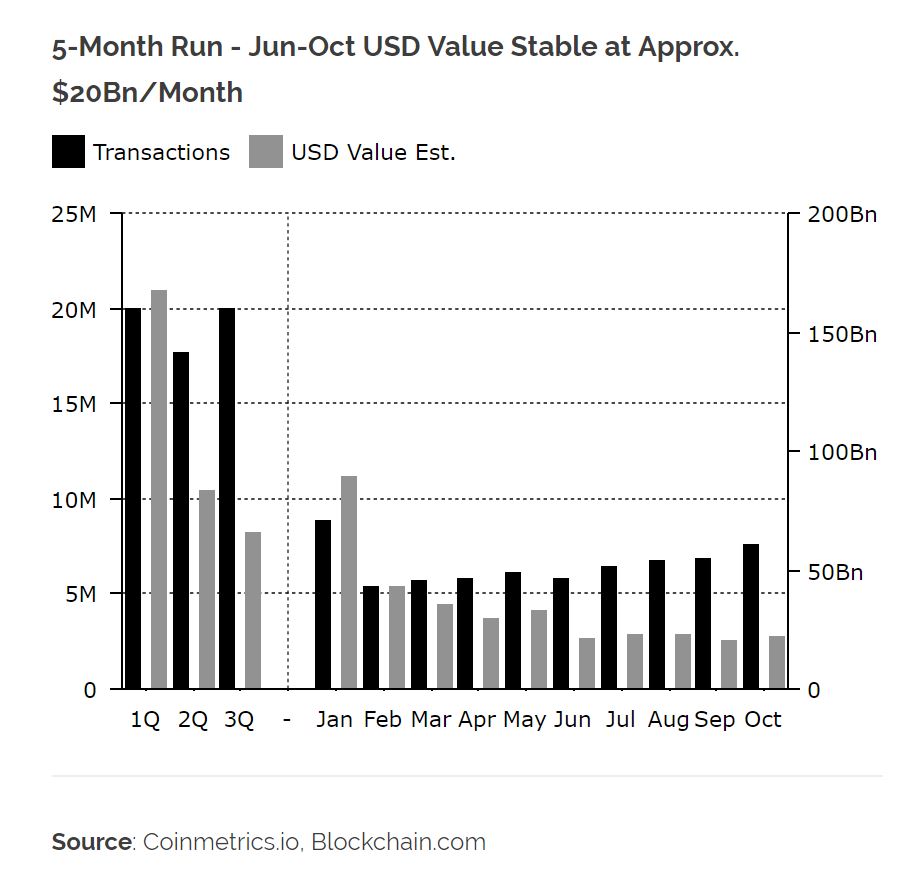

You would have to be blind to not recognize the story this chart is telling.

There is a time to play intraday levels, this isn't it.#Bitcoin is being sent. pic.twitter.com/qqIub9NWcX

— Cantering Clark (@CanteringClark) July 27, 2020

Meanwhile, these gains in BTC means it is not a good time for altcoins. As a matter of fact, it’s a “lose-lose situation” for them as altcoins will dump no matter in which direction Bitcoin moves.

Ditching the BuckSafe-haven assets are currently in demand amidst concerns over a diplomatic row between the United States and China and rising coronavirus infections. Stocks that were tumbling recovered losses on the expectations that US Senate Republicans will unveil a $1 trillion coronavirus aid package.

Interestingly, the US Dollar Index is getting hammered as bitcoin surges to a new 2020 high, a level last seen in August 2019. The USD index has fallen to the lowest level in over two years.

Source: TradingView DXY Chart, YTDThe trillions of dollars printed by the Fed is the reason why the US dollar is eroding. The US dollar falling at an alarming rate means the euro is rising as it has the most weight in its basket of currencies.

“If you think about the U.S. dollar's value against the stock market, or gold, or against just about any other financial asset, it's plain to see that people are ditching the buck as fast as they can,” wrote analyst Mati Greenspan in his daily newsletter Quantum Economics.

He also touched upon if the US dollar’s status as the reserve currency is in danger which he says not in the immediate sense as such shifts take a long time but “certainly the dangerous game politicians have been playing, and the extraordinary amounts of free money could possibly have the effect of hastening that shift.”

Riskless profits at GBTCAn increase in bitcoin price means the companies related to it are also enjoying gains. Grayscale Bitcoin Trust has jumped over 14% while Riot Blockchain gains 23%. Overstock only saw 5.1% greens.

The shares of Canaan also jumped 33% since Friday only to drop over 9% today. The same has been the case for bitcoin miner manufacturer Ebang which rose 13% but fell almost 5% today.

As we reported, in the second quarter, Grayscale Investments attracted $900 million from institutional investors, about double its previously quarterly high. This brings the total assets under its management to over $4 billion.

At that time, it was revealed Grayscale was buying a record amount of BTC, more than what was minted in the market after the halving. But the last time Grayscale filed a Form 8-K with the Securities and Exchange Commission (SEC) to disclose its outstanding shares was on June 25. As such, it’s been weeks since GBTC bought any bitcoin.

Grayscale products are known for their exuberant premium to the market value of the underlying product. In May 2017, the premium on GBTC was trading over 130% above BTC’s value, and this year ETHE saw over 750% premium to Eth price.

Many investors take advantage of this arbitrage opportunity, which is a “pretty common trade,” said Kyle Samani, co-founder of Austin, Texas-based hedge fund Multicoin Capital Management LLC.

This is why a lot of hedge funds contribute in-kind to the trusts by buying or borrowing coins on their own, as such, creating more units of the trusts. “If those shares trade at a premium to the underlying assets, the trade provides riskless profits,” Samani said.

The structure of Grayscale’s investment trusts allow for a periodic private placement of shares with accredited investors and includes a lock-up period of 12 months. But it’s the retail investors who are the most at risk as they can purchase shares in the exchange-traded trusts but don’t participate in the private placements. However, Grayscale has emphasized that it doesn't control prices on the secondary market.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|