2020-6-10 15:38 |

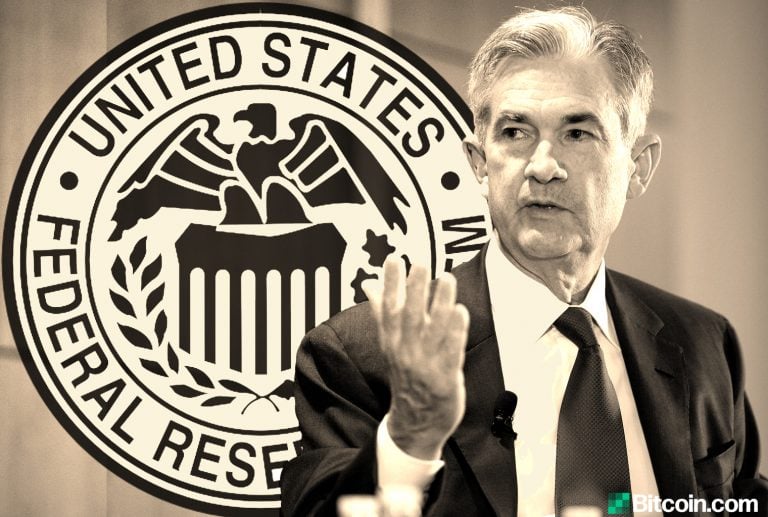

The Fed may remain intransigent about negative rates, but bitcoin may benefit from other central bankers who are keeping the option firmly on the table. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|