2020-8-11 13:00 |

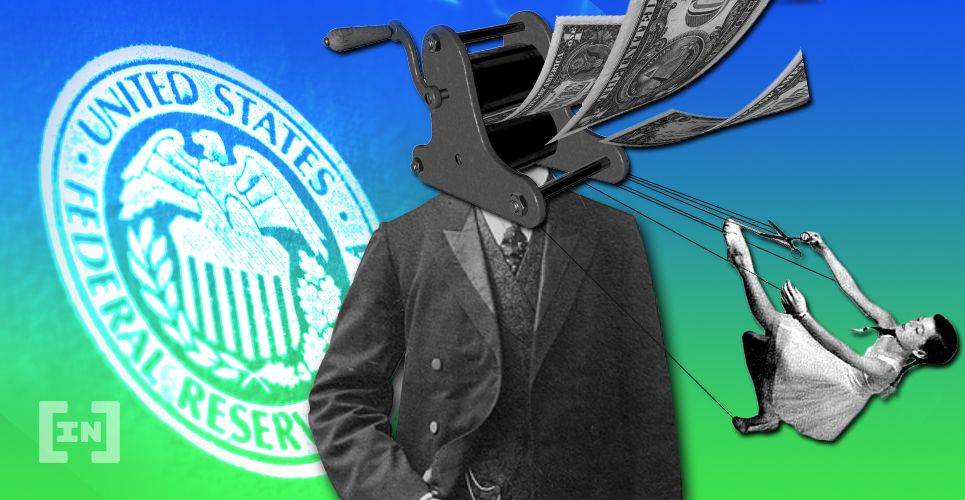

The Fed bought 46% of the $3.4 trillion in debt securities issued by the Treasury in the first half of 2020, with private investors scooping up the rest. origin »

Bitcoin price in Telegram @btc_price_every_hour

Half Life (NUKE) на Currencies.ru

|

|